|

Capital markets produced no new initial public offerings during the holiday week. However, closing out the year, Chinese firms left a mark on the IPO market in 2018. According to Yahoo! Finance, Chinese firms completed 33 of the 190 IPOs on U.S. exchanges, the second highest total since 2009. Those 33 firms also raised just over $9 billion, second in the post-recession era to 2014, where $29 billion was raised on the back of Alibaba’s $25 billion IPO.

Last Tuesday and Wednesday, the Federal Open Market Committee held their December meeting. The board elected to raise rates for the fourth time this year, although the median governor is anticipating one less rate hike in 2019. The Commerce Department made downward revisions to its third quarter GDP estimates, knocking a tenth of a percent off its previous estimates. Lastly, the Kansas City Federal Reserve released its December Manufacturing Survey and Index, showing a slowdown in manufacturing activity during the month due to declines in production, shipments and new orders for exports.

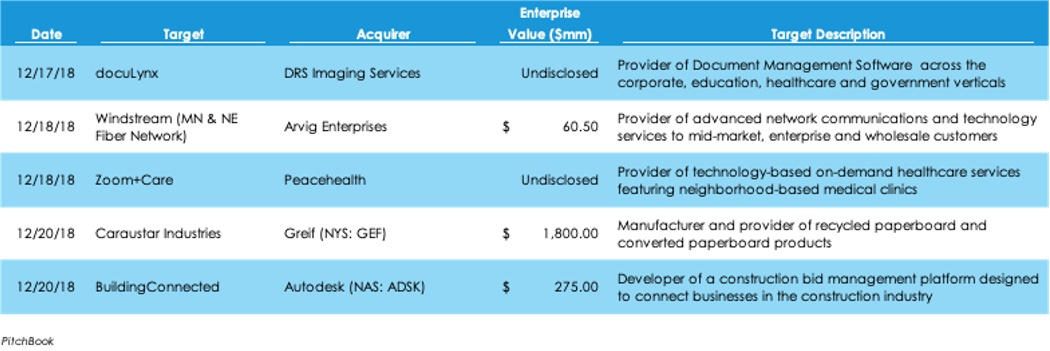

Last week, there were 29 merger and acquisition deals, worth a total of $6.87 billion of announced investments, per preliminary data supplied by Pitchbook. The largest deal was industrial packing manufacturer Greif’s (NYS: GEF) $1.8-billion acquisition of paperboard maker Caraustar Industries.

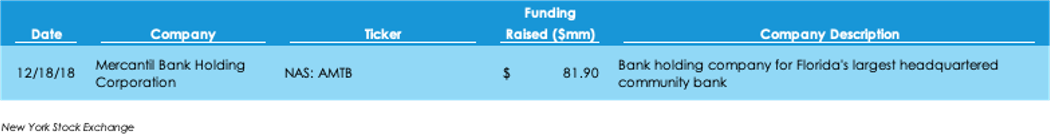

Last week, a single IPO was completed: Mercantil Bank Holding Company, the parent company of the largest community bank headquartered in Florida, Amerant Bank. The biggest IPO news of the week, however, comes out of Silicon Valley as Pinterest announced that it may go public as early as April 2019. The IPO for the social media giant joins the long line of tech debuts planned for 2019 that includes brands such as Uber, Lyft, AirBnb, Palantir, and Slack, all of which may fetch valuations over $1 billion. In fact, Uber is expected to be valued at roughly $120 billion. Pinterest, a social media platform in which users share new interests, ideas, and images by “pinning” them to their own boards or other’s boards, may be valued at $12 billion in the public markets.

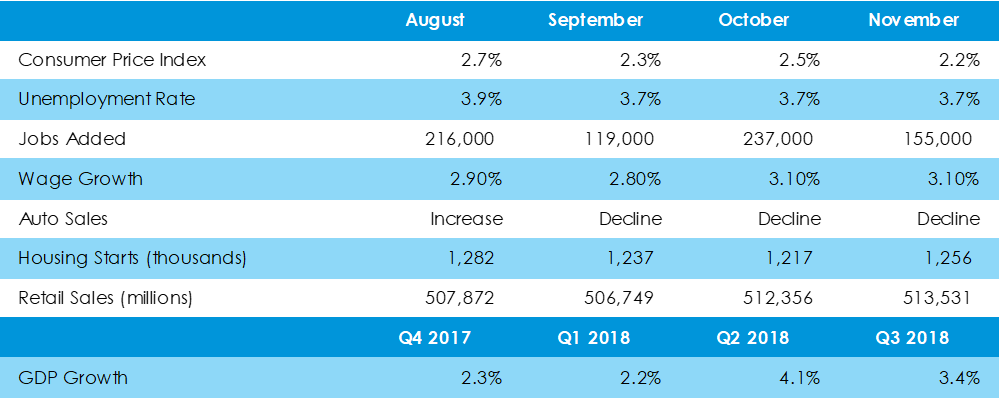

Last week, the Commerce Department’s retail spending report showed a notable gain in retail spending for the trailing twelve months through November, showing strong consumer demand heading into the holidays. Also, the Institute for Supply Management (ISM) released its semi-annual economic growth survey, revealing that although purchasing and supply managers expect revenue and investment growth, they believe 2019 will be a weaker year than 2018. Lastly, the Labor Department shared the November Consumer Price Index, which showed flat growth from October and a 2.2% annual increase. This week, the Federal Open Market Committee will meet on Tuesday and Wednesday to determine whether a rate hike is justified.

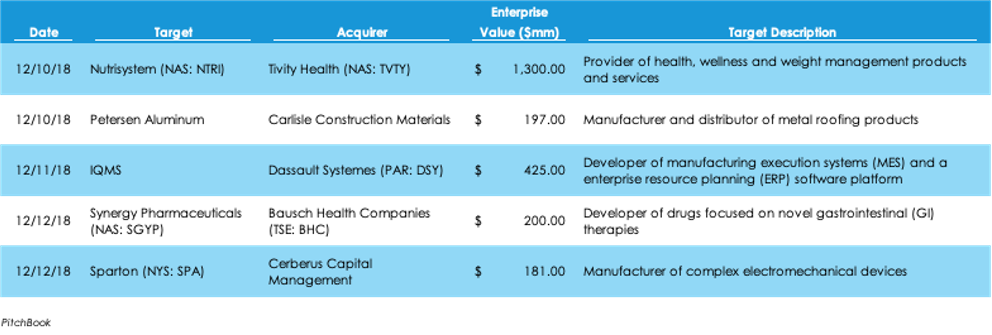

Last week, M&A markets produced 31 deals worth a collective $4.6 billion, according to preliminary data from Pitchbook. The largest was Tivity Health’s $1.4-billion cash and stock acquisition of Nutrisystem, a supplier of weight management products and services.

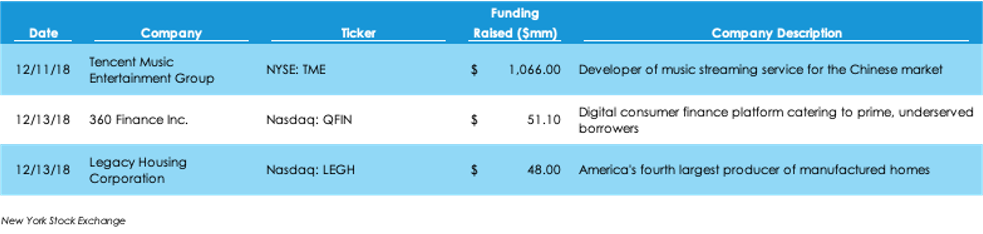

The top headline for this week’s IPO markets is Tencent’s New York Stock Exchange listing of its music streaming service subsidiary. Tencent Music Entertainment made waves with the largest traditional IPO since Alibaba in 2014, raising $1.1 billion. The largest online music platform in China, with 800 million active users, Tencent Music operates three music streaming apps - QQ Music, Kugou and Kuwo – as well as karaoke app WeSing. The IPO marks roughly $9 billion in fundraising for Chinese firms going public in the U.S. in 2018

November came as another month of steady economic output, with the economy sustaining its employment situation with consistent wage growth, while consumer inflation falls slightly. The Labor Department said for November the unemployment rate remained unchanged at 3.7% for the third straight month, with 155,000 jobs added and an unchanged wage growth rate at 3.1%. Despite the continued tightness in the labor market, the headline inflation figure, Consumer Price Index, grew only 2.2% over the last twelve months, down slightly from 2.5% in October. Last week saw the Bureau of Labor Statistics release nonfarm payroll figures that fell well short of expectations and pulled the three-month average to a 12-month low. Further, the unemployment stayed the same for the third straight month at 3.7%, and wage growth was at 3.1% for the second straight month. The total net worth among U.S. households broke to a record high in the third quarter after a 1.9% rise in net asset values. Last, the Commerce Department released October’s trade deficit report, showing the foreign trade gap widen by 1.7% to a ten-year high.

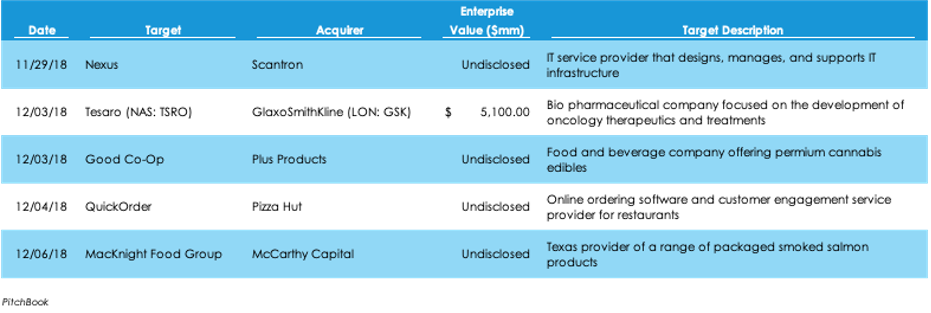

According to data provided by Pitchbook, the first week of December saw 17 M&A deals for a reported $9.5 billion in invested capital. These numbers are slightly lower than last week’s 26 deals. The largest deal this week was London-based GlaxoSmithKline’s $5.1-billion acquisition of Boston’s Tesaro, an oncology-focused bio pharmaceutical company. In the week, six of the deals were for targets from the Great Lakes region and seven companies there were purchased were direct-to-consumer businesses.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed