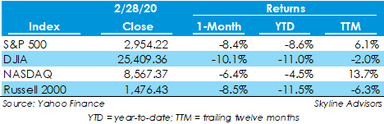

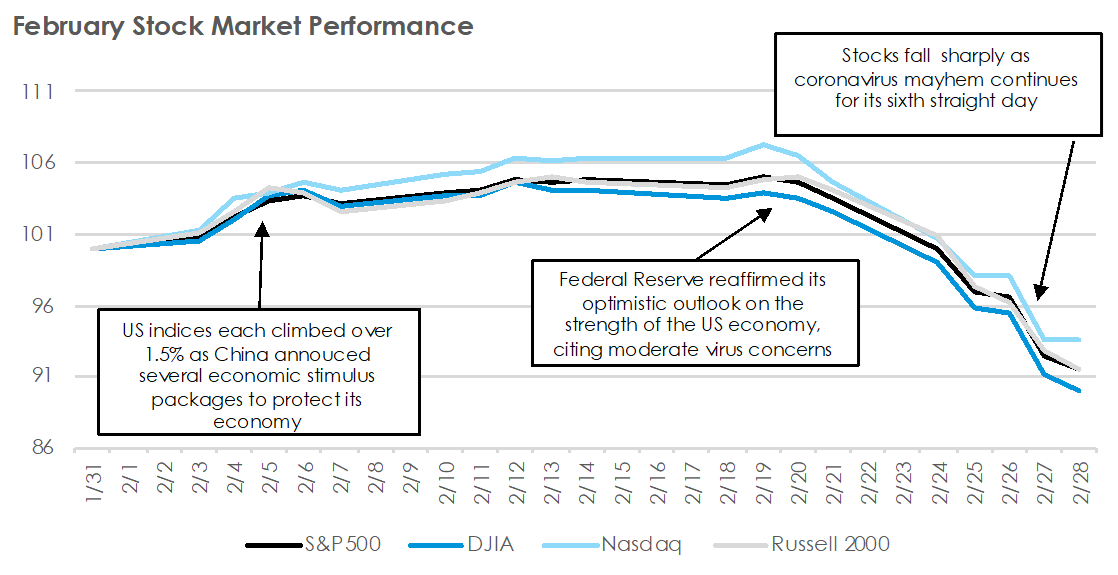

After starting February with strong gains in the 4-6% range for the major US indices, the market collapsed from record highs and into correction territory within the last six trading days of the month. The market sustained gains during the first half of the month as government and economic officials around the globe seemed to be taking appropriate action to insulate economies from the effects of the novel coronavirus outbreak. However, by the last two weeks of February, investors were spooked by weak economic data domestically and abroad, stoking fears of a global economic slowdown.

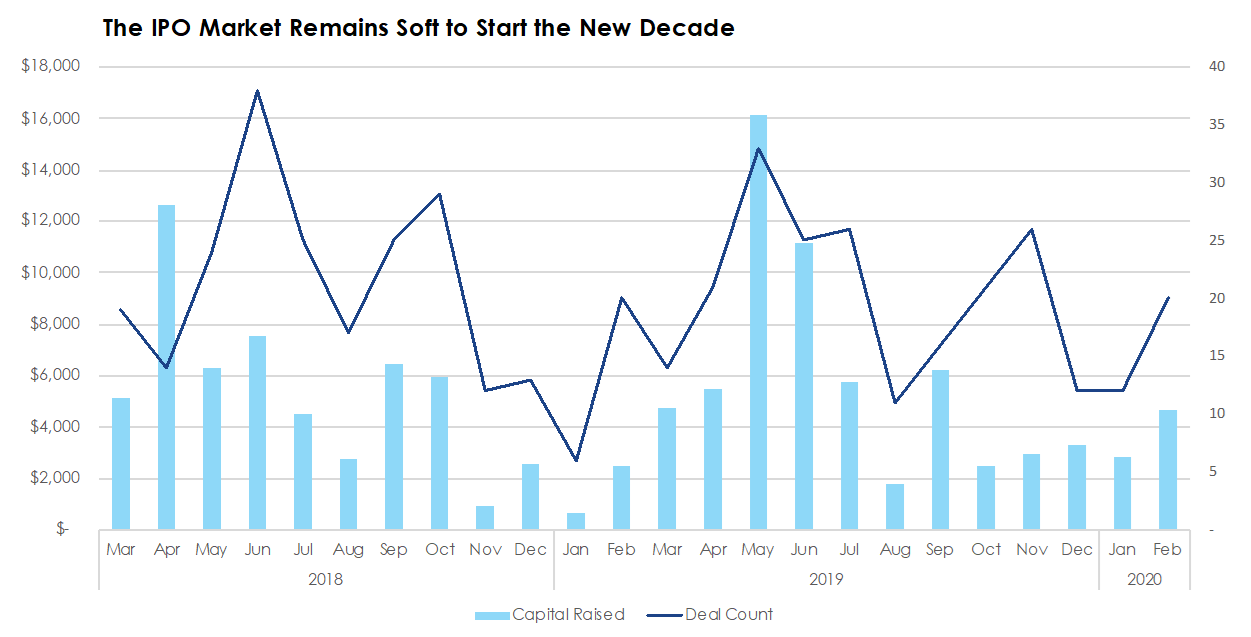

The IPO Market in the US Remained at Low Activity Levels During JanuaryUS IPO activity increased in February, with 18 deals for a total of $4.6 billion in capital raised, a 65% and 67% increase, respectively, over January. However, 18 of the 20 IPOs this month came before February 21, when the US stock market began declining. The largest IPO of the month was a $1.6 billion fundraising by PPD, Inc., a drug development laboratory and contract research organization, on February 6, 2020.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed