|

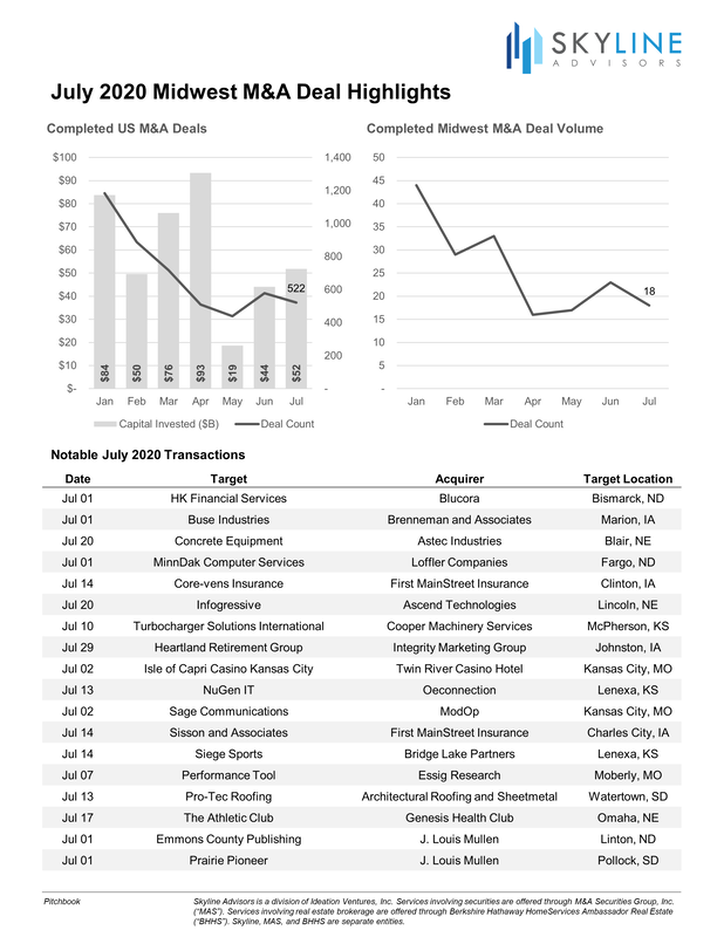

M&A activity continued to pick up in July, according to preliminary data from Pitchbook. In the US, there was more than $50 billion in M&A spending, the second month of increases from May’s low. While deal counts are currently showing a sequential decline from June, we suspect there will be an increase as deals are reported (there tends to be a lag in deal reporting). We continue to monitor M&A volume, which is supported by the reopening of economies across the nation but is under pressure from rising COVID-19 cases.

In the Midwest, 18 deals were reported completed for July so far. The largest reported deal was Bluecora’s (NASDAQ: BCOR) $100-million acquisition of Bismarck, North Dakota-based HK Financial Services. More notably, there were a handful of sizeable announced deals at the end of the month, including: Strata Decision Technology’s pending $365-million purchase of Chesterfield, Missouri-based EPSi; Corsair Capital’s pending $350-million buyout of Overland Park-based Multi Service Technology Solutions; and Watco Companies’ anticipated $310-million acquisition of Pittsburgh, Kansas, rail assets from Dow Chemical. The table below highlights some of the other notable M&A transactions within the six-state Midwest region during July.

If you are not already on our newsletter mailing list, you can complete the signup form below to receive periodic capital market updates, news, and resourceful articles.

Stay Informed...

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed