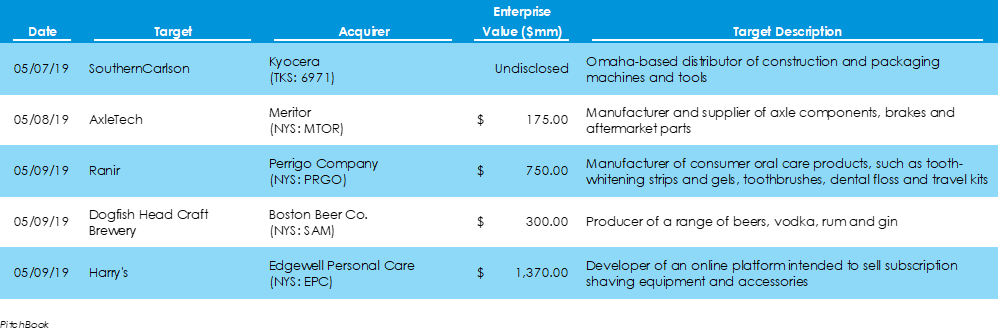

Maker of Samuel Adams Buys Delaware Craft BreweryData from Pitchbook shows that $84.5 billion was invested in 33 deals across American M&A markets last week, 10 more deals and $71.1 billion capital than the week prior. Four of those deals were for over $2.5 billion, including $38-billion and $23.3-billion-dollar deals, both of which were in the energy space. Another deal that caught significant media coverage was that of Boston Beer Co., the brewer of Samuel Adams brand beers, which paid $300 million to acquire Dogfish Head Brewery, a craft beer maker from Milton, Delaware. Dogfish produces over 250,000 barrels of beer annually.

A larger jump in retail sales proved to be one of very few optimistic highlights in last week’s economic news. The week entailed mostly negative news, as housing starts increased less than expected, the Philly Fed’s Manufacturing Index slipped significantly, and the University of Michigan Consumer Sentiment Index fell unexpectedly.

Last week’s economic news continued to signal a booming U.S. economy. In summary, the NFIB’s Small Business Optimism Index rose to its second-highest all-time level of 107.8; the Consumer Price Index (CPI) for May, often a sign of inflation, rose 2.8% over the last twelve months; and Federal Reserve officials elected to raise rates a quarter of one percentage point to keep the economy from growing too quickly. The Fed’s Board of Governors also signaled for an extra rate hike for 2018.

Of all economic news last week, perhaps the most intriguing are the jobless claims and GDP reports. Jobless claims fell to the lowest level since 1961, and GDP for the first quarter of 2018 slipped on consumer spending weakness.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed