|

Last week, the National Association of Realtors announced that U.S. existing home sells fell dramatically year-over-year in December and that home-price inflation is slowing down to a seven-year low. Also, the Equipment Leasing and Finance Association revealed that American companies are borrowing and leasing slightly less for capital investment purposes than one year ago. Lastly, worldwide credit levels continue to rise to great heights, equivalent to 318% of global output, as of September.

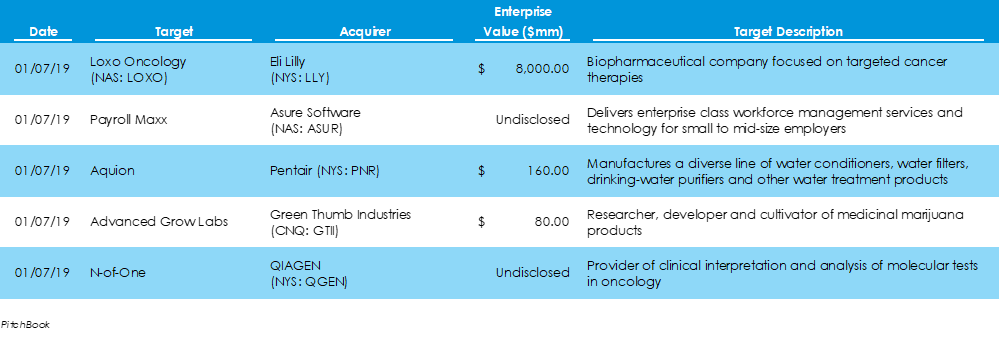

According to data from Pitchbook, there were 25 M&A deals announced last week for a total price tag of $1.56 billion. The largest deal was Dai-Ichi Life Insurance’s $1.2-billion acquisition of Denver-based Great-West Life & Annuity Insurance Company. Great West operates the nation’s second largest provider of retirement plans, Empower Retirement.

Adena Friedman, the Chief Executive at the Nasdaq stock exchange indicates that market volatility is not necessarily to blame for the lack of IPOs at the start of 2019. She says interest to go public is still there, but the SEC, which ultimately approves a company’s IPO plans, is closed with the government shutdown.

The Federal Reserve’s January 2019 Beige Book shows a general increase in economic activity, while the labor market remains tight and input costs are on the rise. The University of Michigan revealed that consumer sentiment fell to its lowest level in over two years, according to its Survey of Consumers. The ongoing government shutdown and market volatility were the leading factors. Also, the Labor Department released its import- and export-price indices for December, which both fell during the month. Year over year, import prices had their largest drop since September 2016.

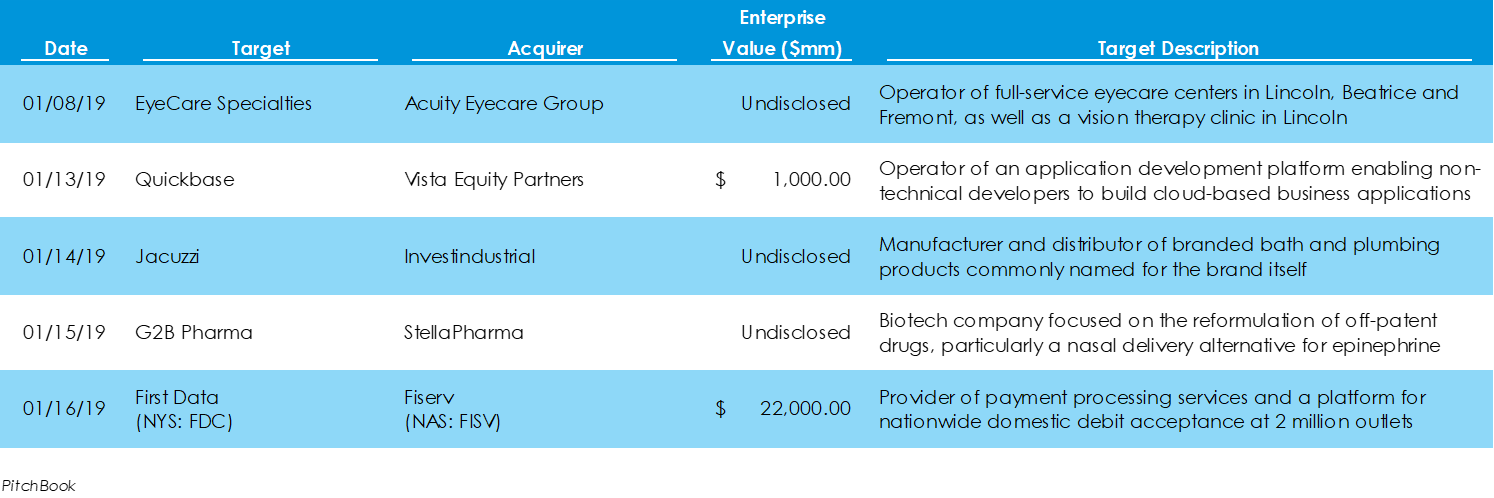

Preliminary data supplied by Pitchbook shows that there were 28 M&A transactions last week for $24.05 billion in total invested capital. The headlining transaction was the $22-billion all-share transaction by Fiserv for First Data. The deal is one of the largest in the fast-growing financial technology, or “fintech,” sector.

Another week without IPOs, but Silicon Valley tech giants continue to prep for their debuts later this Spring. Pinterest, a social media platform for sharing recipes, home design ideas and style inspiration, has begun interviewing bankers to underwrite its listing.

The minutes from the Federal Open Market Committee’s December meeting were released, showing the board’s reluctance to increase interest rates amid weakening inflationary pressures and slowing global growth. The Bureau of Labor statistics furthered this point when releasing its December Consumer Price Index, which revealed the first monthly decrease in prices in nine months. The inflationary gauge did rise on an annualized basis, albeit slower than in prior months. Also, unemployment insurance claims fell unexpectedly in the first week of the new year.

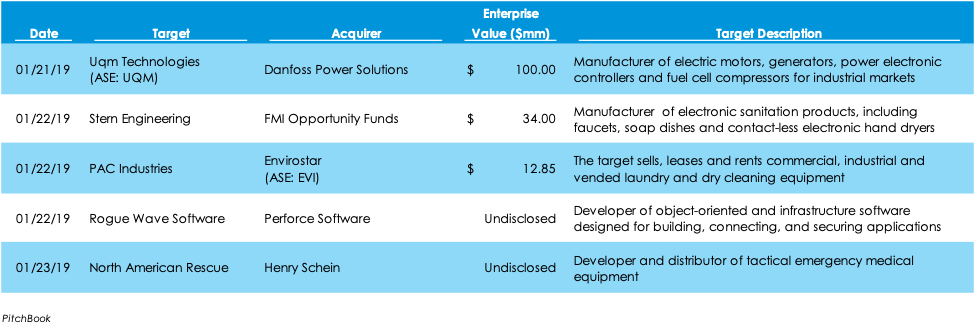

According to preliminary data supplied by Pitchbook, there were 24 M&A deals this last week, totaling $9.31 billion in deal spending. The largest announced transaction of the week was Eli Lilly’s buyout of publicly traded Loxo Oncology for $8 billion.

Saudi Aramco is again searching for ways to raise money in an IPO. Saudi Arabia’s energy minister says the long-delayed IPO will take place in 2021. The Kingdom released the results of an independent audit of their oil reserves last week, showing they control 260 billion barrels in oil reserves. Since the inception of Aramco’s IPO idea, the plans have been critiqued for not being transparent enough. Experts suggest these metrics are a first step to revealing enough about the company to potential investors.

Two surveys on U.S. manufacturing activity suggest a dramatic slowdown in the sector. HIS Markit’s manufacturing PMI revealed a subtle 1.5-point drop to a 15-month low, while the Institute for Supply Management’s PMI experienced a one-month decline of 5.2 points, the greatest in 10 years. Despite waning manufacturing activity, the job market experienced an unexpected surge as 312,000 jobs were added, 136,000 more than expected, while the unemployment rate rose slightly and wage gains posted a nine-year higher.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed