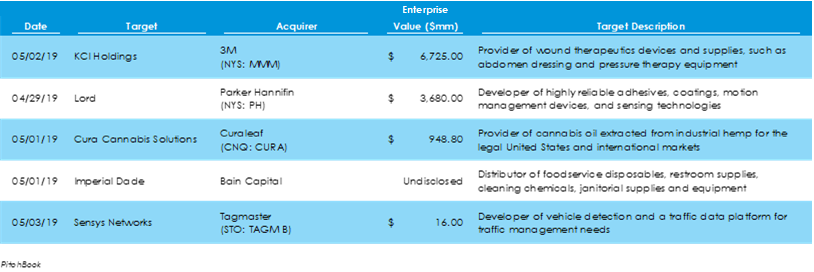

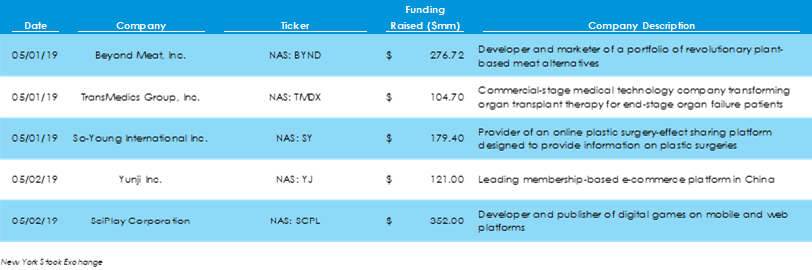

Chevron-Occidental Bidding War for Anadarko Heats UpPitchbook data reveals there were 23 deals for $13.4 billion invested capital in M&A markets last week. That is $9.8 billion more capital than the week before on two fewer deals. Two billion-dollar deals, 3M’s acquisition of KCI Holdings and Parker Hannifin’s acquisition of Lord, drove the increase in value from last week, contributing $6.7 billion and $3.7 billion, respectively, to the increase. M&A news was encapsulated by Occidental Petroleum and Chevron’s bidding war for Anadarko Petroleum and their Permian Basin shale-oil fields. Warren Buffett has committed to financing $10 billion of Occidental’s bid. Beyond Meat Goes Public and Uber to Go Public This WeekLast week, there were six new initial public offerings that raised $1.1 billion collectively, according to the New York Stock Exchange. Beyond Meat, the producer of plant-based meat alternatives, raised $277 million, and SciPlay, the mobile game developer, raised $352 million. Uber’s initial public offering is expected later this week, which will be the largest company to go public since Facebook did so in 2012. Unemployment Reached 3.6% in April, the Lowest since December 1969’s 3.5% RateAmong economic news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed