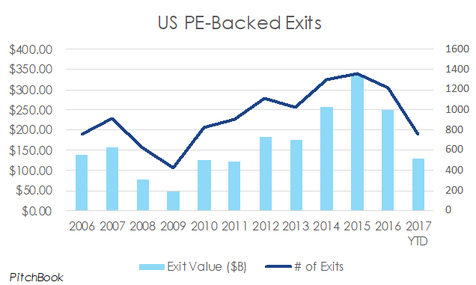

According to PitchBook, mergers and acquisitions (M&A) by private equity (PE) funds trended down in the third quarter of 2017 with an estimated 959 deals closed, valued at approximately $163 billion. This is a subset of the overall M&A market, as this only includes deals by PE firms and excludes acquisitions by strategic buyers. For the first three quarters of the year, deal value and closings are both down 11% from the first three quarters of 2016. This comes as a surprise, as fundraising continues to be strong, and private equity “dry powder” (the capital that the funds have raised but not yet deployed) is at an estimated $556 billion. Fewer numbers of investments being made and lower aggregate deal value may be the effect of fewer quality deals on the market and less flexibility in price. Venture Capital Aggregate Deal Value on Pace for All-Time High Despite Declining Transactions10/4/2017

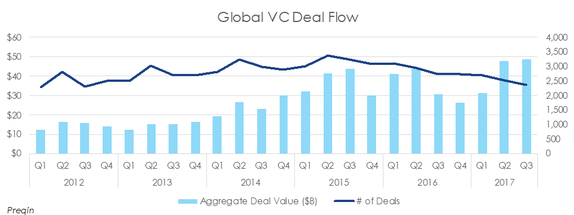

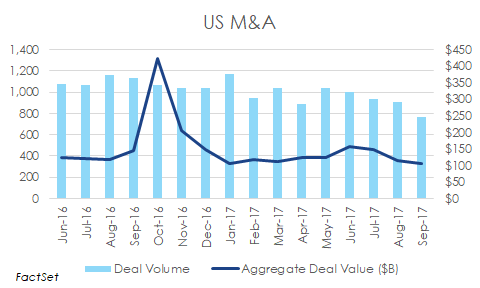

There were 2,362 global venture-backed deals, representing $49 billion in value, in the third quarter of 2017, according to Preqin. While this is the sixth consecutive quarter of declining transactions, the deal value in the quarter represents the second consecutive quarter of record highs, and the value through the first three quarters of 2017, at $128 billion, is on pace to become an all-time annual high. This comes as deal count through the first three quarters of 2017 are down 14% to 7,552 announcements from 2016’s 8,792. The US accounted for 40% of global deals, both in terms of volume and value.  Overall US mergers and acquisitions (M&A) activity decreased 22% year over year in the third quarter of 2017 to 2,610 announcements from 3,358 in the third quarter of 2016, according to FactSet. Aggregate deal value decreased 4% to $368 billion from $383 billion in the respective periods. The decline in deal count may be attributed to continued high prices and a perception of fewer “high-quality” companies being on the market. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed