|

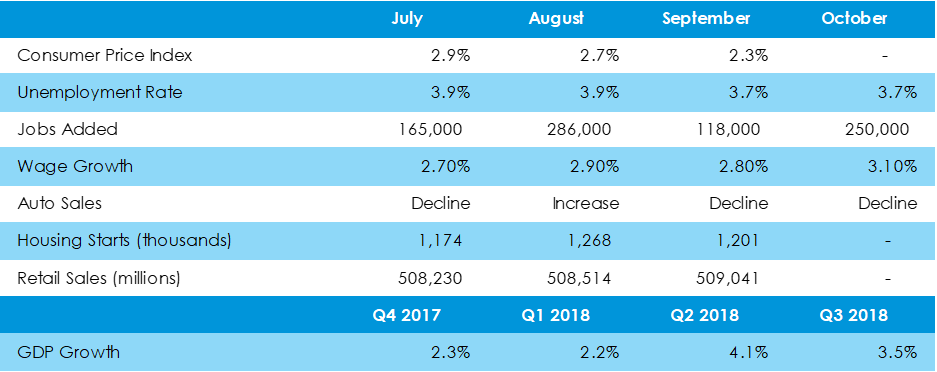

November’s final Consumer Sentiment reading fell more than expected to 97.5 points, continuing a slide off of March’s fourteen-year-high reading of 101.4. New housing starts grew last month amid rising tariff-related costs for builders, driven by new construction of multi-family housing units. Lastly, initial unemployment claims rose suddenly to a four-month high of 224,000, despite continuing claims falling to 1.67 million, a level not seen since the early 1970s.

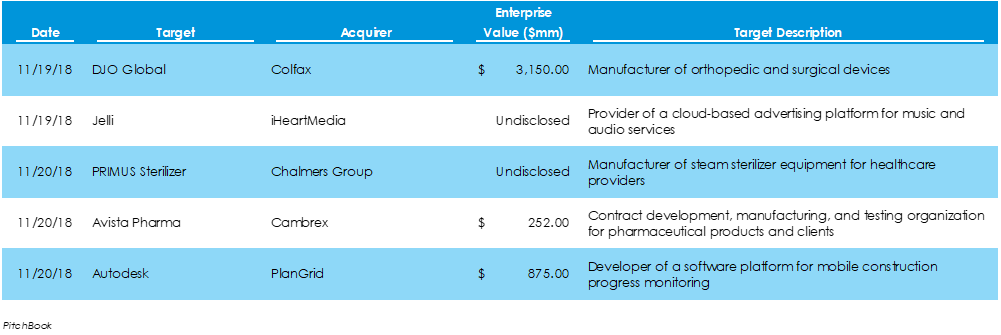

According to preliminary data from Pitchbook, last week there were 18 M&A deals for a total of $6.94 billion capital invested. One deal, Colfax’s $3.15 billion bid for DJO Global, was for greater than $1 billion. A total of seven deals were for $100 million to $1 billion. Seven of the eighteen deals involved industrial, infrastructure, or manufacturing companies. The West Coast garnered the most attention with six deals. The following are a selection of last week’s deals within Skyline’s areas of focus.

Last week, the lone company to go public, TuanChe, a Chinese automotive e-commerce company, raised $20 million. While last week was slow for IPOs, 2019 is anticipated to be the exact opposite. A handful of Silicon Valley’s largest constituents are slated for public offerings, with a few aiming for valuations in the twelve-figure range. Uber, Lyft, Airbnb, and WeWork are headlining the group of Unicorns expected to go public.

The week ending November 17 revealed Consumer Price Index data that surpassed the Fed’s 12-month 2% inflation target. Also, the Treasury Department says that the Government recorded a $100.5 billion deficit in October 2018, a 60% increase from a year before. Lastly, the New York Federal Reserve reported that U.S. household debt rose to $13.51 trillion, the 17th consecutive quarter of increasing household debt.

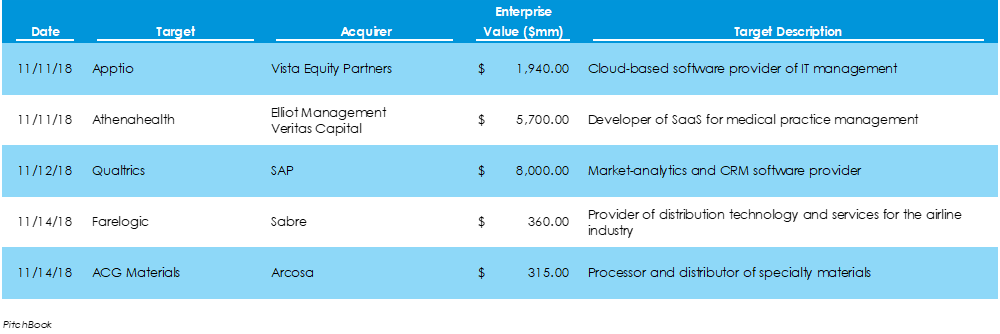

Last week, a total of 32 M&A deals took place, with $34.3 billion of capital invested. Six deals were worth over $1 billion, constituting 91.5% of the deal value last week. Eight of the deals were for manufacturing firms, accounting for $15.7 billion capital invested. Another eight companies acquired were information technology firms. The largest deal was a $13.2-billion cash acquisition of Johnson Controls’ Power Solutions Business by Brookfield Business Partners.

Last week, four private companies made the jump to go public, consisting of two financial companies and two healthcare companies. In total, the four companies – Eton Pharmaceuticals, Vapotherm, Weidai, and Bain Capital Specialty Finance – raised $282.9 million in financing, according to Pitchbook. Bain Capital Specialty Finance, the largest of the IPOs, raised $151.9 million in a spin-off of Bain Capital’s middle market business development division.

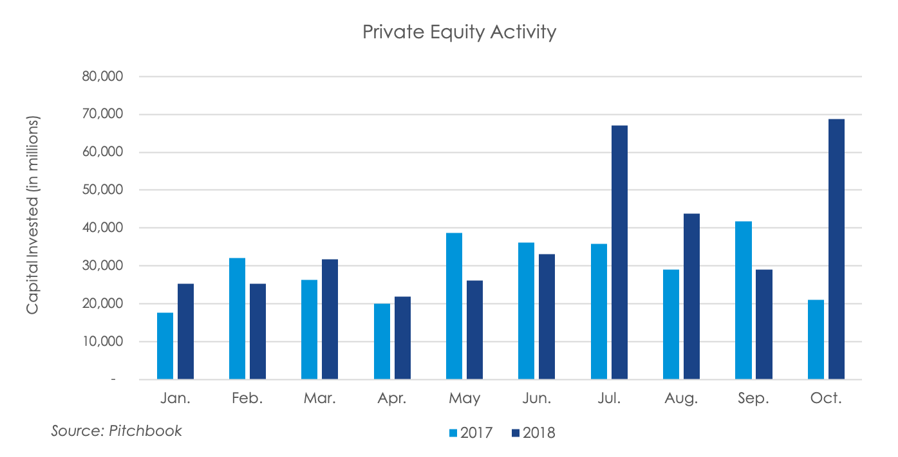

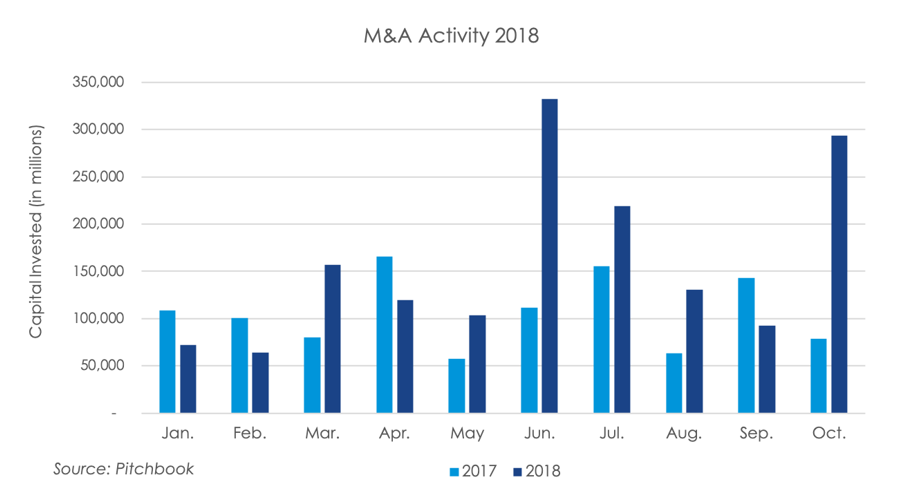

Private equity activity, in line with M&A spending, made a sudden upward spike in October, climbing 137% from September and 228% from October 2017 to $68.8 billion, the highest monthly level in 2017 and 2018, as shown by preliminary data supplied by Pitchbook. Like M&A activity, the jump in private equity spending appears to have been driven by 17 deals worth over $1 billion, which accounted for $58.6 billion, 85.2% of the monthly total.

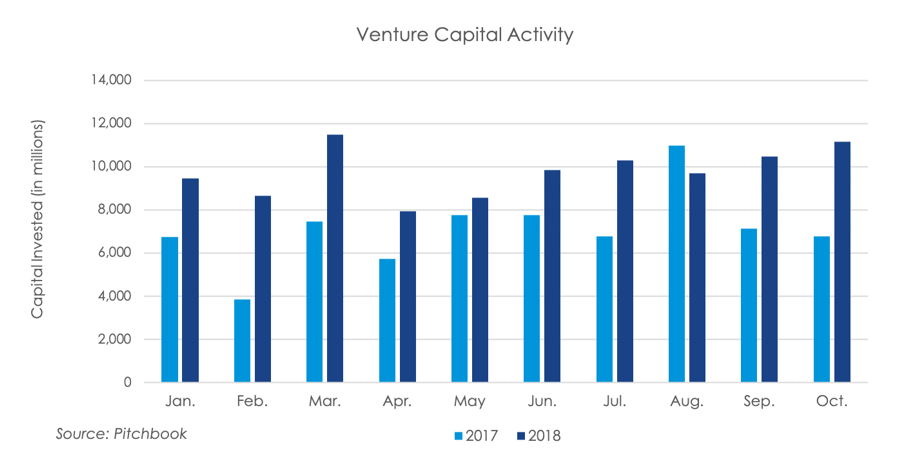

Based on preliminary data from Pitchbook, venture capital firms invested 6.7% more capital in October than in September, rising from $10.5 billion to $11.2 billion. However, deals were larger, as total deals counts fell by 85 to 707, a 10.7% decline. This trend of fewer deals but more invested capital has been continuing for three months now, constituting a 52.8% increase in capital per deal over the period.

In October, the U.S. Bureau of Economic Analysis released their third quarter gross domestic product report, showing the economy grew at a 3.5% annual rate, faster than the 3.4% expected rate. The growth comes on the heels of strong consumer spending of 4.0% and low inflation of 1.6%, as provided by the Personal Consumption Expenditures (PCE) price index. The report comes out as concerns continue to escalate regarding rising interest rates and tightening trade restrictions. Total announced dollars spent on mergers and acquisitions activity spiked suddenly last month, reaching the second-highest mark for the calendar year on the back of a few mega-deals. Corporations and buyout firms announced total acquisition expenditures of $293.6 billion on 873 deals, a 272.0% increase from one year prior and a 218.1% spike from September, per preliminary data supplied by Pitchbook. The spike may be attributed to a high concentration of deals for more than $1 billion. $270.7 billion, or 92.2% of capital was for ten-figure deals.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed