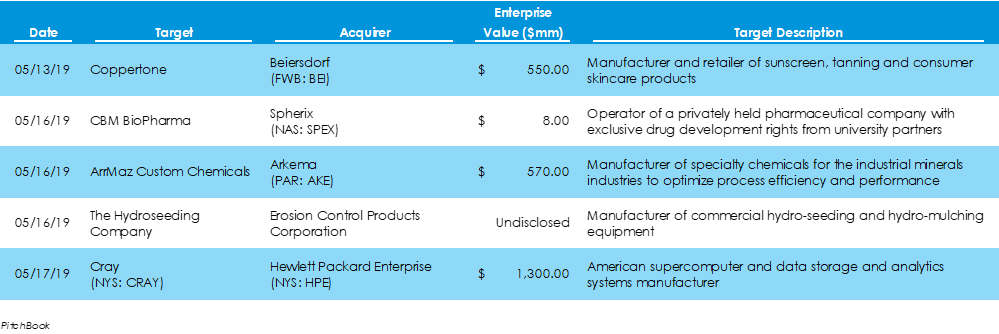

Disney Claims Control of Hulu Ahead of Disney+ Streaming RolloutPitchbook data reveals that $9.5 billion was invested across 27 M&A deals in the U.S. last week, 6 fewer deals and $75 billion less capital after outsized M&A activity in the week prior. Two deals – targets Cray and Hulu - were in the billion-dollar range. The Walt-Disney Company acquired full control of Hulu for $5.8 billion, after what once was joint ownership by Disney, 21st Century Fox, Comcast, and Time-Warner.

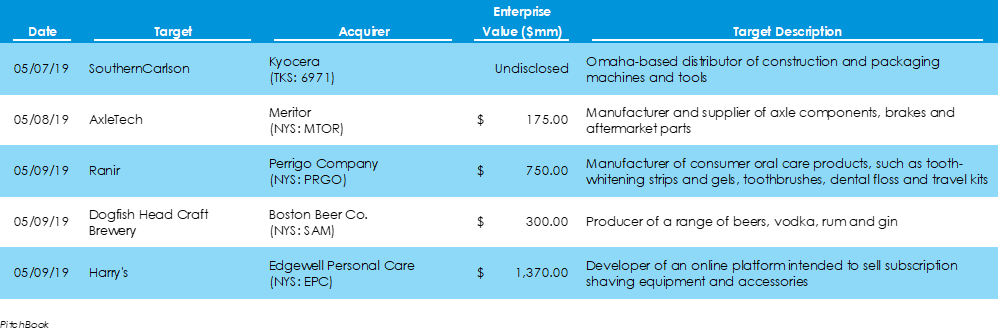

Maker of Samuel Adams Buys Delaware Craft BreweryData from Pitchbook shows that $84.5 billion was invested in 33 deals across American M&A markets last week, 10 more deals and $71.1 billion capital than the week prior. Four of those deals were for over $2.5 billion, including $38-billion and $23.3-billion-dollar deals, both of which were in the energy space. Another deal that caught significant media coverage was that of Boston Beer Co., the brewer of Samuel Adams brand beers, which paid $300 million to acquire Dogfish Head Brewery, a craft beer maker from Milton, Delaware. Dogfish produces over 250,000 barrels of beer annually.

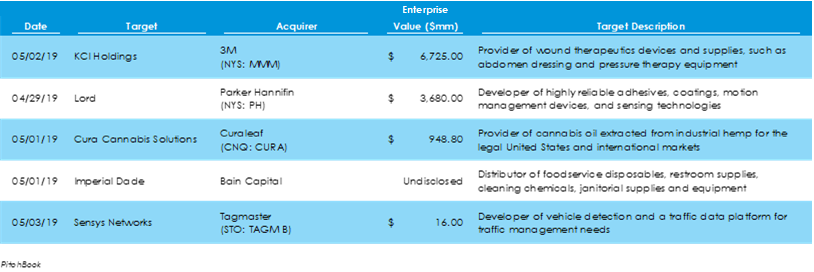

Chevron-Occidental Bidding War for Anadarko Heats UpPitchbook data reveals there were 23 deals for $13.4 billion invested capital in M&A markets last week. That is $9.8 billion more capital than the week before on two fewer deals. Two billion-dollar deals, 3M’s acquisition of KCI Holdings and Parker Hannifin’s acquisition of Lord, drove the increase in value from last week, contributing $6.7 billion and $3.7 billion, respectively, to the increase. M&A news was encapsulated by Occidental Petroleum and Chevron’s bidding war for Anadarko Petroleum and their Permian Basin shale-oil fields. Warren Buffett has committed to financing $10 billion of Occidental’s bid.

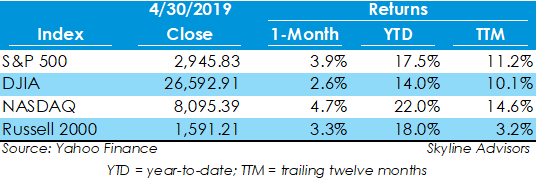

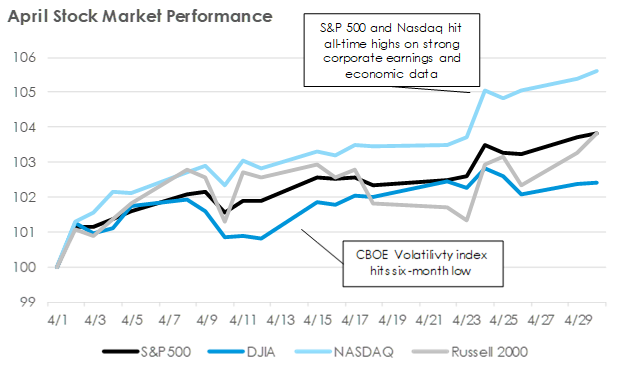

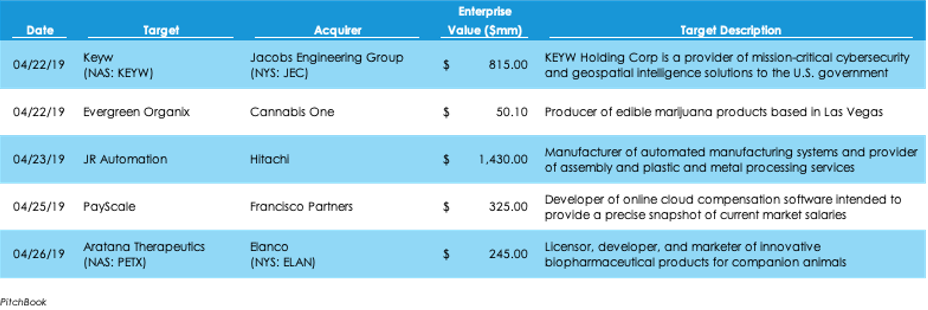

Stock market indices increased 2.6% or more in April, as earnings season continued with generally positive results and economic news. The S&P 500 marked its best four-month stretch in nearly nine years, increasing 3.9% to 2,945.83. The Dow Jones Industrial Average (DJIA), NASDAQ, and Russell 2000 also increased 2.6%, 4.7%, and 3.3%, respectively. Year to date, these indices are up 14% or more. Cannabis M&A Spiked Last Week with Four Deals in the U.S.Pitchbook data shows M&A activity slowing last week, with $3.6 billion invested across 24 deals, $11.2 billion capital and seven deals fewer than the week prior. Japanese multinational conglomerate Hitachi shelled out $1.43 billion for Michigan-based industrial robotics integrator JR Automation in the week’s largest deal. Deal making in the cannabis space was hot last week, with four U.S. cannabis producers and distributors being acquired.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed