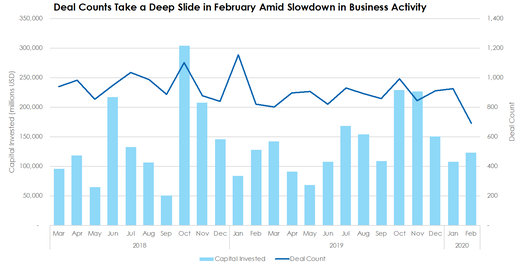

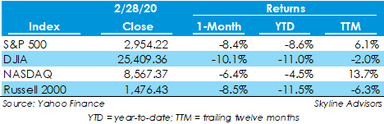

Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month.  After starting February with strong gains in the 4-6% range for the major US indices, the market collapsed from record highs and into correction territory within the last six trading days of the month. The market sustained gains during the first half of the month as government and economic officials around the globe seemed to be taking appropriate action to insulate economies from the effects of the novel coronavirus outbreak. However, by the last two weeks of February, investors were spooked by weak economic data domestically and abroad, stoking fears of a global economic slowdown.  Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed