|

International M&A news sees major developments in ongoing deals such as 21st Century Fox's SKY UK deal falling through due to recent CMA remarks, the Spanish government's approval of a takeover bid for Spanish motorway controller Abertis by Italian motorway operating firm Atlantia, and a bio-tech deal troubled by insider trading allegations.

A few notable initial public offerings (IPOs) over the past week include the $2.3B raising by PagSeguro Digital, a Brazilian competitor of PayPal, the Blackstone Group's public offering of Gates Industrial Corp., and a middle market immuno-cancer drug research company.

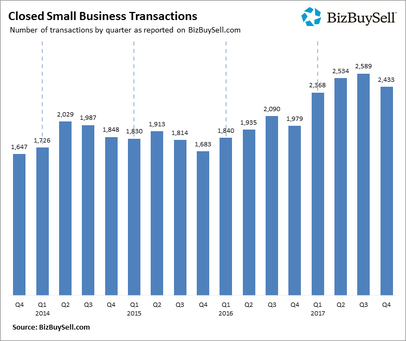

BizBuySell released its Fourth Quarter 2017 Insight Report, which revealed that small business transactions reached a record high in 2017. Successfully closed transactions in 2017 totaled 9,919, up 27% from 2016’s 7,842. The 27% growth rate is the largest since 2013. Business brokers cited strengthening revenue and profit numbers as the strongest reason for the increase in transactions. Indeed, the median revenue for businesses sold in 2017 was up 5.8% from 2016. Median cash flow increased nearly 7% over the same period. According to the National Center for the Middle Market’s Middle Market Indicator, three quarters of middle market companies reported revenue increases over the past twelve months. Fourth quarter 2017 revenue growth for middle market companies was recorded at 7.6%, up from 6.9% at the end of 2016 and above the six-year average revenue growth rate of 6.7%. These companies optimistically estimate further growth in 2018 at 5.4%.

Last week’s economic news was slightly disappointing, as a number of indicators missed estimates, though jobless claims fell to a 45-year low. Still, given the higher than usual number of states estimating claims, the jobless claims number is a rough estimate.

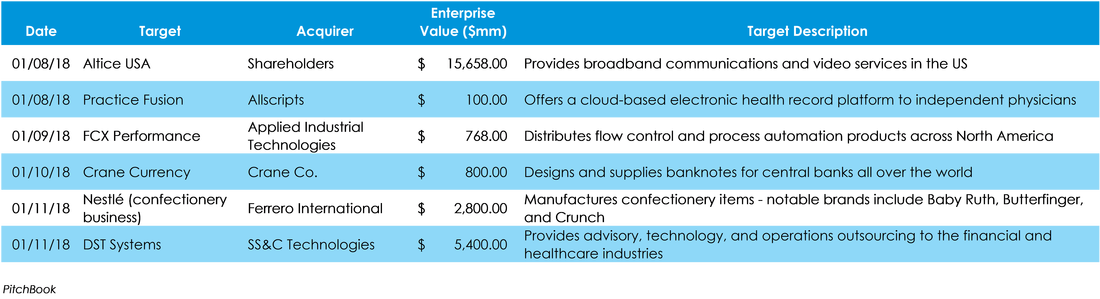

Three M&A deals valued companies over a billion dollars last week: Blackhawk Network Holdings, Spectrum Brands’ battery segment, and La Quinta’s hotel segment all fetched valuations of roughly $2 billion or more.

Last week was a quiet week for IPOs. Security company ADT Corp. highlighted the week with a $1.7 billion offering. Speculation continues among other tech-based companies such as SurveyMonkey and Spotify.

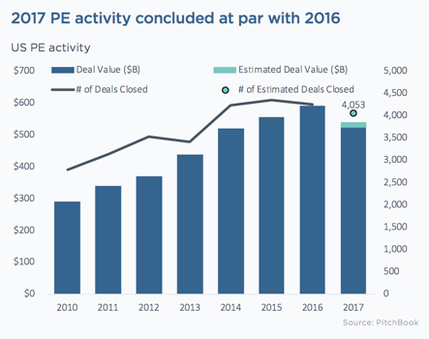

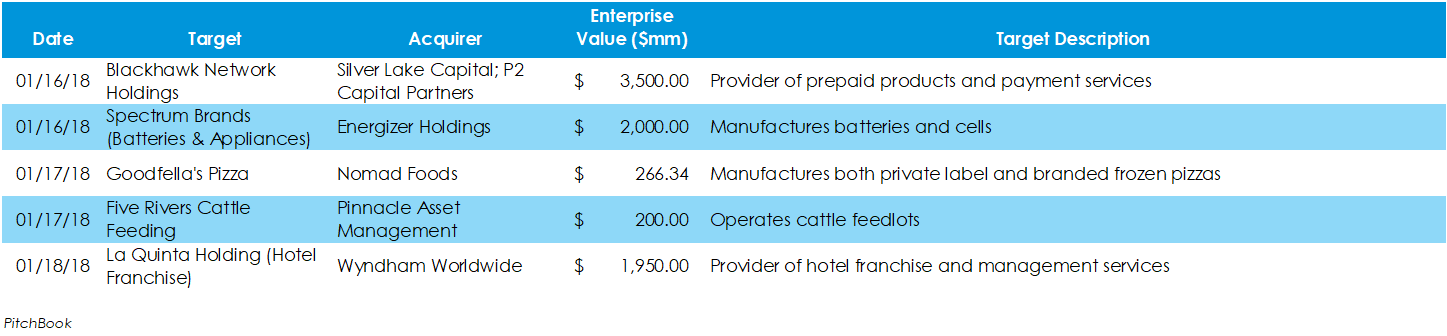

Pitchbook released its 2017 Annual US PE Breakdown report this week. The total value of private equity (PE) deals completed in the US in 2017 was estimated at $538 billion across 4,053 deals. This activity is down 8.9% from 2016, which is a bit counterintuitive at first since PE funds have record amounts of “dry powder” to invest. Three quarters of the follow-on funds raised by private equity funds during the year were larger than their predecessor funds. PitchBook’s recent 2018 Crystal Ball Survey report found that private equity firms had two main concerns. The first was a perceived “high-priced” environment, with the median EBITDA (earnings before interest taxes depreciation and amortization) in 2017 coming in at 10.5x. The second was a perceived lack of “quality” targets being on the market after the record volume of deals over the last several years. Of the six notable mergers and acquisition (M&A) transactions highlighted this week, the spin off of Altice USA from its European parent and the acquisition of Midwest-based DST Systems were the largest transactions.

The general tone of economic data released last week signals increasing confidence among both consumers and businesses.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed