|

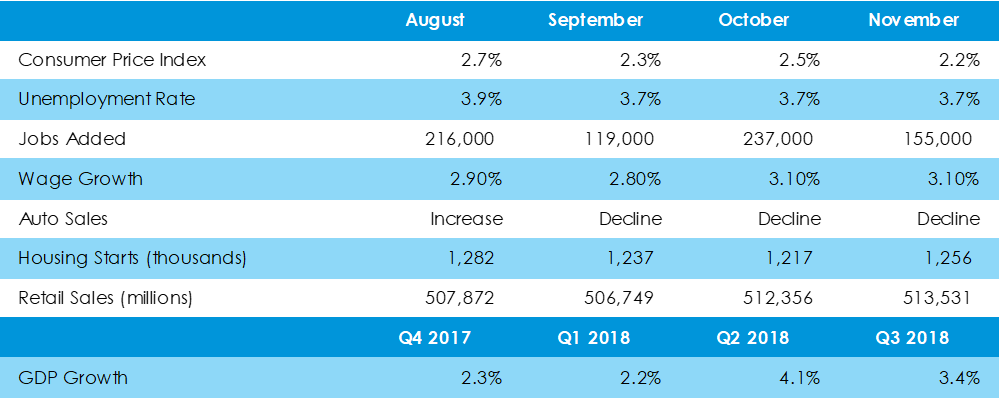

November came as another month of steady economic output, with the economy sustaining its employment situation with consistent wage growth, while consumer inflation falls slightly. The Labor Department said for November the unemployment rate remained unchanged at 3.7% for the third straight month, with 155,000 jobs added and an unchanged wage growth rate at 3.1%. Despite the continued tightness in the labor market, the headline inflation figure, Consumer Price Index, grew only 2.2% over the last twelve months, down slightly from 2.5% in October. Despite fears of a recession, retail sales grew 0.2% month-over-month in November, according to the Commerce Department. Excluding volatile categories of food, automobiles, gasoline and building materials, sales grew 0.9%. According to CNBC, November’s increase in core retail sales suggests a strong pace of consumer spending in the fourth quarter. A strong climb in consumer spending, which makes up two-thirds of gross domestic output, could keep U.S. output figures afloat through the end of the year, despite a cooling housing market and slumping auto sales.

The Commerce Department’s personal-consumption expenditures (PCE) measurement for November also signals strength in consumer demand. The measure increased at a seasonally-adjusted 0.4% rate for the ninth-straight month of household spending growth. The PCE inflation index, the Federal Reserve’s preferred inflation measure grew only 1.8%, below the Fed’s 2% target. The slowdown can be mostly attributed to falling gasoline and energy prices globally. Last quarter economic output grew at a revised 3.4% annual rate, and economists are projecting output growth below 3% for the fourth quarter. The highlights from our weekly economic updates during November 2018 included: Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed