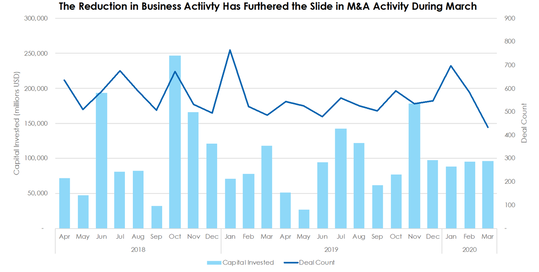

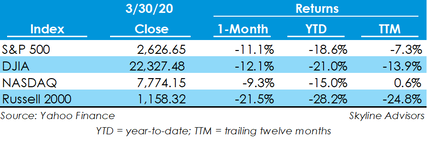

M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%.  The effects of coronavirus on business and consumer activity has completely disrupted financial markets in the U.S. During March, the S&P 500 and Dow Jones Industrial Average indices each fell by at least 25% at one point, while the Nasdaq fell by roughly 20% at its lowest point. The Russell 2000, a small-cap index measuring market values of the smallest 2,000 U.S. stocks, lost nearly one-third of its value, representing the disproportionate toll coronavirus will have on smaller U.S. businesses. The stock market had begun to make a recovery at the end of the month, after Congress approved a $2-trillion stimulus package to bolster struggling consumers and businesses. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed