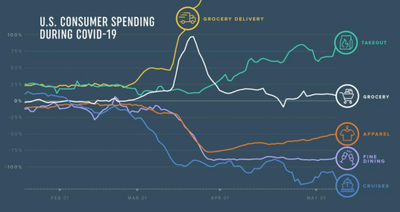

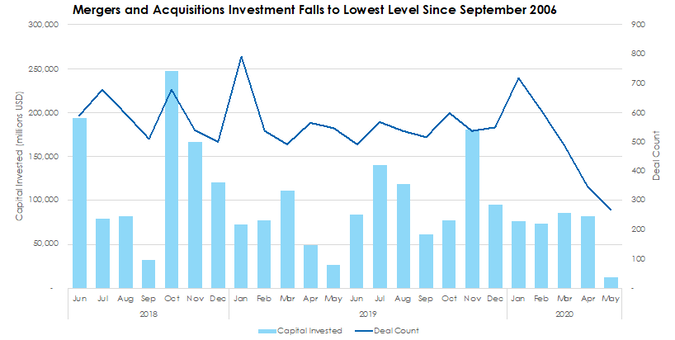

We are all aware that the “corona-conomy” has been bad for certain businesses while it has been mediocre or even good for others. But these generic labels are typically very binary and tend to imply the extremes. The true impact on individual sectors tends to vary significantly from the average. Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

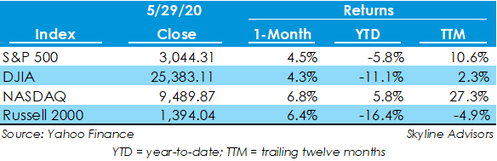

Stock Markets Stage Sharp Rebound in May  Easing of quarantine restrictions and hopes for a vaccine gave US equities a boost during May, adding on to strong year-to-date performances in large cap indices. Year-to-date, the S&P 500, Nasdaq, and Dow Jones gained 10.6%, 27.3%, and 2.3%, respectively, while the Russell 2000, a small cap index, is down 4.9%. In May alone, the large cap S&P 500 and Dow Jones gained 4.5% and 4.3%, and the tech-heavy Nasdaq and small cap Russell 2000 gained 6.8% and 6.4%, respectively. Optimism surrounding reopening economies supported equities during May. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed