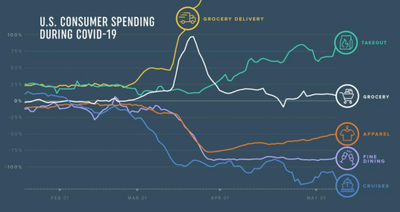

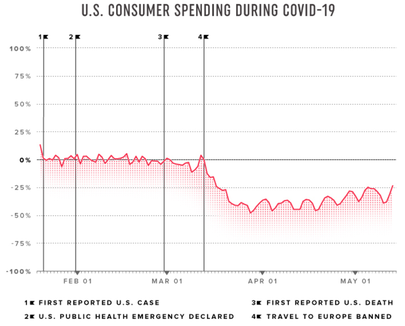

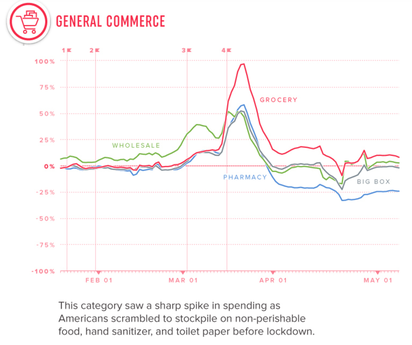

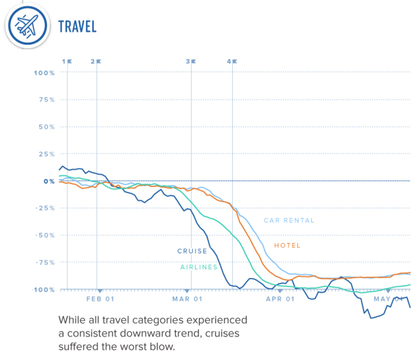

We are all aware that the “corona-conomy” has been bad for certain businesses while it has been mediocre or even good for others. But these generic labels are typically very binary and tend to imply the extremes. The true impact on individual sectors tends to vary significantly from the average.  As pointed out in our recent first quarter 2020 reports on economic & public markets, merger and acquisition (M&A) activity, private equity activity, and venture capital investments, industry segments and sectors are not impacted equally. Extreme headlines naturally capture readers’ attention more, and politics – particularly during an election year – impact how data is portrayed. It is always important to understand the data behind the headlines. For example, we recently saw a headline that Gartner was estimating IT spending would “plummet” in 2020. Any executive of a technology company likely shutters at such a headline. However, the data represented “only” an 8% decline. An 8% decline in IT spending is a huge overall dollar figure for the industry but is hardly “plummeting” compared to other industry segments affected by COVID-19. As we hear about businesses that are up or down due to COVID-19, we appreciated this recent infographic from Visual Capitalist. Consumer spending in April fell 16.4% from March and 21.6% compared to the same period of the prior year, according to the Department of Commerce. But individual industry segments varied widely from this mean. According to 1010Data, the change in consumer spending (year-over-year) on fine dining, for the week ending May 5th, shows an 88% decline. Even more drastic is spending on cruises, which declined more than 100% during that week (potentially including refunds in its calculation). On the other hand, spending on grocery increased 8% during the period and grocery delivery spending climbed a staggering 397%. And while most restaurants experienced sales declines, food delivery services saw an increase in consumer spending of 48%, as restaurants shifted to takeout.  As the economy has begun to reopen, there are many questions to be answered concerning the long-term outlook for the industries facing these extremes. Whether a sector is up or down right now, they likely fall into one of three broad categories: (1) those temporarily impacted significantly (good or bad) and whose fortunes change rather swiftly as the economy opens up and gets back to an “old normal,” (2) those experiencing long-term fundamental shifts that will continue their current performance (again, whether good or bad) for the long-term as the world adjusts to a “new normal” in certain facets of life, and (3) those that likely experience an in-between case where slower changes in fortune occur while social distancing efforts remain in place during what some are calling the interim “now normal.”  Which category a business falls into impacts their working capital needs, resource planning, and other strategic initiatives. But the first step is determining which category a businesses’ industry falls into, which may not be a clear-cut answer. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed