|

Last Wednesday, the Federal Open Market Committee (FOMC) held their second bi-monthly (once every two months) meeting, and the first meeting under the Fed's new Chairman, Jerome Powell. Wednesday's meeting resulted in an increase of 25 basis points (0.25%), moving the benchmark short-term interest range to 1.50%-1.75%, and the Fed hinted at the potential of at least two more rate hikes during the six remaining FOMC meetings. The recent increase leaves the Fed funds rate around 1.63%, which is at its highest level since September 2008. The 2018 GDP growth forecast was increased to 2.7% from its previous 2.5%. Many of the board members kept their 2018 projections for short-term inflation around 1.9% and longer-term inflation slightly above 2.0%. Additionally, it has been speculated that the Fed might be looking to shrink its nearly $4.5-trillion balance sheet. The FOMC's meeting notes go into detail concerning reasoning for rate hikes, specifically positive economic growth, low unemployment, and job gains during the recent months.

Economic highlights from last week included:

Broadcom's Takeover of Qualcomm Blocked by the Committee on Foreign Investment in US (CFIUS)3/20/2018

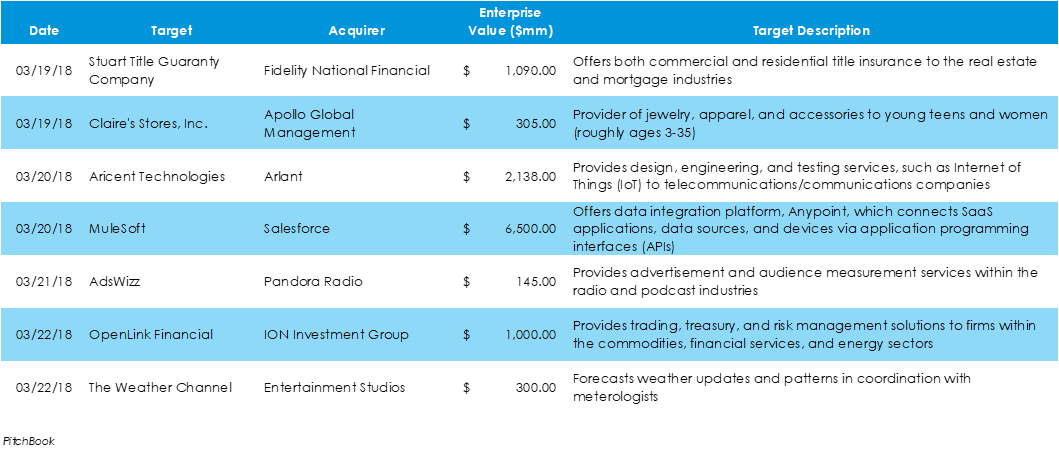

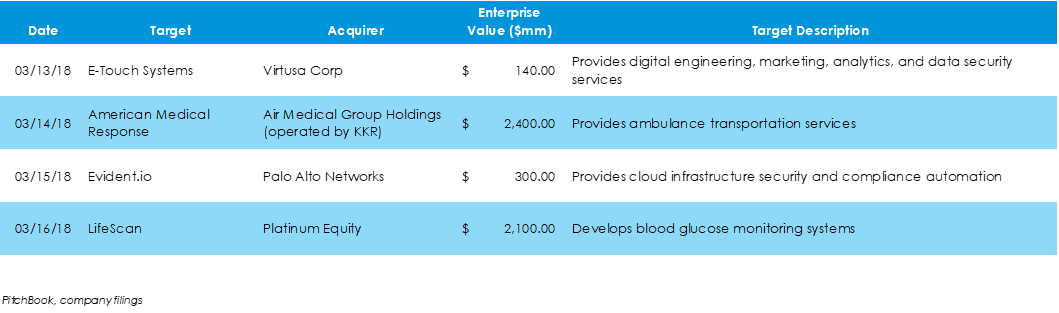

Last week was quite tumultuous in the M&A space. The most notable event was the CFIUS' denial of Singapore-based Broadcom's acquisition of U.S.-based Qualcomm. Other major events included the bankruptcies of debt-ridden iHeartMedia and Toys ‘R’ Us, a few healthcare-related corporate divestitures, and two technology deals.

The past week saw the largest tech IPO perform well beyond the Street's expectations, a clinical-stage biopharmaceutical firm, and the debut of two of the largest German IPOs in recent years.

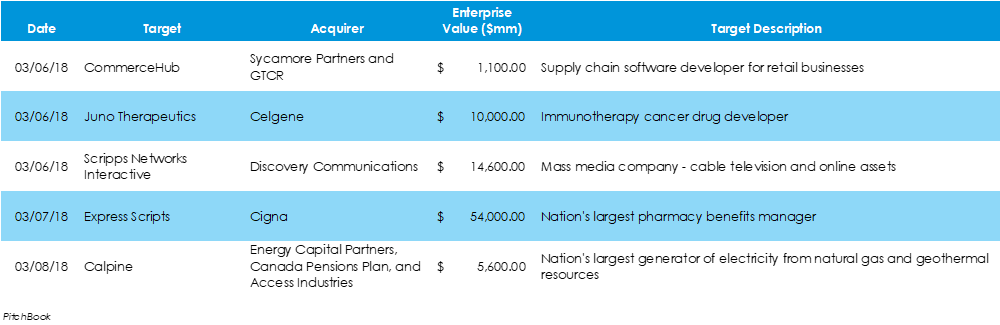

The past week saw plenty of multi-billion-dollar deals. The M&A highlights of the past week included three potential or completed public-to-private leveraged buyouts (LBOs) and three traditional M&A transactions, led by Cigna's $54 billion acquisition of Express Scripts.

Last week was a quiet week for IPO activity. A few notable public offerings were the cancellation of a private equity-backed broadcasting firm's IPO, a biopharmaceutical and artificial intelligence firm, and the registration for a Latin-American broadcasting division IPO by telecom giant, AT&T.

The average U.S. consumer feels quite strongly about the overall economy and his/her well-being due to increasing employment, higher wages, and higher after-tax disposable incomes and disregards the ensuing hysteria related to potential Fed interest rate hikes and stock market volatility.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed