|

This past week, mortgage applications and refinancing activity continued to decrease, with refinances falling to 18-year lows. Jobless claims also rose to a seven-week high for the week ended May 19th, with the four-week average reversing course to an increase.

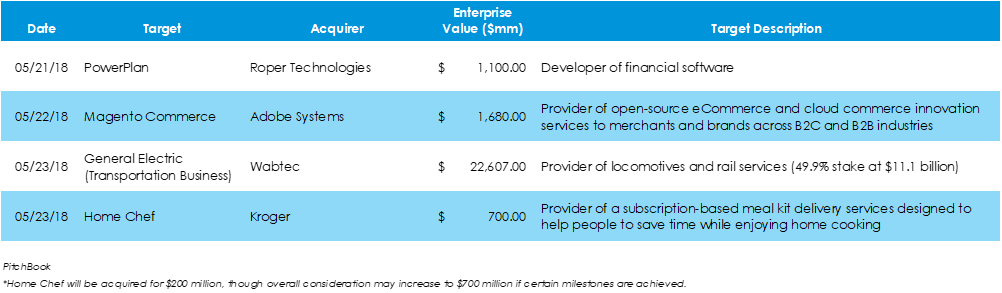

Last week, General Electric announced it had sold 49.9% of its transportation business to Wabtec Corporation for approximately $11.1 billion. The move came as CEO John Flannery announced a major overhaul of the GE conglomerate late last year. Other significant deals included Roper Technologies’ acquisition of PowerPlan, Adobe’s purchase of Magento, and Kroger’s acquisition of Home Chef.

GreenSky, a fintech company that facilitates loans for home improvement projects via smartphone applications, debuted Thursday on the public markets. The unicorn company priced on the high end of the range and sold well above its expectations of 34 million shares. Another notable IPO was that of EVO Payments, which is a payment processor. EVO raised $224 million.

The number of Americans applying for unemployment benefits increased 11,000 to 222,000 for the week ended May 12th, according to the Department of Labor. Economists polled by Reuters estimated the weekly claims number to come in at 215,000.

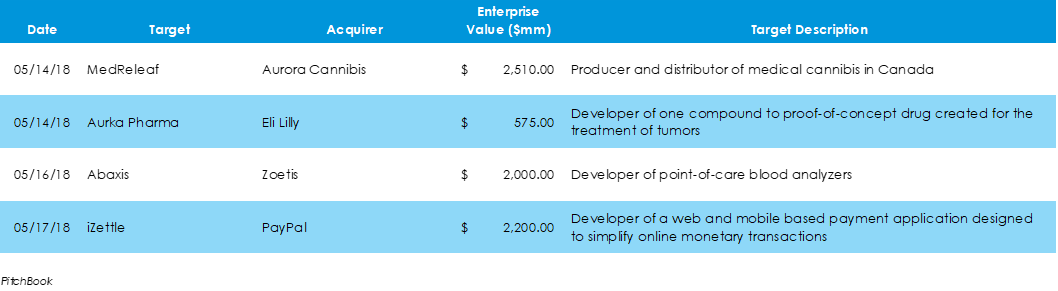

Two large healthcare deals took place last week, with Zoetis buying Abaxis for $2 billion and Eli Lilly acquiring AurKa Pharma for $575 million. In other news, Aurora Cannabis will acquire MedReleaf in the largest marijuana deal ever.

Houzz, a website that helps homebuyers discover design ideas, shop for their home, and find home professionals, hired a new CFO from LinkedIn. Richard Wong, LinkedIn’s former vice president of finance, is set to become Houzz’s first executive, The move signals speculation that Houzz may soon file for an initial public offering. Since founding in 2010, Houzz has raised over $600 million and may be valued at approximately $4 billion.

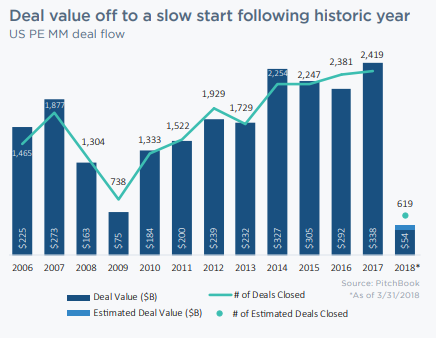

Middle-market private equity firms completed 619 transactions in the first quarter of 2018, representing $53.6 billion in deal value, according to Pitchbook. Compared to the first quarter of the 2017, completed transactions increased 17%, while deal value declined 40%, signaling a shift toward smaller transactions. Highlights of last week’s economic news include jobless claims that remained at 48-year lows, slowing consumer credit growth, and a withdrawal from the Iran nuclear deal, which may result in higher oil prices in the near term.

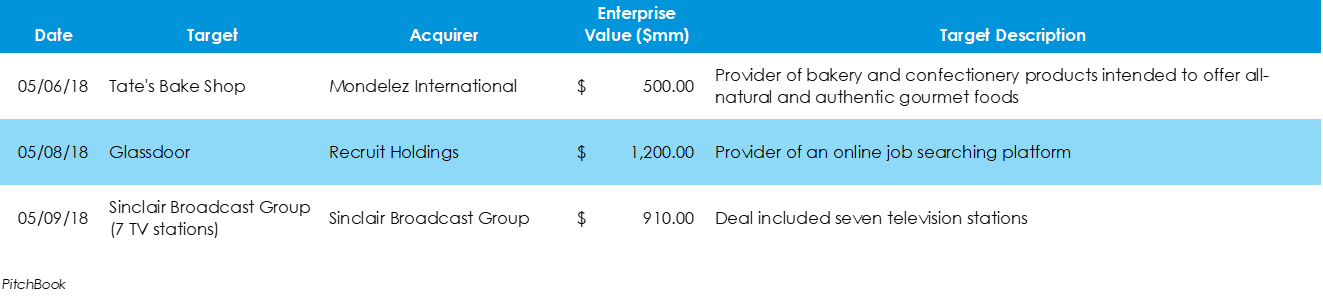

Last week’s mergers and acquisitions activity included two food deals early in the week – Nestlé’s agreement to sell Starbucks-branded consumer packaged goods and Mondelez’s acquisition of Tate’s Bake Shop. Other deals included Recruit Holdings’ acquisition of Glassdoor and Twenty-First Century Fox’s purchase of seven television stations. On the topic of Twenty-First Century Fox, Comcast gained attention last week, as it sought to outbid Disney for Twenty-First Century Fox.

In the largest IPO since Snap’s IPO in March 2017, French insurer Axa took its US arm of holdings public but missed its anticipated target by $1 billion. In other news, the fifth largest asset-based truckload carrier announced plans to go public again after being taken private in 2007.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed