|

Sluggish merger and acquisition (M&A) activity carried over into September, as just over 500 transactions were completed in the US during the month.

Despite an apparent leveling off of deals (more September deals will certainly be reported as there is a lag in reporting), preliminary data from PitchBook suggests that overall transaction value climbed roughly 60% month over month. In the Midwest, 14 transactions were preliminarily reported, a slight increase from August’s 11 deals. Deals in the information technology space were favored, accounting for six of the 14 completed. Preliminary data from PitchBook suggests that August was a slow month for national and Midwest merger and acquisition (M&A) activity. In the US, fewer than 500 deals were completed during the month, a nearly 25% reversal of the recovery we began to see after May’s lows. Similarly, M&A activity in the Midwest fell to the lowest level of the year. However, the data may not be as dreary as a first glance shows – more than 150 deals were announced in the US during the month, estimated to account for over $110 billion in transaction value. Furthermore, the Midwest had one deal announced during the month that topped $1 billion – Waystar Health announced during the month that it would acquire Overland Park-based eSolutions for an estimated $1.35 billion.

M&A activity continued to pick up in July, according to preliminary data from Pitchbook. In the US, there was more than $50 billion in M&A spending, the second month of increases from May’s low. While deal counts are currently showing a sequential decline from June, we suspect there will be an increase as deals are reported (there tends to be a lag in deal reporting). We continue to monitor M&A volume, which is supported by the reopening of economies across the nation but is under pressure from rising COVID-19 cases.

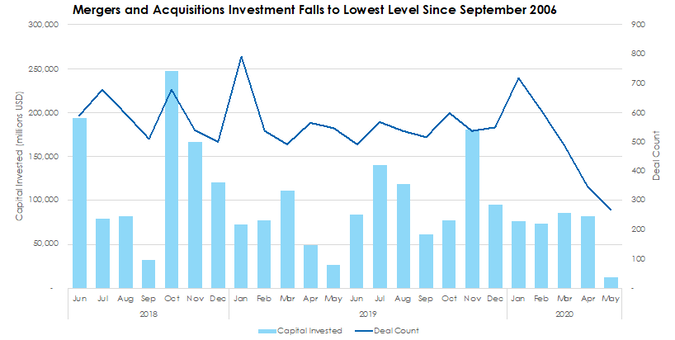

Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

As the world struggled to contain and understand the full impact of the coronavirus (COVID-19) pandemic in the first quarter, the main economic impact (see our summary here) did not manifest itself until the second half of March. It is unsurprising, given the sudden stop, that merger and acquisition (M&A) activity echoed general economic trends, particularly in light of the uncertainty surrounding how long restrictive measures would remain in place and whether there would be a “V-shaped” recovery.

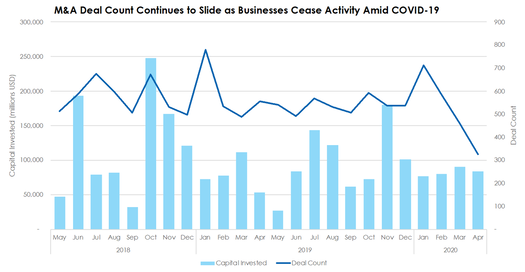

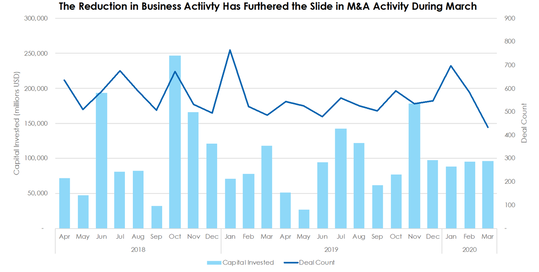

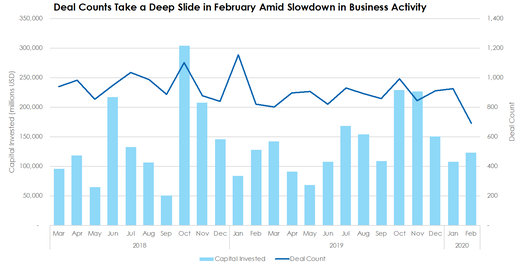

M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%. M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%. Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month.  Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

Skyline Advisors Releases its Third Quarter 2019 Capital Markets Review: Midwest Edition Report12/6/2019

Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for the third quarter of 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed