As we publish our Economic and Public Market Update for the first quarter of 2020, it is obvious that the first quarter was a wild ride. It included US stock markets reaching all-time highs and ended with the fastest 20% market drop on record. The drop, spurred on by the coronavirus pandemic, put an end to the longest bull market in history.

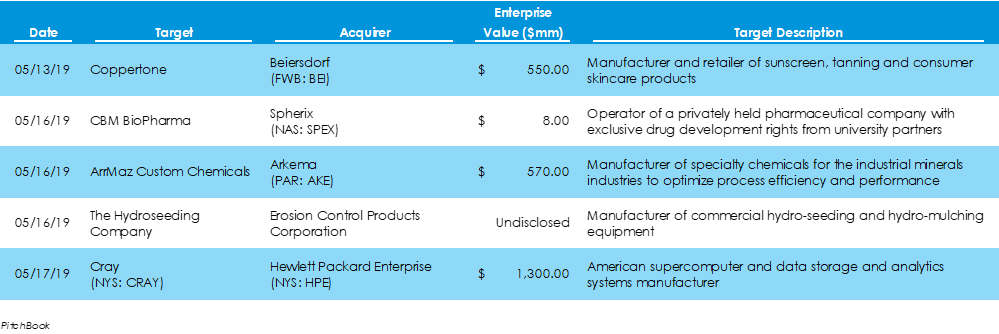

While nothing compares to the loss of human life, the economic toll of the pandemic and the practical shutdown of the economy has been significant to say the least. The full impact is still playing out, including whether we can achieve the V-shaped recovery we all hope for, but the economic results began to deteriorate in the final weeks of the first quarter. Advanced estimates of the first quarter GDP came in at -4.8%, marking the first quarterly decline since 2014. Estimates for second quarter GDP project a decline of more than 30%. Disney Claims Control of Hulu Ahead of Disney+ Streaming RolloutPitchbook data reveals that $9.5 billion was invested across 27 M&A deals in the U.S. last week, 6 fewer deals and $75 billion less capital after outsized M&A activity in the week prior. Two deals – targets Cray and Hulu - were in the billion-dollar range. The Walt-Disney Company acquired full control of Hulu for $5.8 billion, after what once was joint ownership by Disney, 21st Century Fox, Comcast, and Time-Warner.

Last week’s economic news was slightly disappointing, as a number of indicators missed estimates, though jobless claims fell to a 45-year low. Still, given the higher than usual number of states estimating claims, the jobless claims number is a rough estimate.

According to the Federal Reserve’s latest release, industrial production increased 0.2% in November, following an upwardly revised October at 1.2%. Manufacturing production also increased 0.2%, marking it's third consecutive monthly increase. Compared to November 2016, industrial production increased 3.4%. Excluding post-hurricane gains of 3.0% in oil and gas extraction, total industrial production would have been unchanged in November from October. November capacity utilization for the industrial sector was 77.1%, which is 2.8% below the long-term average from 1972 to 2016.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed