|

Last week, gross domestic product figures showed slightly stronger economic output, particularly driven by consumer spending. The personal consumption expenditures index missed the Federal Reserve’s inflation target for the fourth straight month. Also, unemployment applications increased for the week ending October 20, but continuing claims declined for the week.

During the week ending October 27, M&A markets had a total of 36 deal transactions announced for a total of $7.7 billion in disclosed funding. Six of thirteen deals with disclosed terms had price tags between $100 million and $500 million and only two deals were greater than $1 billion. Oil and gas companies had five deals worth $4.3 billion, and the South was the most favored target geography with eleven deals. The following are a selection of transactions from last week in Skyline’s core industry focuses:

New York Stock Exchange data shows that only four firms debuted on the U.S. public exchanges last week. The group raised a total of $1.6 billion, most of which came on the back of StoneCo’s $1.2 billion IPO. Other market first-timers include Pintec Technology and Gamida Cell. Also making headlines, Cloudflare announced its preparations for a $3.5 billion 2019 public debut.

Last week, U.S. retail sales growth dramatically missed economists’ expectations for September, according to Commerce Department data. The Labor Department released their data from the August Job Openings and Labor Turnover Survey, indicating more than one job opening for every unemployed worker. Also, the Federal Open Market Committee shared the minutes from the end-of-September meeting, indicating a potential for interest rates to continue to rise.

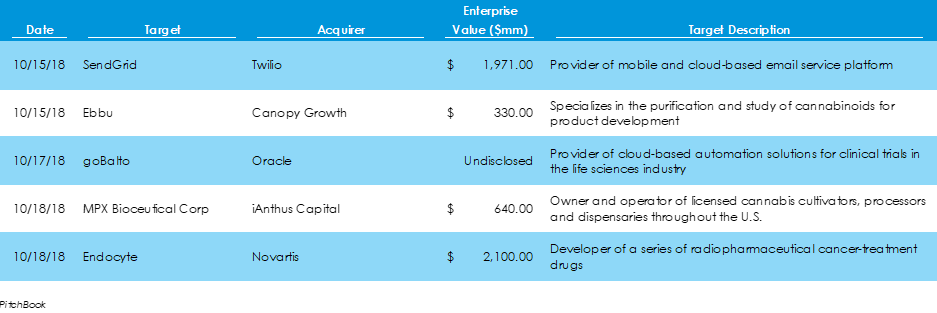

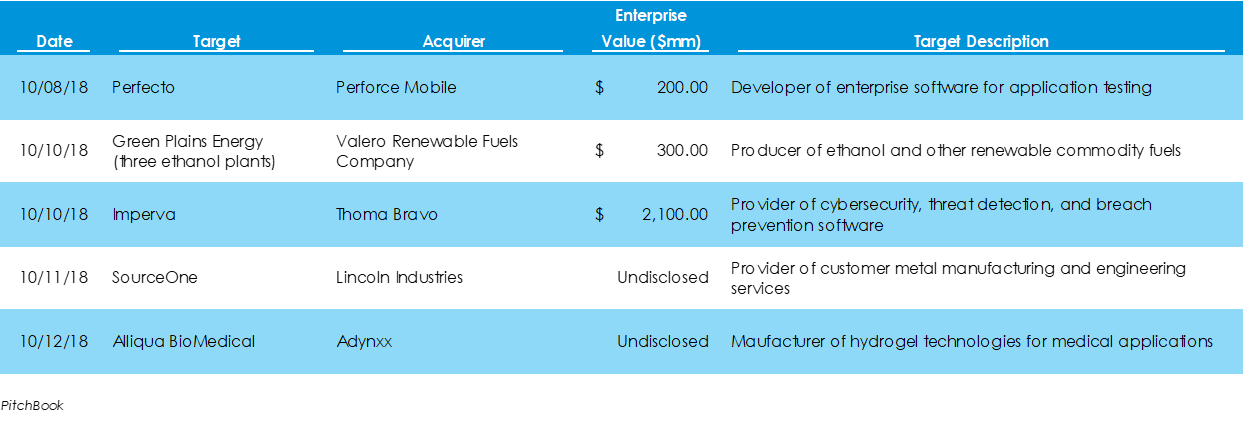

For the week ending October 19, capital markets saw a total of 32 M&A transactions with total capital flows of $19.65 billion. Eight deals were disclosed between $100 million and $500 million, the highest of any category. The tech, media, and telecommunications (TMT) vertical had $2.8 billion capital invested last week, continuing the strong run of deal activity in the space. The Rocky Mountain region was particularly active last week, with five deals for total disclosed capital of $7.9 billion. The following are a selection of transactions from last week in Skyline’s core industry focuses:

Per the New York Stock Exchange website, seven firms priced their IPOs last week, raising a combined $1.08 billion in capital. Four of the newly public firms are healthcare-focused companies, and they raised a total of $287 million. The largest IPO was the lone IT firm, SolarWinds, which raised $375 million.

A week after the employment figures put fear in investors over potential rate hikes, the Bureau of Labor Statistics cooled those fears with its CPI report, which detailed lower-than-expected inflation. At the start of last week, the International Monetary Fund curtailed its global growth forecast, citing trade tensions between the U.S. and its trading partners as a threat to economic growth. October’s preliminary Consumer Sentiment Survey was also released last week and featured slightly lower consumer confidence in the economy.

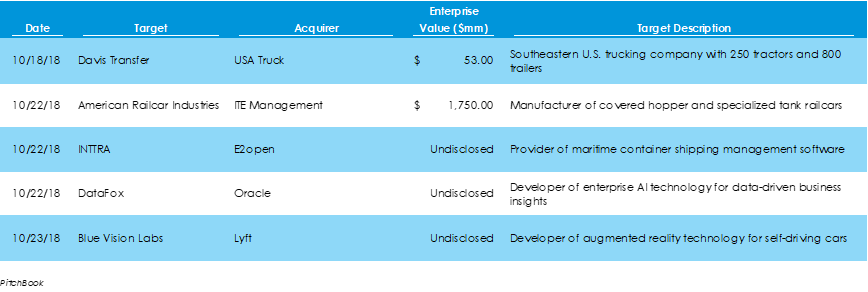

Last week, according to Pitchbook, M&A markets featured 36 deals for a total of $23.3 billion in invested capital. The $23.3 billion of invested capital is an increase of approximately 108% from the week prior, primarily due to a number of large acquisitions and buyouts. Also, a survey published by consulting firm EY last week shows that the M&A market has room to run. Ninety percent of the roughly 500 corporate executives surveyed believe that M&A conditions will improve over the next twelve months, with only 1% foreseeing a decline in conditions. Further, 51% of the executives say they plan to pursue acquisitions in the coming months, an increase from the 46% who said the same in April. The following are some of last week’s acquisitions featured in Skyline’s core industry focuses:

According to data provided on the New York Stock Exchange website, a total of four U.S. companies listed on U.S. exchanges last week, raising just over $1 billion in total funding. The debuts included two healthcare companies, Equillium and Allogene, one business-to-business SaaS firm, Anaplan, and one industrial metals firm, Livent.

Labor figures released last week showed a nearly full labor market. The unemployment rate fell to 3.7%, wages grew at a controlled 2.8%, and jobless claims were near levels not seen since 1969. However, the impressive jobs report spooked bond investors about future rate hikes by the Fed, prompting a bond market selloff that sent yields to seven-year highs.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed