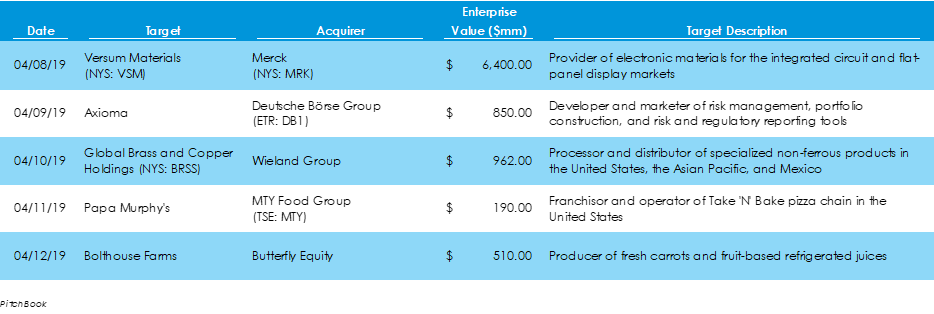

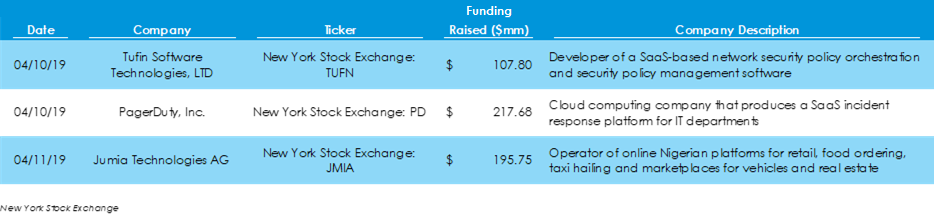

Campbell’s Soup to Sell Bolthouse Farms Brand in Refocusing Effort Pitchbook data reveals that $43.6 billion in capital was spent on 27 M&A deals throughout last week, $28.4 billion more capital than the week before but on two fewer deals. Chevron (NYS: CVX) shelled out $33 billion to acquire Texas-based Anadarko Petroleum (NYS: APC) in the week’s largest deal. Uber Files for IPO, Citing Cash Set Aside for Driver’s to Purchase SharesAccording to the New York Stock Exchange, three companies listed with U.S. stock exchanges last week, all on the NYSE. The three firms – Tufin Software, PagerDuty and Jumia Technologies – raised total capital of $521.3 million, $1.1 billion less than the week before. Uber also officially filed for its long-awaited $1-billion IPO. In the filing, the firm revealed that it set aside up to $10 thousand per driver for common stock share purchases, with amounts based on the number of lifetime trips. Consumer Sentiment and Job Openings Decline as Fed Reconsiders Policy ChangeAmong economic news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed