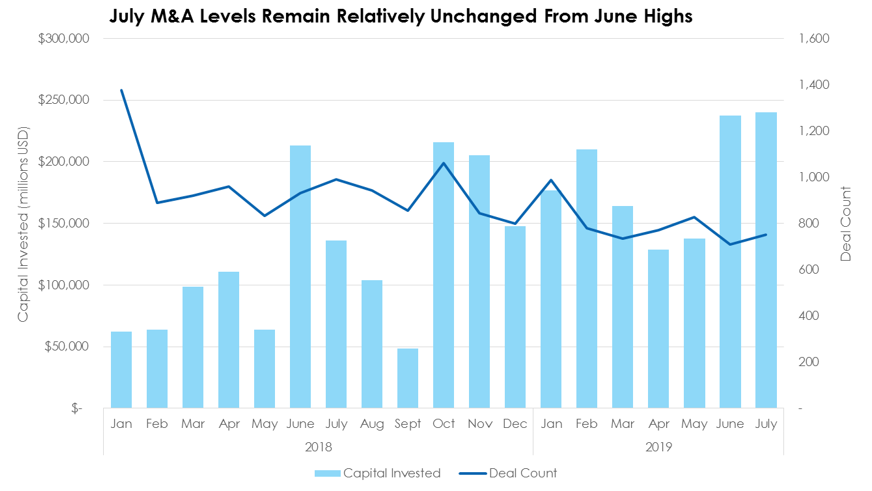

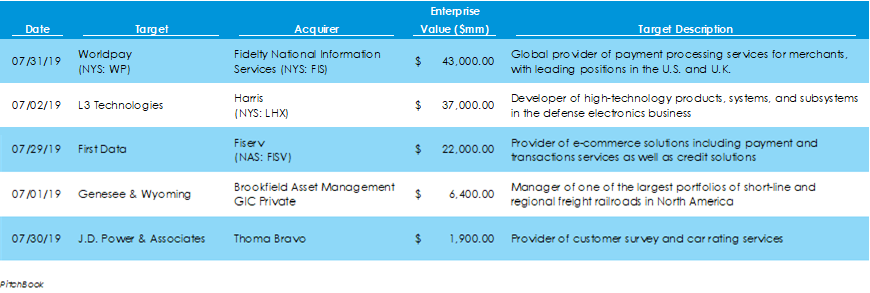

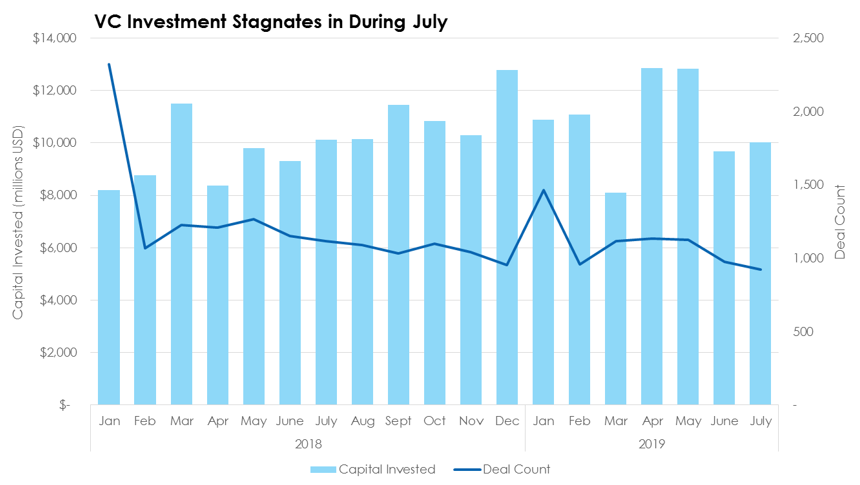

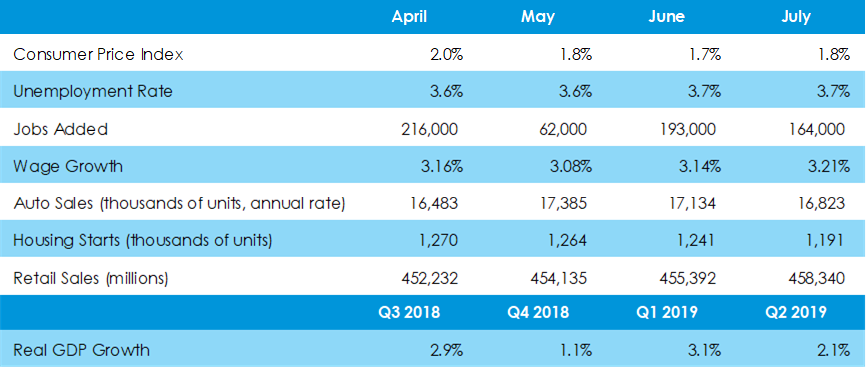

Acquisition Investment is Lifted to a Two-Year High on the Back of Five Out-sized DealsAccording to preliminary data from Pitchbook, there were 752 M&A deals worth a total of $240 billion in July, remaining relatively unchanged from the $237 billion spent on corporate acquisition and leveraged buyout deals in June. Over 60% of the deal value is comprised of the buyouts of five target companies: Worldpay, L3 Technologies, Red Hat, First Data, and Array BioPharma. Median deal value for July 2019 is down 26% to $140 million from $190 million in June. However, over the last 19 months, the median deal valuation has been trending upward from $50.5 million in January 2018. Invested capital continues to rise, while monthly deal counts are trending downward, indicating more capital is being spent on fewer, larger deals. In fact, year-to-date capital spending on M&A has grown 73% while deal count has fallen 19% from the same YTD period in 2018. It is an interesting time for firms to be spending larger sums on acquisitions, particularly as the US economy continues to face headwinds associated with Chinese trade, geopolitical concerns in the Middle East, and a softening global economy that is cutting interest rates. The information technology and financial services sectors experienced an uptick in their deals counts, rising 25% and 15%, respectively. Financial services saw an uptick as 22 regional banks and 15 insurance brokerages swapped ownership. On the information technology side, coincidentally, 17 financial software companies were acquired along with 49 business and productivity software developers. Unity Receives Largest VC Investment in Tepid Month Similar to M&A activity, venture capital investment in July was up only 3.6% to $10 billion, while deal count was down 5.4% to 922 closings. The trend of more money into smaller deals continues in the VC market, as year-to-date, capital invested in startups from VC funds has grown 14%, while total deal volume has fallen 18%. Along with other asset classes as the cycle has matured, the median post-money valuations of VC-backed companies has risen dramatically in the last 20 months, climbing from $15 million in January 2018 to $41 million as of last month. The largest venture deal in July was $525 million in funding provided to Unity, a real-time 3D technology developer, by Silver Lake Management, Sequoia Capital and D1 Capital Partners. Another notable financing was a Series B round of $120 million for Elon Musk’s The Boring Company, a company developing tunnel boring services designed to solve traffic problems. With all the dry powder available to private equity and venture capital funds, equity funding is available to private companies at levels traditionally only available in the public markets. This is leading a lot of companies that are mature enough for IPOs to stay private, receive helpful venture capitalist advice, and avoid scrutiny from Wall Street. This is seen at a large scale with startups such as Uber but can also be identified at a single month level. Pitchbook data shows that 18% of VC deals in July were in rounds 4 through 7, however, these deals received two-thirds of the invested capital in the month. Private Equity Firms Showing Signs of Softening as Economic Conditions are Assessed Pitchbook data shows that private equity investment activity in July has led to a two-month slide from a 2019 high of $60 billion in May. In July, there were 338 leveraged and public-to-private buyouts, worth a total of $33 billion in capital invested. Year-to-date, on the other hand, invested capital has increased 26% to $269 billion, while deal volume has fallen 17% to 2,792 deals. The largest deal of the month was a $6.4-billion public-to-private buyout of one of North America’s largest short-line rail operators, Genesee & Wyoming (NYS: GWR).  During the last couple of months, the global economy has begun to show signs of softening with a handful of central banks beginning to cut rates. This may encourage investment from buyout shops, as debt is cheaper. However, the one-to-three-year economic outlook has become gloomier, likely leading a number of active and potential deals to be shelved for the time being. This risk-off approach is leaving fewer quality deals to chase, which is contributing to rising valuations in the space. Advanced Reading of GDP Falls to 2.1% from Q1’s 3.1%

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed