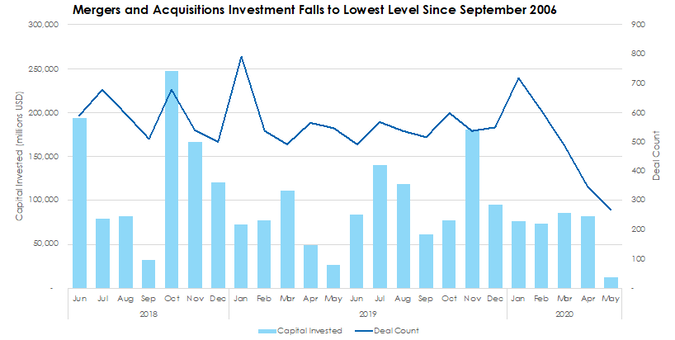

Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

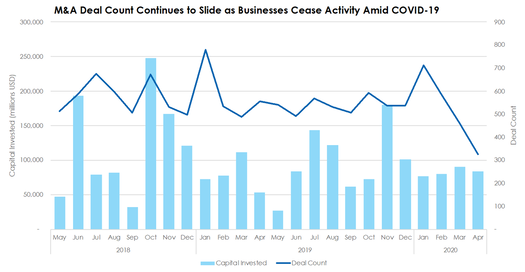

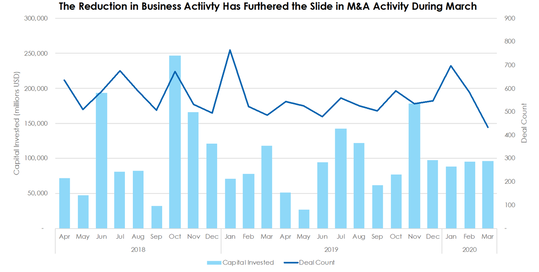

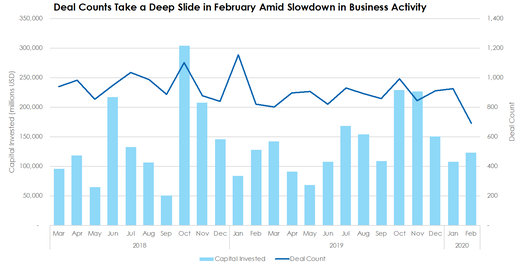

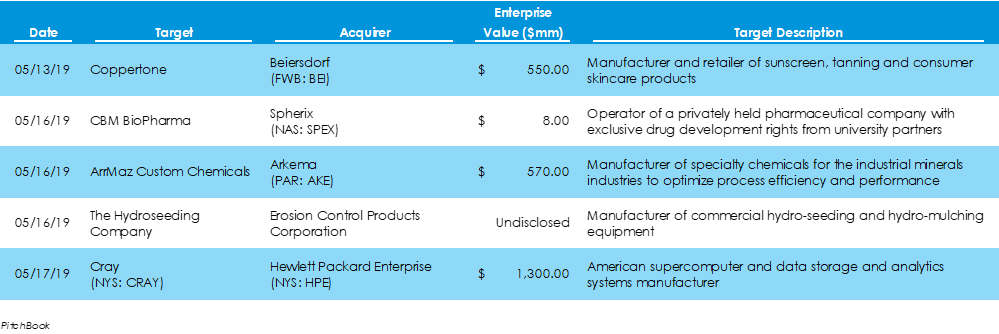

M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%. M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%. Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month. Disney Claims Control of Hulu Ahead of Disney+ Streaming RolloutPitchbook data reveals that $9.5 billion was invested across 27 M&A deals in the U.S. last week, 6 fewer deals and $75 billion less capital after outsized M&A activity in the week prior. Two deals – targets Cray and Hulu - were in the billion-dollar range. The Walt-Disney Company acquired full control of Hulu for $5.8 billion, after what once was joint ownership by Disney, 21st Century Fox, Comcast, and Time-Warner.

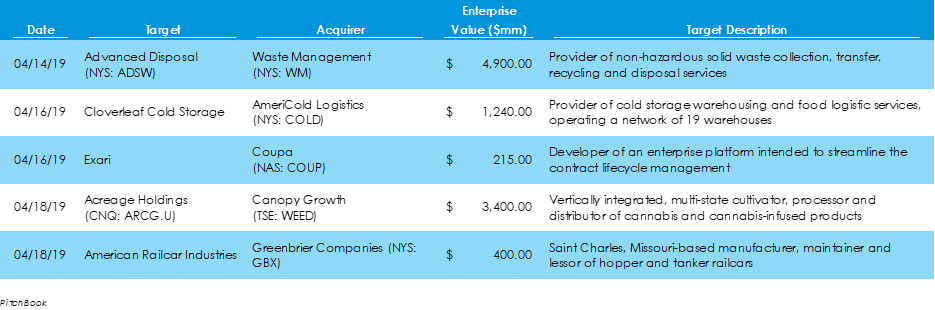

Waste Management Grows Eastern U.S. Operations by Acquiring Advanced Disposal Data supplied by Pitchbook reveals that $14.8 billion in capital was deployed across 31 M&A transactions last week, four deals more and $28.8 billion less capital than the elevated levels of the week prior. The largest deal of the week was Waste Management’s $4.9 billion acquisition of Advanced Disposal, which will help expand the nation’s largest waste collector’s East Coast operations. Also, Canopy Growth announced a deal to acquire Acreage Holdings once cannabis is federally legalized in the U.S.

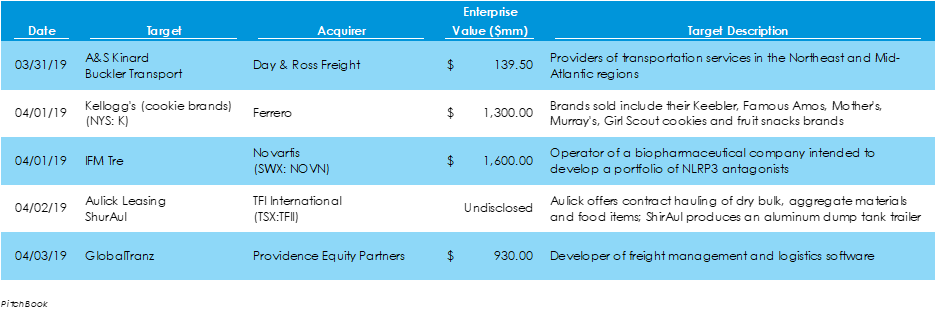

Transportation Space Highlights Last Week’s M&A ActivityData from Pitchbook shows that $15.2 billion of capital was invested across 29 M&A deals last week, $4.4 billion less capital on two more deals than the previous week. The largest two deals during the week were Stonepeak Infrastructure Partners’ $3.6 billion LBO of Oryx Midstream Partners and the $2.44 billion acquisition of AmeriGas Partners by UGI Utilities. AmeriGas is a publicly traded propane distributor, and Oryx is a natural gas collection group. The transportation space was an active sector, as A&S Kinard and Buckler Transport were acquired by Day & Ross Freight; TFI International acquired Nebraska-based Aulick Leasing and its manufacturing business, ShurAul; and Providence Equity Partners acquired transportation software provider GlobalTranz.

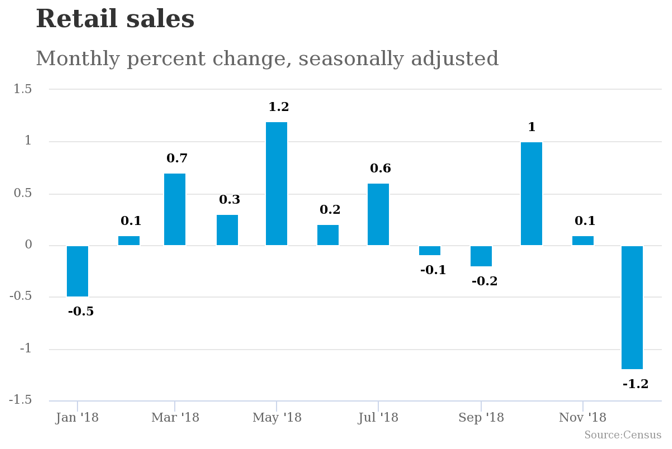

In last week’s economic news, US job openings reached a record high at 7.3 million, marking 1.2 jobs available for every unemployed person. However, despite the record-breaking job market, the week’s most notable news was a relatively steep decline in retail sales during the month of December. US retail sales dropped 1.2% during the month, or the greatest percent decline in more than nine years.

According to CNN Business and Mastercard SpendingPulse, year-over-year U.S. holiday spending grew at its fastest rate in six years. From November through Christmas Eve, Americans spent just more than $850 million, a 5.1% increase from the 2017 holidays. E-commerce sales also surged, with 19.1% more sales than in 2017. In fact, within the last year, mobile e-commerce holiday sales grew 57% from 2017 and in-store pickup sales grew 47%.

Last week, the Commerce Department’s retail spending report showed a notable gain in retail spending for the trailing twelve months through November, showing strong consumer demand heading into the holidays. Also, the Institute for Supply Management (ISM) released its semi-annual economic growth survey, revealing that although purchasing and supply managers expect revenue and investment growth, they believe 2019 will be a weaker year than 2018. Lastly, the Labor Department shared the November Consumer Price Index, which showed flat growth from October and a 2.2% annual increase. This week, the Federal Open Market Committee will meet on Tuesday and Wednesday to determine whether a rate hike is justified.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed