|

People seeking work filed 245,000 initial claims for state unemployment benefits during the week ended December 23rd, according to a report filed Thursday by the Labor Department.

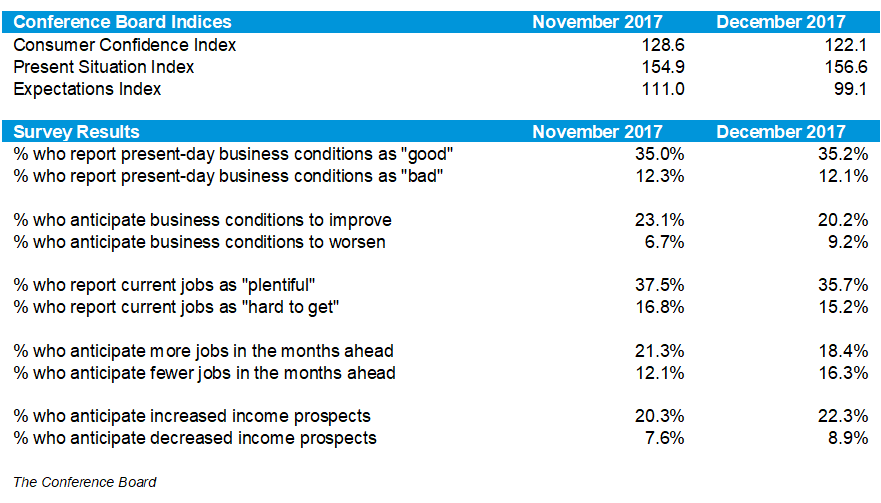

The Consumer Board Consumer Confidence Index decreased from 128.6 in November to 122.1 in December (1985 = 100).

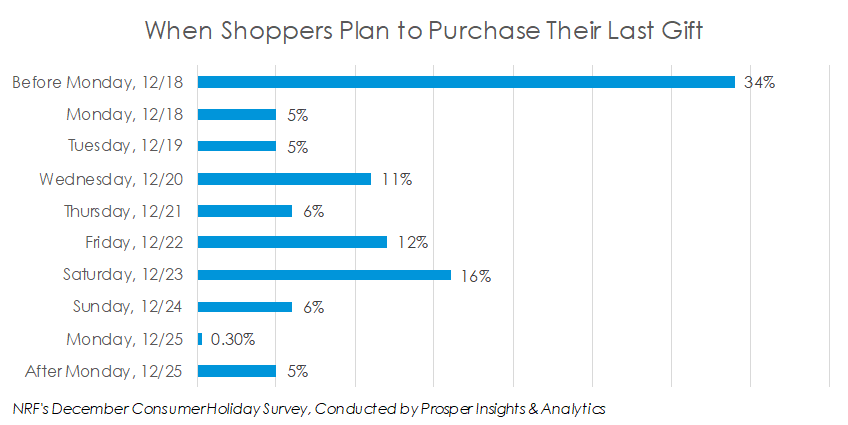

First Data recently reported that retail spending increased 6.6% between October 28th and December 18th, compared to the same period of last year. The company also found that e-commerce sales continued to outpace traditional, brick and mortar retail stores, with increases of 11% and 5.4%, respectively.

President Trump is now celebrating in Florida after signing the bill for the Tax Cuts and Jobs Act. The Tax Cuts and Jobs Act, which is now officially known as “An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018,” cuts business taxes from 35% to 21% and cuts several personal tax rates, though personal tax cuts are currently temporary. The law also adds a 20% deduction of income for businesses structured as tax flow-through entities, which is a common structure among small businesses.

According to the National Association of Realtors (NAR), sales of existing homes increased 5.6%, the strongest pace in over a decade, in November.

The Commerce Department announced today that November new housing starts resulted in a seasonally adjusted annual rate of 1.3 million units, with single-family houses being the biggest driver with an 8.7% increase so far this year. This is the fastest pace of single-family housing starts since September 2007, right before the start of the Great Recession.

After weeks of compromising their respective bills of the forthcoming tax reform, House and Senate Republicans released their joint tax bill yesterday afternoon. With votes planned early in the upcoming week, the bill may become law within days. Below are some key features of the bill.

According to the Federal Reserve’s latest release, industrial production increased 0.2% in November, following an upwardly revised October at 1.2%. Manufacturing production also increased 0.2%, marking it's third consecutive monthly increase. Compared to November 2016, industrial production increased 3.4%. Excluding post-hurricane gains of 3.0% in oil and gas extraction, total industrial production would have been unchanged in November from October. November capacity utilization for the industrial sector was 77.1%, which is 2.8% below the long-term average from 1972 to 2016.

Following a two-day policy meeting, the Board of Governors of the Federal Reserve System raised its prime rate Wednesday by a quarter point, from 1.25% to 1.50%. The increase - which affects interest rates on several instruments, such as credit cards and mortgages - marks the third increase this year and just the fifth since 2008. The Fed lowered interest rates to zero after the 2008 financial crisis in an effort to encourage borrowing and spending, which would accordingly spur the economy. As the economy has gradually recovered, the Fed has raised rates in steps, though rates are still relatively low historically. The intent when raising rates is to control inflation by balancing demand/supply and attracting foreign investment.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed