Venture Capital Aggregate Deal Value on Pace for All-Time High Despite Declining Transactions10/4/2017

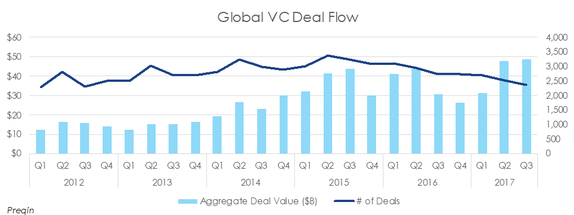

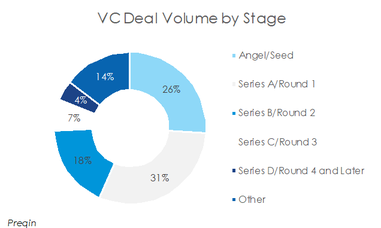

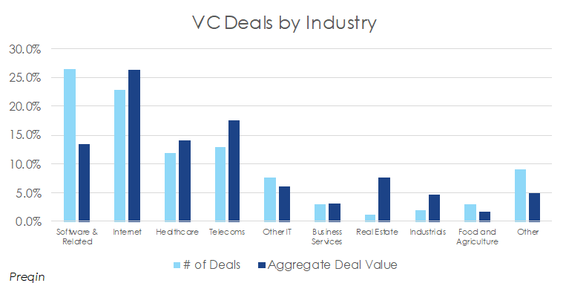

There were 2,362 global venture-backed deals, representing $49 billion in value, in the third quarter of 2017, according to Preqin. While this is the sixth consecutive quarter of declining transactions, the deal value in the quarter represents the second consecutive quarter of record highs, and the value through the first three quarters of 2017, at $128 billion, is on pace to become an all-time annual high. This comes as deal count through the first three quarters of 2017 are down 14% to 7,552 announcements from 2016’s 8,792. The US accounted for 40% of global deals, both in terms of volume and value.  Startups are typically raising capital from “angel” investors (high net worth individuals) or first rounds (typically referred to as Series A rounds) from venture capital funds. Each round of funding is typically sequentially labelled, so Series D rounds would be for companies that have undergone at least four or five rounds of capital raises. Angel and series A rounds accounted for more than half of volume in the third quarter, yet value was driven largely by later-stage rounds. In fact, though the average value of financing rounds up to series C has decreased in 2017, the average value of series D deals is at a record high.  Technology, media, & telecom (TMT) and healthcare continued to be attractive investments, as TMT accounted for over 60% of volume and over 55% of value, while healthcare accounted for 12% and 14% of volume and value, respectively. For more granular details on the status and trends in valuations, deal terms, and other factors in your industry and geographic area, contact one of our team members. We will also post industry-specific reports from time to time. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed