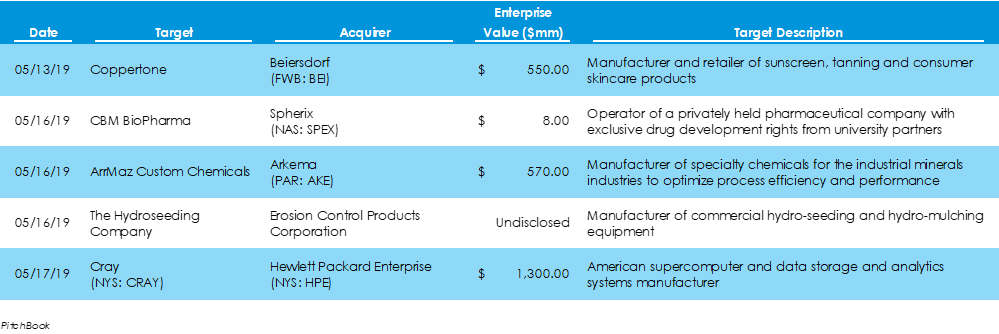

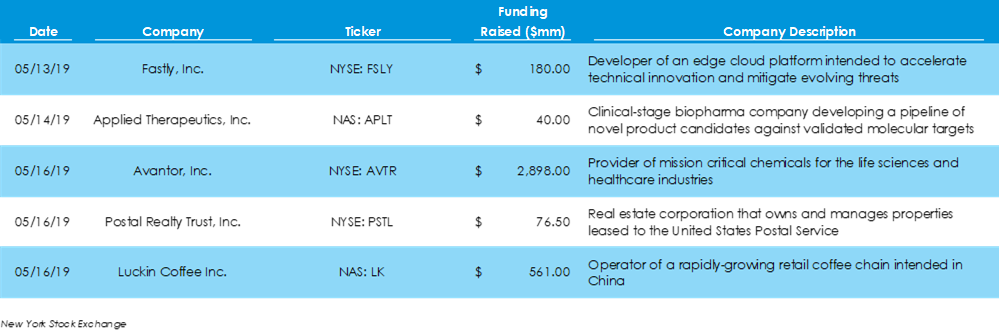

Disney Claims Control of Hulu Ahead of Disney+ Streaming RolloutPitchbook data reveals that $9.5 billion was invested across 27 M&A deals in the U.S. last week, 6 fewer deals and $75 billion less capital after outsized M&A activity in the week prior. Two deals – targets Cray and Hulu - were in the billion-dollar range. The Walt-Disney Company acquired full control of Hulu for $5.8 billion, after what once was joint ownership by Disney, 21st Century Fox, Comcast, and Time-Warner. Five Firms Join U.S. Exchanges in Wake of Uber’s IPOAccording to data from the New York Stock Exchange, the NYSE and Nasdaq had five companies go public last week, raising $3.8 billion cumulatively. The largest of the IPOs was Avantor, a provider of chemicals for healthcare companies, which raised $2.9 billion. Retail Spending and Industrial Production Fell During April, While Housing Starts ClimbedAmong economic news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed