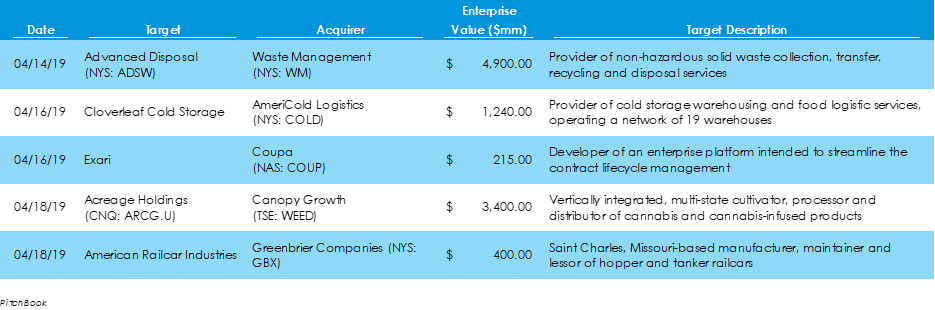

Waste Management Grows Eastern U.S. Operations by Acquiring Advanced Disposal Data supplied by Pitchbook reveals that $14.8 billion in capital was deployed across 31 M&A transactions last week, four deals more and $28.8 billion less capital than the elevated levels of the week prior. The largest deal of the week was Waste Management’s $4.9 billion acquisition of Advanced Disposal, which will help expand the nation’s largest waste collector’s East Coast operations. Also, Canopy Growth announced a deal to acquire Acreage Holdings once cannabis is federally legalized in the U.S.

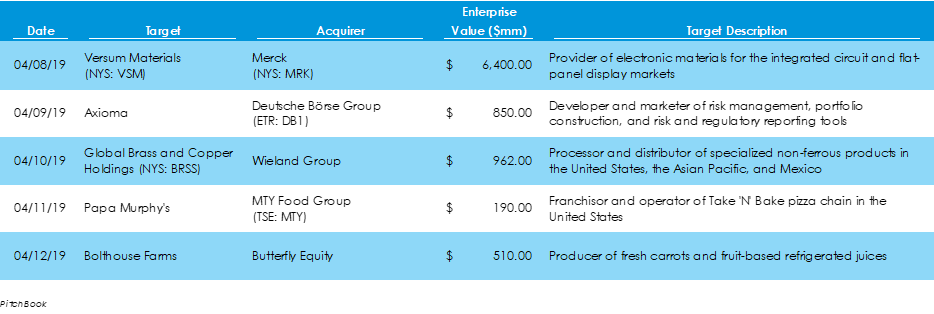

Campbell’s Soup to Sell Bolthouse Farms Brand in Refocusing Effort Pitchbook data reveals that $43.6 billion in capital was spent on 27 M&A deals throughout last week, $28.4 billion more capital than the week before but on two fewer deals. Chevron (NYS: CVX) shelled out $33 billion to acquire Texas-based Anadarko Petroleum (NYS: APC) in the week’s largest deal.

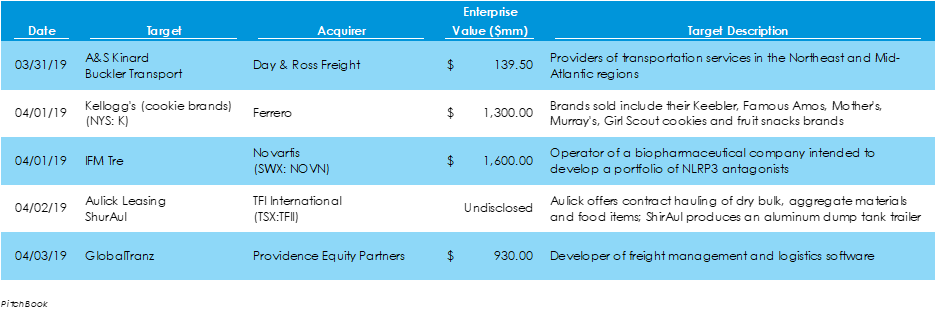

Transportation Space Highlights Last Week’s M&A ActivityData from Pitchbook shows that $15.2 billion of capital was invested across 29 M&A deals last week, $4.4 billion less capital on two more deals than the previous week. The largest two deals during the week were Stonepeak Infrastructure Partners’ $3.6 billion LBO of Oryx Midstream Partners and the $2.44 billion acquisition of AmeriGas Partners by UGI Utilities. AmeriGas is a publicly traded propane distributor, and Oryx is a natural gas collection group. The transportation space was an active sector, as A&S Kinard and Buckler Transport were acquired by Day & Ross Freight; TFI International acquired Nebraska-based Aulick Leasing and its manufacturing business, ShurAul; and Providence Equity Partners acquired transportation software provider GlobalTranz.

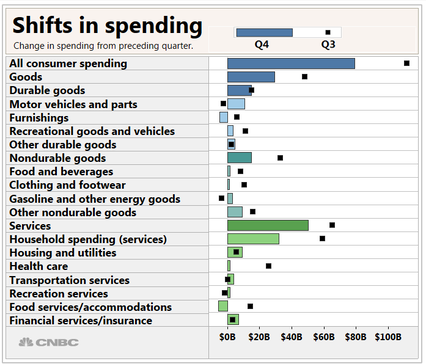

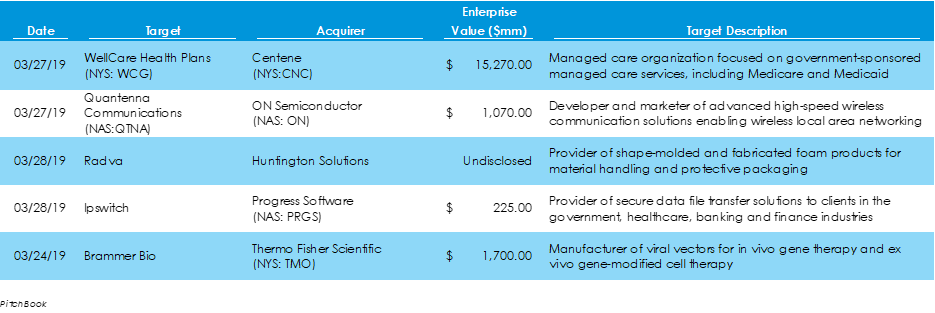

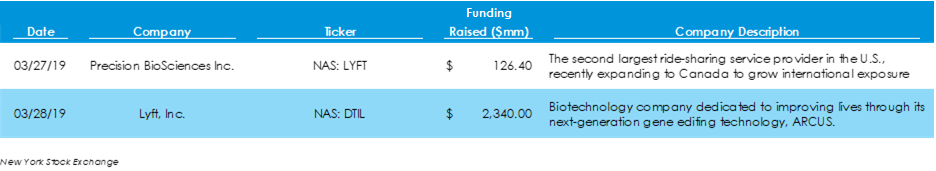

Mergers & Acquisitions: Manufacturing Sector Sees Continued Strong Activity in the M&A SpacePitchbook data reveals that $19.6 billion of capital was invested across 27 M&A transactions last week, twelve more deals but $17.2 billion less capital than in the week prior. The largest deal was publicly traded Centene’s corporate acquisition of WellCare Health Plans, also a publicly traded company, for $15.3 billion. The manufacturing vertical has been busy in 2019 through the end of last week, posting 48 transactions and $19 billion capital invested in LBOs and corporate acquisitions. Initial Public Offerings: Lyft Follows Through with Long-Awaited IPO According to the New York Stock Exchange website, two companies went public last week, the same figure as the week before. However, those two companies, Lyft and Precision BioSciences, combined raised more than in the prior week, raising $2.3 billion and $126 million, respectively. Lyft has been a highly anticipated IPO since the beginning of 2018, and the results of its IPO are indicative of it. The company priced its IPO at $72 per share, well above its initial estimates after a roadshow in which the firm received commitments in excess of expectations. As of trading close on Friday, Lyft was valued at approximately $26.5 billion. Economy: U.S. Fourth Quarter Economic Growth Revised Downward Among news last week:

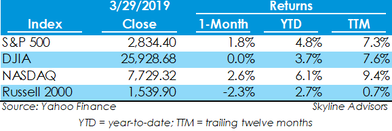

Stocks ended a volatile month with mixed results, with the S&P 500 index registering a 1.8% gain in March, while the Dow Jones Industrial Average, NASDAQ, and Russell 2000 closed the month with 0%, 2.6%, and -2.3% returns, respectively. It was the strongest quarter for the S&P 500 since the second quarter of 2009. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed