|

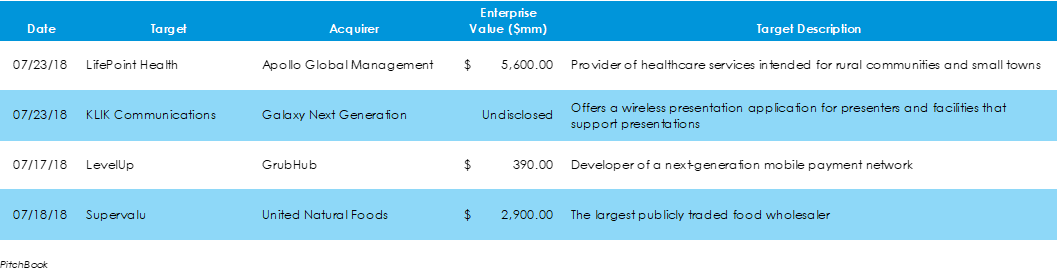

Last week, two tech companies, one healthcare provider, and one food distributor made M&A headlines. LifePoint Health, a hospital operator was acquired for $5.6 billion. KLIK Communications was acquired for an undisclosed amount. LevelUp accepted a $390 million acquisition bid from GrubHub. Lastly, food wholesaler Supervalu was acquired by United Natural Foods for $2.9 billion.

Last week, biotech firms Replimune Group, Aquestive Therapeutics, and Liquidia Technologies made public debuts on the NASDAQ, raising $100 million, $68 million, and $50 million, respectively. Further, cybersecurity provider Tenable and digital marketer Aurora had initial public offerings, raising $250 million and $77 million, respectively.

Last week, reports from the Commerce Department and the National Association of Home Builders indicated the housing market is beginning to cool off. Also, the Department of Commerce released their U.S. retail sales report for the month of June, showing a slight increase in retail activity. Finally, on Thursday, the Department of Labor announced that weekly jobless claims reached their lowest level since 1969.

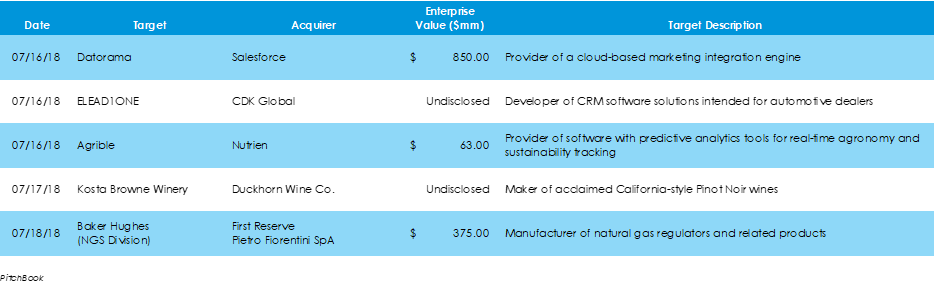

Last week, Salesforce headlined M&A activity with the acquisition of CRM provider Datorama. Other notable deals made during the week included acquisitions of Agrible, an agronomy software provider; ELEAD1ONE, a maker of CRM software for auto dealers; Kosta Browne, a California winery; andGE’s Baker Hughes sold their natural gas solutions business to private equity firm First Reserve.

Crinetics Pharmaceuticals, Rubius Therapeutics, Constellation Pharmaceuticals, and Allakos all debuted shares on the NASDAQ last week. Three of the four firms are clinical-stage, with the exception being Rubuis. Crinetics, Rubius, and Allakos all raised over $100 million in their initial public offerings

Last week the Department of Labor released its June reading on the Consumer Price Index, and the Federal Reserve released its consumer credit figures for the month of May. Both measures experienced stark upward growth during their respective months and over the twelve months prior.

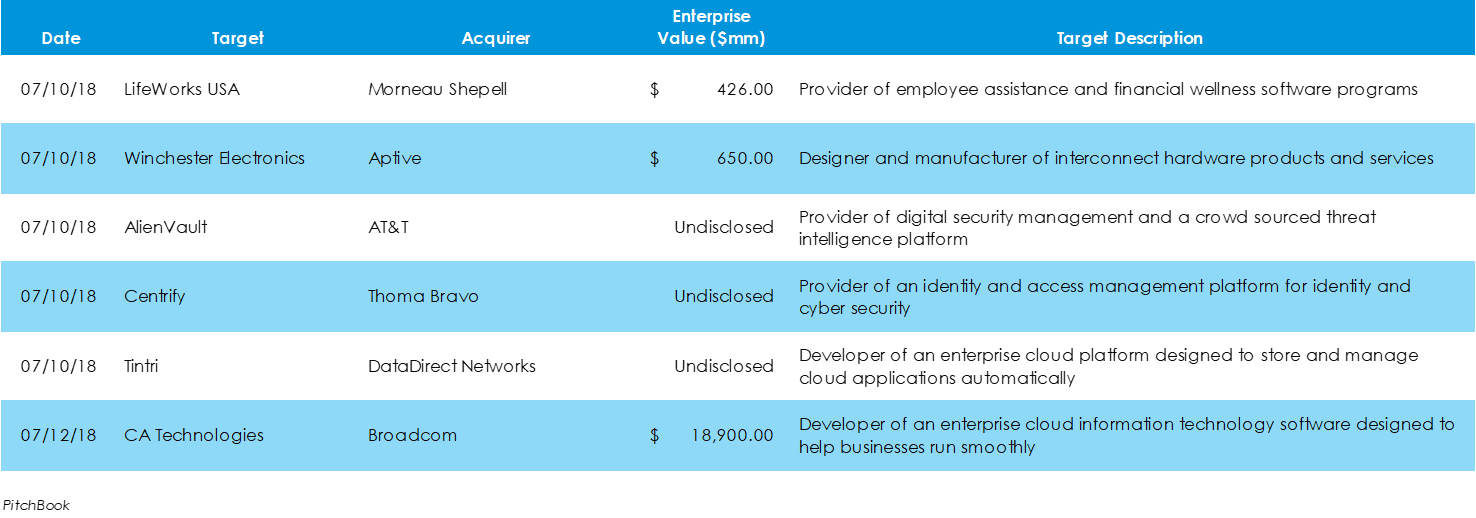

Last week, a number of tech and cybersecurity firms made deals to be acquired. AT&T made another purchase, this time of AlienVault, a cybersecurity firm. Centrify, another cybersecurity provider, was bought out by private equity firm Thoma Bravo. Tintri filed for chapter 11 bankruptcy and was acquired by DataDirect Networks hours later. LifeWorks USA was acquired by Canadian HR firm Morneau Shepell. Winchester Electronics, a 77-year-old company, was acquired by Ireland’s Aptiv. Lastly, on Friday, Broadcom finalized a deal to acquire software provider CA Technologies.

There were no new share offererings on U.S. exchanges last week. However, a few multinational companies are planning debuts. Canada’s Tilray and China’s Tencent Music are both planning American IPOs, while biotech firm Vaccinex filed for a NASDAQ IPO

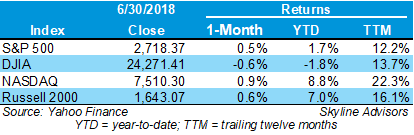

The stock market closed June mostly in the black, with the Dow Jones Industrial Average (DJIA) the sole major index that lost ground (-0.6%). The S&P 500 closed the month at 2,718.37 for a gain of 0.5% in June, while the NASDAQ and the Russell 2000 each closed June with gains of 0.9% and 0.6%, respectively. Last Monday, the Institute for Supply Management released their monthly manufacturing report, showing strong gains, despite industry disruption. On Tuesday, U.S. automakers released their monthly auto sales reports, all showing gains from the year before. Finally, on Friday, the U.S. Department of Labor released the monthly jobs report, which beat analyst expectations on job growth, while unemployment rose slightly.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed