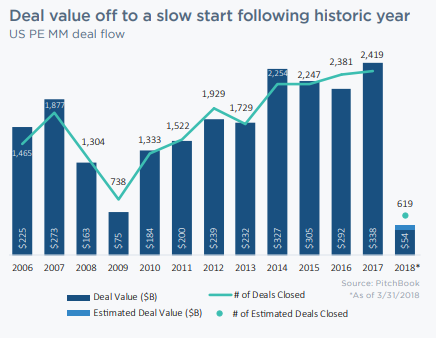

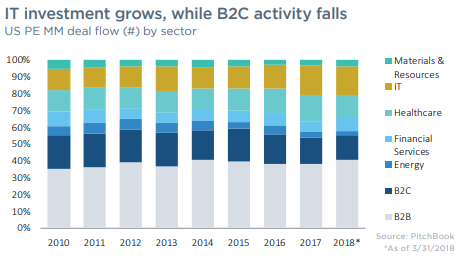

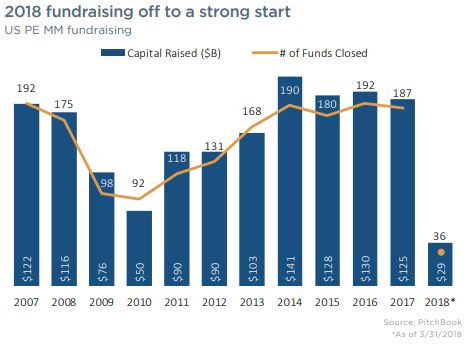

Middle-market private equity firms completed 619 transactions in the first quarter of 2018, representing $53.6 billion in deal value, according to Pitchbook. Compared to the first quarter of the 2017, completed transactions increased 17%, while deal value declined 40%, signaling a shift toward smaller transactions.  Investments in business-to-consumer (B2C) companies fell as a percent of total activity, giving way to increased investment in business-to-business (B2B), information technology (IT), and healthcare deals. In fact, 2017 was the first year in Pitchbook’s dataset in which IT deals outpaced B2C deals, and the trend continued in the first quarter of 2018. Recurring revenue models, which are common in IT investments, seem to be a major draw.  US middle-market PE fundraising is on track to match last year’s efforts, with $29 billion raised across 36 funds in the first quarter. Interestingly, middle-market funds accounted for 79% of total fundraising, up from 52% in 2017. This should lower, as mega funds, such as Blackstone, Oaktree, and Carlyle, are actively fundraising. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed