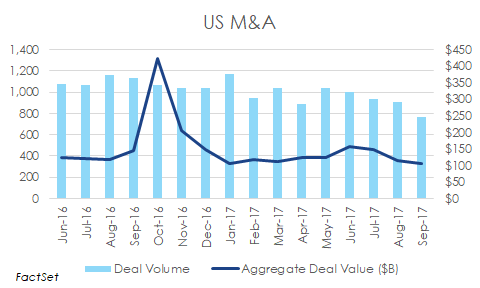

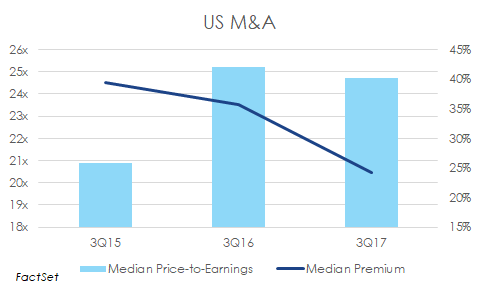

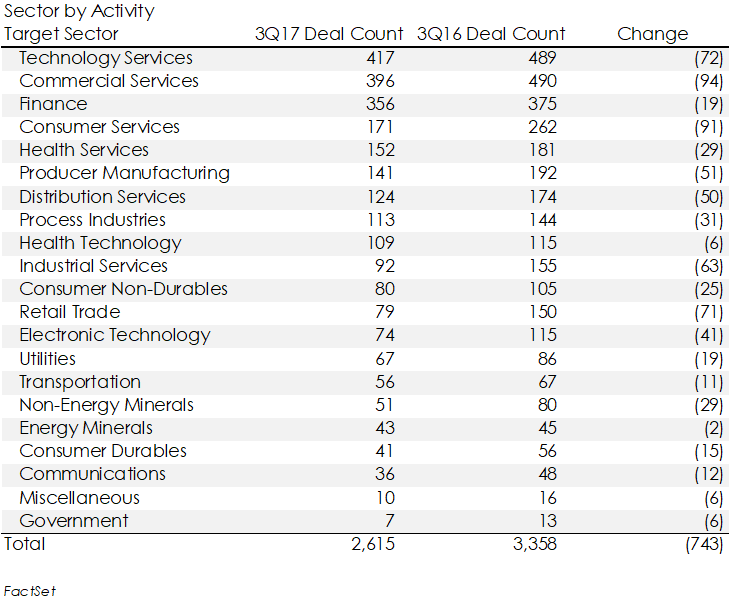

Overall US mergers and acquisitions (M&A) activity decreased 22% year over year in the third quarter of 2017 to 2,610 announcements from 3,358 in the third quarter of 2016, according to FactSet. Aggregate deal value decreased 4% to $368 billion from $383 billion in the respective periods. The decline in deal count may be attributed to continued high prices and a perception of fewer “high-quality” companies being on the market.  For the trailing twelve months ended September 30th, deal volume decreased 11% in 2017 compared to 2016, and deal value increased 6%. The support in value came from larger deals, as the aggregate deal value of deals valued at $500 million to just under a billion increased 32% to $189 billion and the aggregate deal value of deals valued above $1 billion increased 4% to $1.2 trillion. Overall market valuations decreased slightly from year-ago levels in the third quarter, with a median price-to-earnings ratio of 24.7x (compared to 25.2x in 3Q2016). Similarly, middle-market valuations decreased, with a median EBITDA multiple of 9.0x (compared to 9.4x in 3Q2016). Premiums paid in M&A transactions have steadily decreased in the third quarter of the past two years, falling as much as 10% from a year ago. Deal activity decreased across all sectors in the third quarter from the same year-ago period, though decreases were more profound in sectors such as retail trade and industrial services. Aggregate deal value among sectors decreased the most, in terms of percent change, for industrial services, producer manufacturing, and consumer durables and increased the most for miscellaneous, transportation, utilities, and health services. These statistics are broad and each deal and company is unique. A variety of factors, including the type of buyer, industry-specific dynamics, growth rates, and company stage, can significantly impact each deal. Accordingly, the overall market indicators do provide a general sense of market trends and sentiment. Contact one of our team members to discuss more granular statistics driving deals in your industry, geographic area, and deal stage. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed