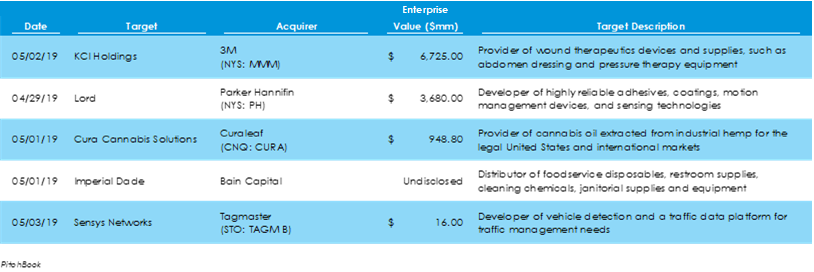

Chevron-Occidental Bidding War for Anadarko Heats UpPitchbook data reveals there were 23 deals for $13.4 billion invested capital in M&A markets last week. That is $9.8 billion more capital than the week before on two fewer deals. Two billion-dollar deals, 3M’s acquisition of KCI Holdings and Parker Hannifin’s acquisition of Lord, drove the increase in value from last week, contributing $6.7 billion and $3.7 billion, respectively, to the increase. M&A news was encapsulated by Occidental Petroleum and Chevron’s bidding war for Anadarko Petroleum and their Permian Basin shale-oil fields. Warren Buffett has committed to financing $10 billion of Occidental’s bid.

The U.S. Federal Reserve has reported that, overall, U.S. industrial production has continued to grow thanks to increased manufacturing and mineral outputs, while utilities production has fallen sharply. IHS Markit’s U.S. Services index showed services output falling to a four-month low but staying in growth territory. Lastly, U.S. soybean exports to China have fallen dramatically from stable levels in August, likely due to the implementation of tariffs from China.

The Federal Reserve’s January 2019 Beige Book shows a general increase in economic activity, while the labor market remains tight and input costs are on the rise. The University of Michigan revealed that consumer sentiment fell to its lowest level in over two years, according to its Survey of Consumers. The ongoing government shutdown and market volatility were the leading factors. Also, the Labor Department released its import- and export-price indices for December, which both fell during the month. Year over year, import prices had their largest drop since September 2016.

Last week saw the Bureau of Labor Statistics release nonfarm payroll figures that fell well short of expectations and pulled the three-month average to a 12-month low. Further, the unemployment stayed the same for the third straight month at 3.7%, and wage growth was at 3.1% for the second straight month. The total net worth among U.S. households broke to a record high in the third quarter after a 1.9% rise in net asset values. Last, the Commerce Department released October’s trade deficit report, showing the foreign trade gap widen by 1.7% to a ten-year high.

The week ending November 17 revealed Consumer Price Index data that surpassed the Fed’s 12-month 2% inflation target. Also, the Treasury Department says that the Government recorded a $100.5 billion deficit in October 2018, a 60% increase from a year before. Lastly, the New York Federal Reserve reported that U.S. household debt rose to $13.51 trillion, the 17th consecutive quarter of increasing household debt.

Weekly jobless claims fell to their lowest level since December of 1969, showing signs of continued labor market strength. The U.S. trade gap narrowed in the second quarter thanks to increased foreign demand for U.S. goods and services, as well as repatriated cash. Lastly, Merrill Lynch’s survey of money managers revealed increased investor pessimism about the outlook of the economy for the next twelve months.

Last week, the Bureau of Economic Analysis updated its original estimate of second-quarter GDP growth, the U.S. Census Bureau announced the July trade deficit reversed its spring and summer trend to widen to a five-month high, and the Consumer Confidence Index for August spiked dramatically to an 18-year high.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed