|

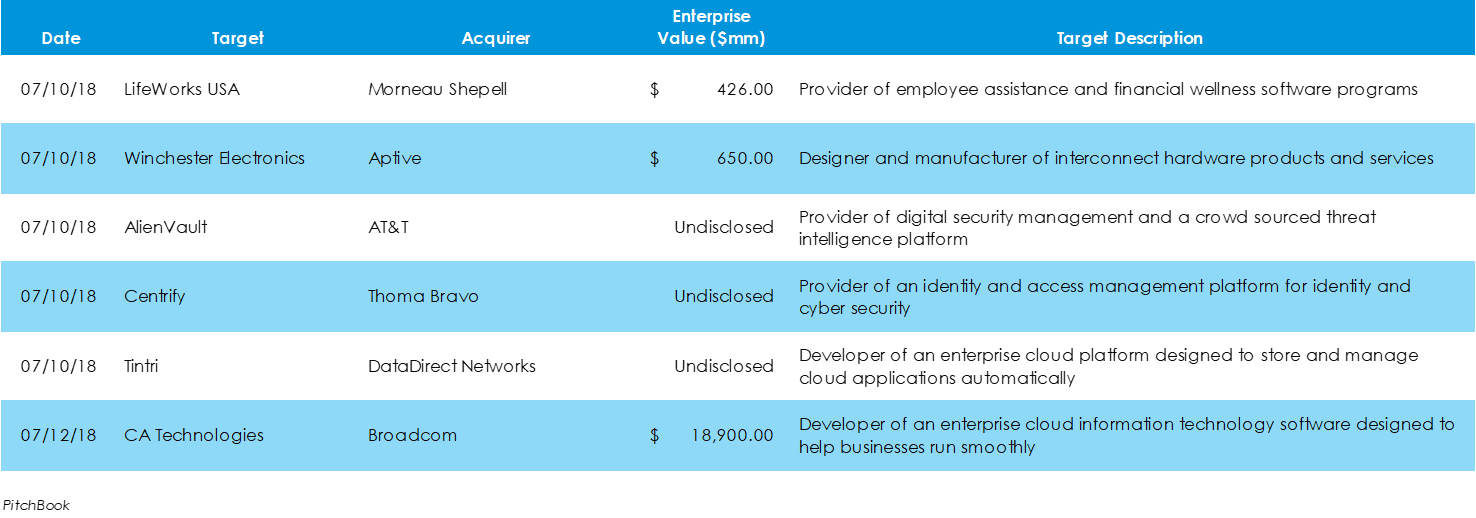

Last week, a number of tech and cybersecurity firms made deals to be acquired. AT&T made another purchase, this time of AlienVault, a cybersecurity firm. Centrify, another cybersecurity provider, was bought out by private equity firm Thoma Bravo. Tintri filed for chapter 11 bankruptcy and was acquired by DataDirect Networks hours later. LifeWorks USA was acquired by Canadian HR firm Morneau Shepell. Winchester Electronics, a 77-year-old company, was acquired by Ireland’s Aptiv. Lastly, on Friday, Broadcom finalized a deal to acquire software provider CA Technologies.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed