|

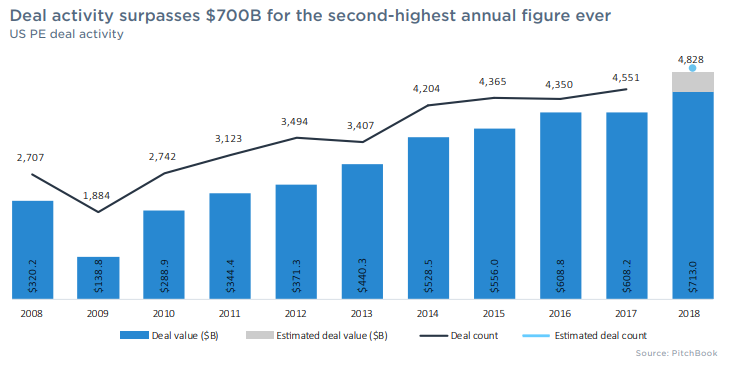

US private equity firms completed an estimated 4,828 deals worth a combined $713 billion in 2018, according to data provider Pitchbook. The figures were the highest deal count and second-highest value on record and represent increases of 5.5% and 7.2%, respectively, from 2017 levels. Notable deals during the year included Blackstone’s majority buyout of Thomson Reuters’ Financial & Risk Business (now called Refinitiv), BDT Capital Partners’ and JAB Holdings’ acquisition of Dr. Pepper Snapple, and Veritas Capital’s and Evergreen Coast Capital’s buyout of Athenahealth.

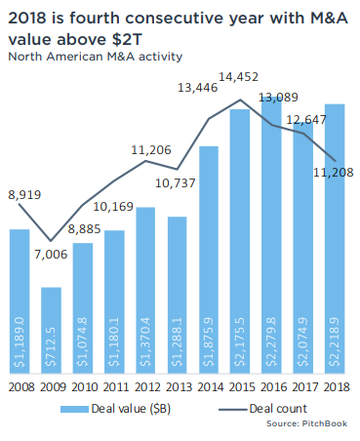

North American M&A value topped $2 trillion for the fourth consecutive year in 2018, with a total value of $2.2 trillion, an increase of 6.9% from 2017, according to Pitchbook. The number of deals completed in 2018 totaled 11,208, down 11.4% from 2017’s 12,647. The median deal size in North America increased 22.4% to $60 million in 2018. The U.S. job market added over 300,000 jobs while wages grew 3.2% for the last twelve months. The job market has been a shining spot in an economy facing rising rates, tariffs, and slowing global growth. New home sales grew dramatically month-to-month in November but are still slumped 7.7% from a year before. Lastly, the Institute for Supply Management showed that manufacturing growth is expanding at a faster rate in the first month of the new year, thanks to increased production and new orders.

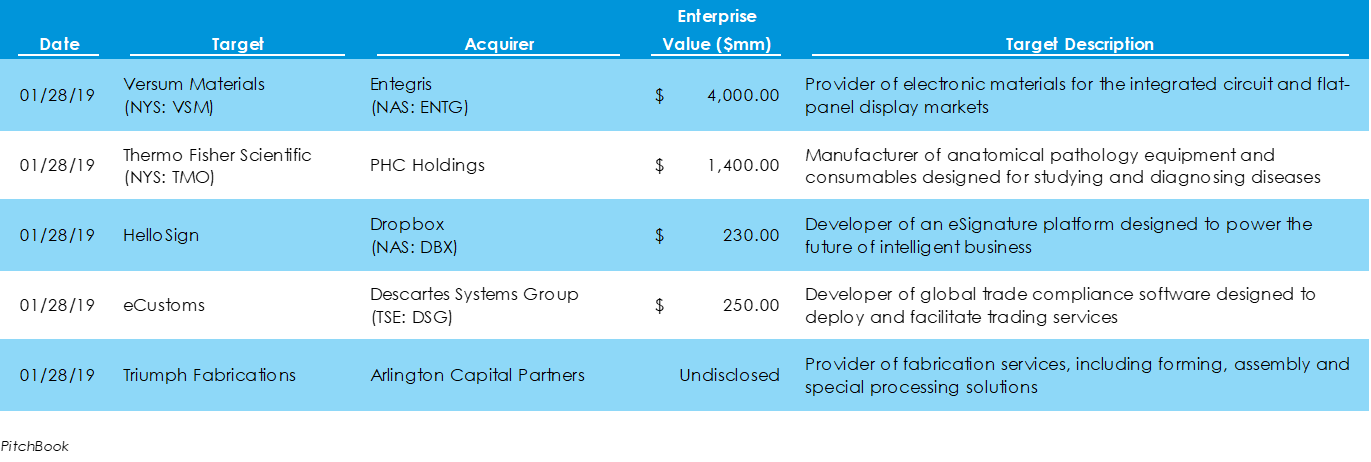

According to preliminary data from Pitchbook, there were 23 deals last week for $10.3 billion of total invested capital. The largest deal was Versum Materials’ $4 billion acquisition of Entegris. Both companies operate in the semiconductor manufacturing space, providing end-to-end materials solutions.

Last week’s lone IPO was New Fortress Energy LLC, which raised $280 million in funding. The company is an integrated gas-to-power company that builds infrastructure for reliable energy supply. Also, German automaker Volkswagen is planning to list its trucking unit, Traton, in April this year. They expect the IPO can raise €5 billion to €6 billion and give the subsidiary a €25 billion valuation. In the U.S., Slack, which is one of the many tech firms planning IPOs this year, announced that it has topped 10 million daily active users on its platform. The announcement lends further credibility to its direct listing plans for the second quarter

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed