|

Monthly sales of existing homes fell for the third straight month and came in below expectations, signaling a further cooling in the housing market. Weekly jobless claims fell during the week of February 16; however, the four-week moving average rose by 4,000 claims, suggesting a potential shift in long-term labor market trends. Lastly, durable goods orders were up in December on the back of a surge in commercial aircraft orders. However, when adjusting for defense and aircraft orders, durable goods orders fell 0.7% in the month.

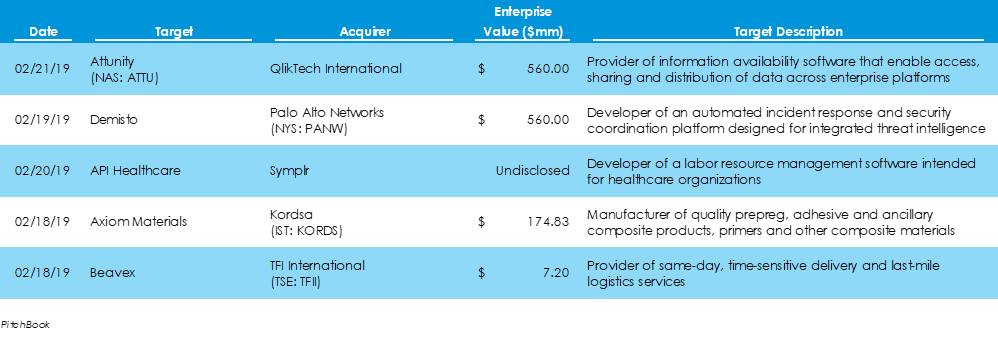

Pitchbook data revealed that last week there 37 M&A deals for a total value of $2.48 billion, four more deals for $7.4 billion less capital invested than the prior week. The two largest deals of the week were QlikTech International’s public-to-private buyout of Attunity and Palo Alto Networks’ acquisition of Demisto, both of which were for $560 million in value.

Last week, it was revealed that Pinterest had confidentially filed with the SEC to go public, seeking a $12 billion valuation and joining the collection of tech IPOs slated for 2019. The hot tech startups in the U.S. have stayed private for much longer than traditional companies, as a flurry of private capital has kept them afloat during the last decade. Last September, Pinterest surpassed 250 million monthly active users and grew revenues 50% in 2018 alone.

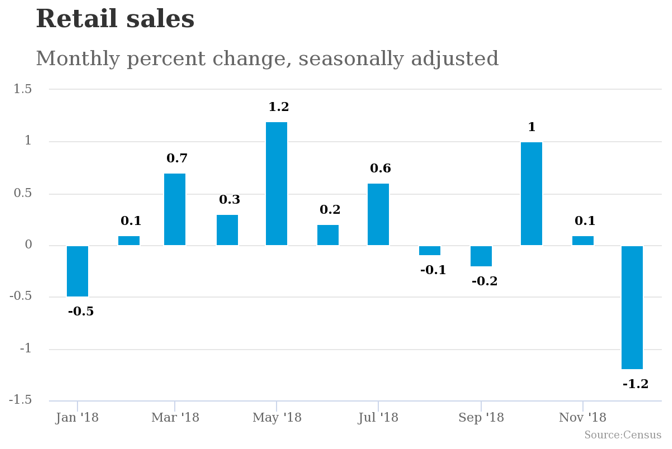

In last week’s economic news, US job openings reached a record high at 7.3 million, marking 1.2 jobs available for every unemployed person. However, despite the record-breaking job market, the week’s most notable news was a relatively steep decline in retail sales during the month of December. US retail sales dropped 1.2% during the month, or the greatest percent decline in more than nine years.

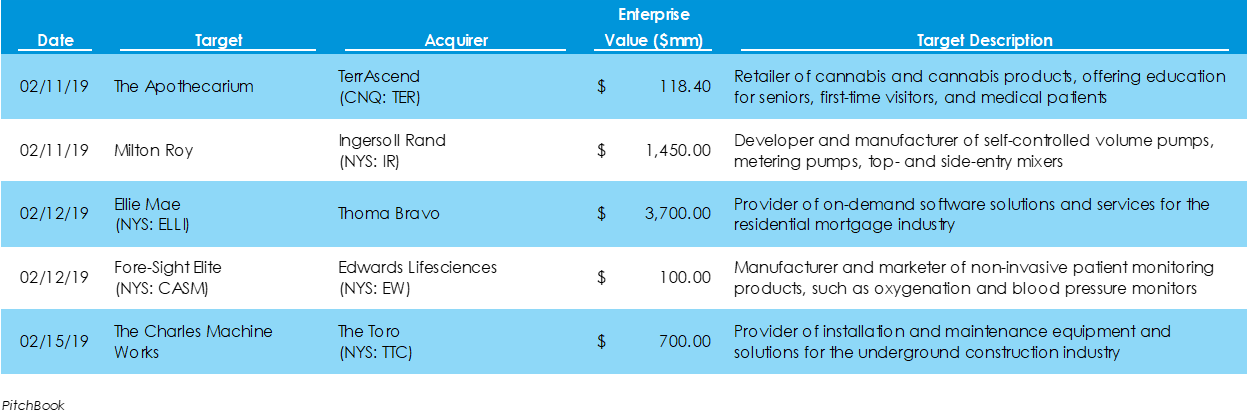

Data from Pitchbook shows $9.88 billion was invested across 33 deals last week, ten more deals than the week prior but for $3.68 billion less value. The largest deal of the week was private equity firm Thoma Bravo’s $3.7-billion public-to-private leveraged buyout of Ellie Mae, a software provider for the residential mortgage industry.

Last week, three companies priced their IPOs to go public: TCR2 Therapeutics, Stealth BioTherapeutics and Avedro, under the tickers TCRR, MITO and AVDR, respectively. All three companies operate in the healthcare industry, marking the second week in a row that three healthcare companies have gone public. In total, the three companies will raise $223 million in new capital.

The U.S. Federal Reserve has reported that, overall, U.S. industrial production has continued to grow thanks to increased manufacturing and mineral outputs, while utilities production has fallen sharply. IHS Markit’s U.S. Services index showed services output falling to a four-month low but staying in growth territory. Lastly, U.S. soybean exports to China have fallen dramatically from stable levels in August, likely due to the implementation of tariffs from China.

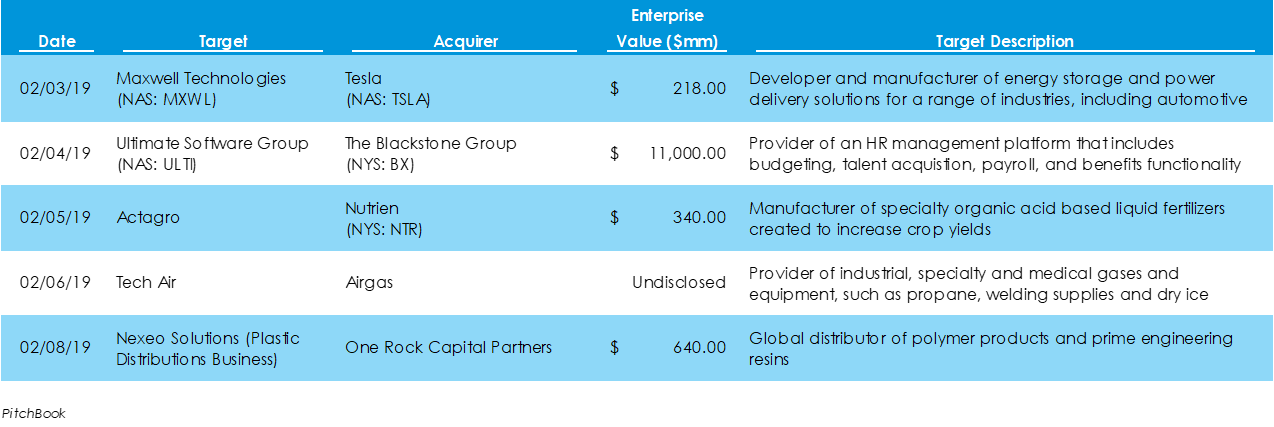

Preliminary data from Pitchbook shows that $13.56 billion was invested across 23 deals last week, the same deal count as the week before but with $3.3 billion more capital. The largest deal was Blackstone Group’s $11 billion public-to-private buyout of the HR management software provider Ultimate Software Group.

Last week, three healthcare companies went public, raising $527.4 million in funding. Gossamer Bio (NAS: GOSS), Harpoon Therapeutics (NAS: HARP) and Alector (NAS: ALEC) all went public on the Nasdaq exchange and raised $276 million, $75.6 million and $175.8 million, respectively.

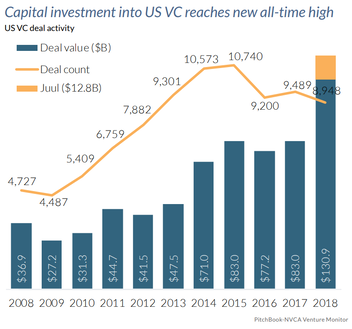

Annual venture capital investment has hit $100 billion for the first time since the dot-com era, according to Pitchbook. Deal value in VC-led deals reached $130.9 billion, up 57.7% from 2017’s value of $83 billion. The number of financings completed, however, fell to 8,948 from 9,489. The last time venture capital investment topped $100 billion was in 2000, when investment reached $105 billion, according to data from Thomson Reuters. Pitchbook included Altria’s $12.8 billion financing of Juul in its calculation. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed