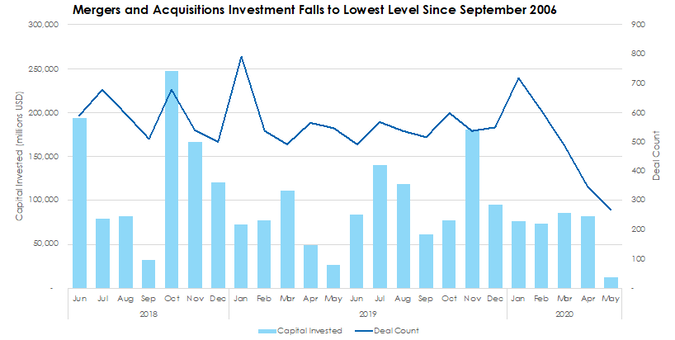

Download the Second Quarter 2020 Private Equity Update here. As the impact of the COVID-19 pandemic dragged into the second quarter, there was a noticeable effect on private equity deal-making. The volume of buyouts and exits (instances in which a private equity investor exits their investment) fell sharply with a 44% decline quarter over quarter, and fundraising was also off from 2019 highs. Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

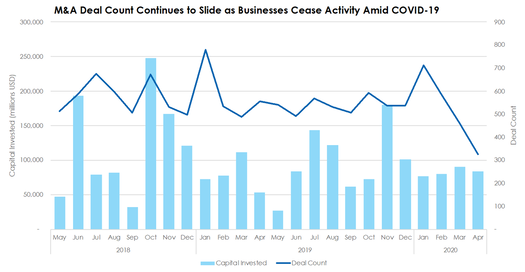

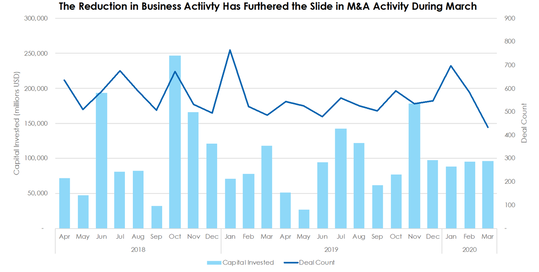

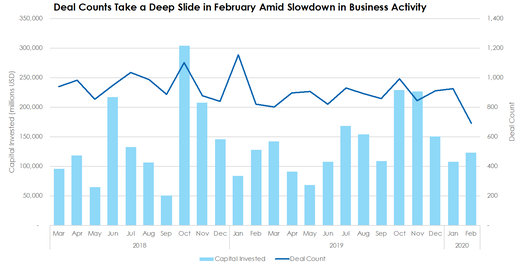

M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%. M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%. Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month.  Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

Skyline Advisors Releases its Third Quarter 2019 Capital Markets Review: Midwest Edition Report12/6/2019

Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for the third quarter of 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

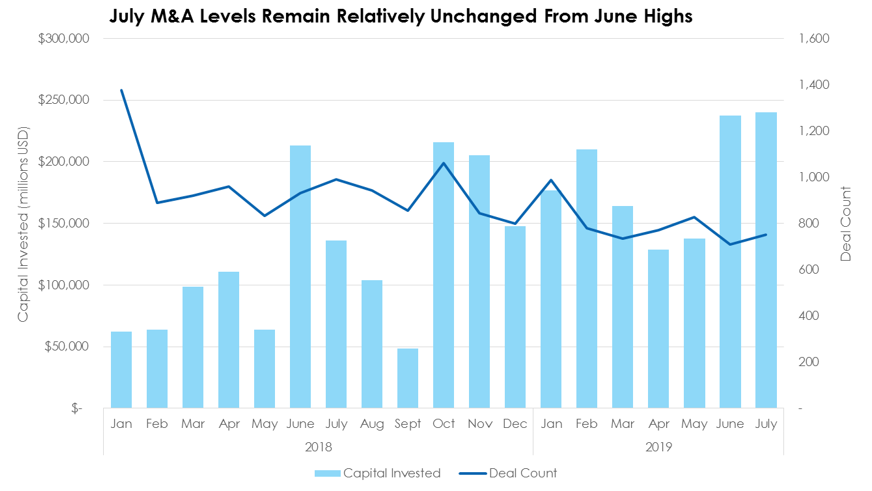

Acquisition Investment is Lifted to a Two-Year High on the Back of Five Out-sized DealsAccording to preliminary data from Pitchbook, there were 752 M&A deals worth a total of $240 billion in July, remaining relatively unchanged from the $237 billion spent on corporate acquisition and leveraged buyout deals in June. Over 60% of the deal value is comprised of the buyouts of five target companies: Worldpay, L3 Technologies, Red Hat, First Data, and Array BioPharma.

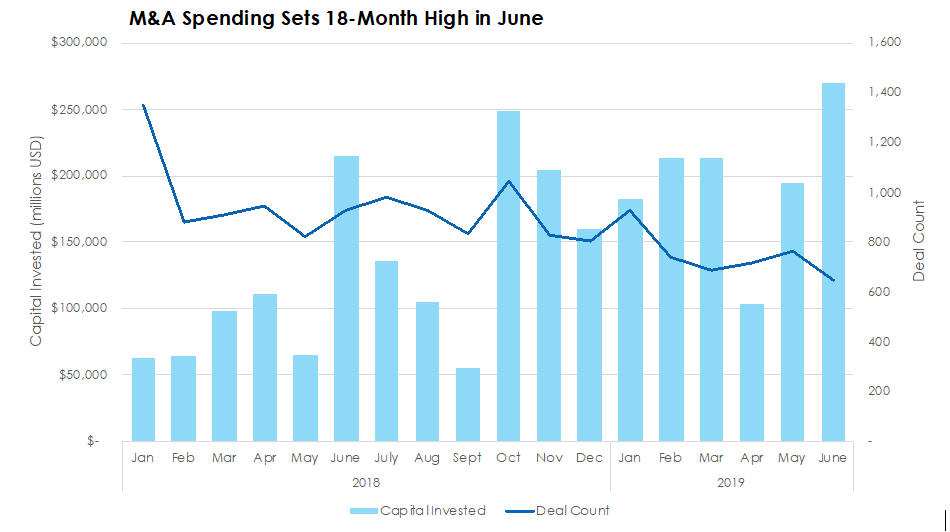

M&A Activity Spikes in June on the Back of Mega Deals In June, there were 643 deals in M&A capital markets worth a combined $270 billion, the highest level since the start of the decade in 2010. However, 45% of that value is attributable to United Technologies’ blockbuster acquisition of defense contractor Raytheon. In fact, the deal is the largest since Time Warner acquired AOL in January 2001.

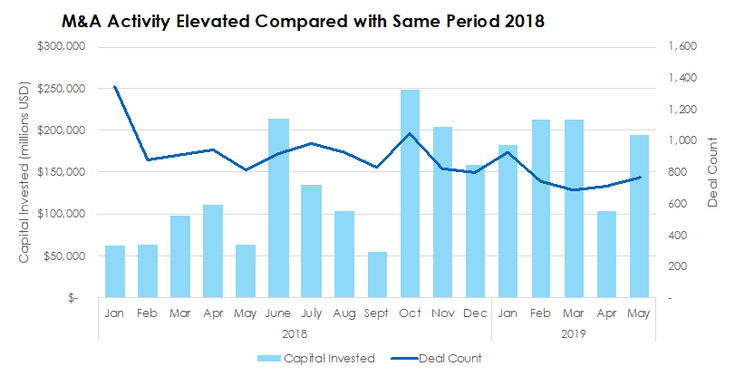

M&A Activity Picks Up in May Despite Weaker Year than 2018There were 720 M&A deals valued at a combined $194 billion in May, according to Pitchbook. For the year through the end of the May, there were 3,756 deals for $906 billion capital, roughly 1,140 fewer deals and $506 billion less value for the same period in 2018.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed