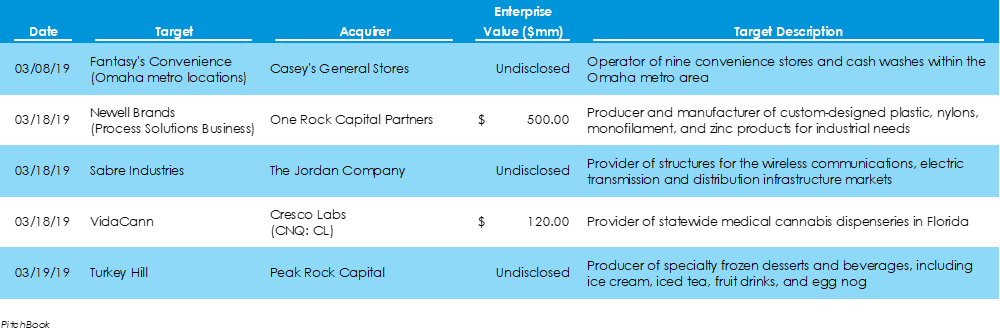

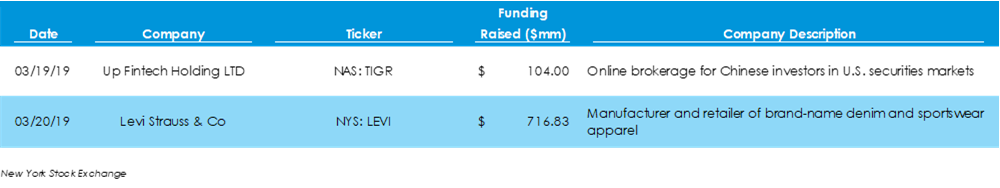

FIS Acquires Worldpay in the Payment Industry’s Largest Deal EverPitchbook data reveals there were 15 M&A deals in the U.S. last week for combined capital of $36.8 billion, eight fewer deals than the week before but for $19.5 billion more in capital consideration. Fidelity Information Services’ $43-billion acquisition of Worldpay, a leading provider of payment processing services, was the largest deal of the week. Also, Peugeot, a French auto manufacturer, reportedly approached Fiat Chrysler about a merger earlier this year. Fiat Chrysler rebuffed the deal that would’ve formed a $45-billion industry giant. Levi Strauss Goes Public, Pricing Their IPO Above the Initial Target RangeAccording to the New York Stock Exchange website, two companies went public last week: blue jean retailer Levi Strauss and Chinese online brokerage firm Up Fintech Holding. The two companies raised a combined $820.8 million, with about $717 million going to Levi Strauss. This is Levi’s second time going public. Also, Lyft is set to finally debut on the Nasdaq in the middle of next week and Pinterest revealed its S-1 filing for going public sometime in April. Federal Reserve Elects to Keep Rates Unchanged Amid Slowing Domestic GrowthAmong news last week:

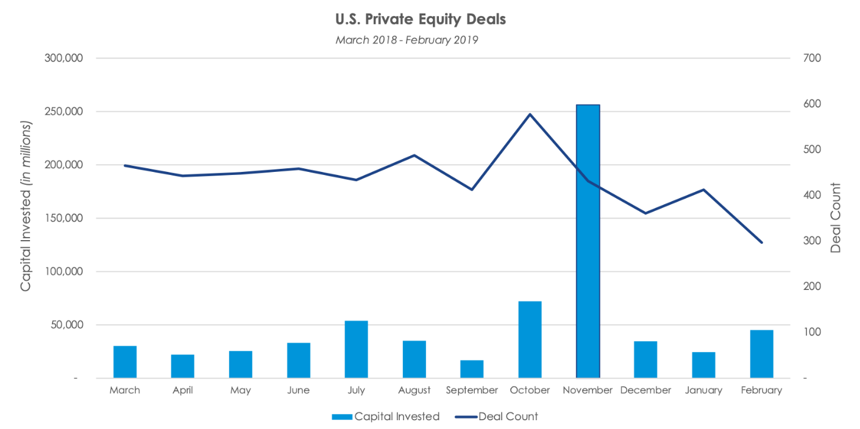

According to Pitchbook, private equity buyout activity in February nearly doubled, posting the fourth highest level of invested capital and the lowest number of deals during the last twelve months. Private equity investment increased 83% from $24.7 billion in January to $45.2 billion. However, only 297 deals took place in the month, almost 20% less than the second lowest month. In fact, the median deal size for private equity was up to $79 million in February, significantly higher than the median deal size of $41 million in 2018.

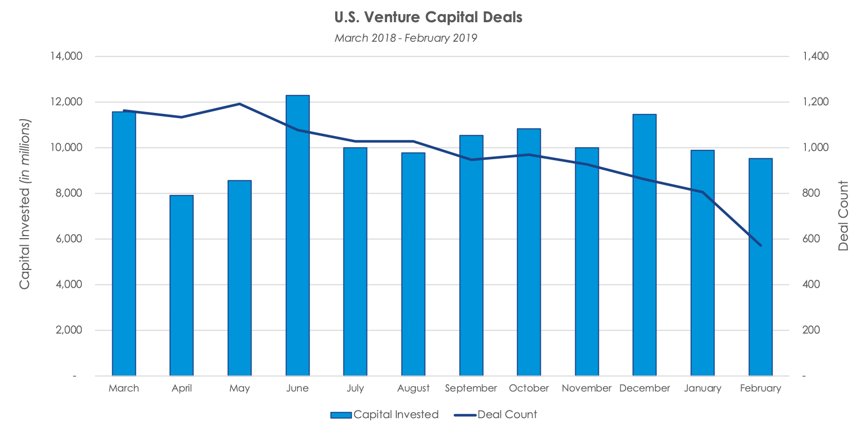

Venture capital investment in February remained in line capital levels invested throughout the last twelve months. According to Pitchbook, venture capital firms invested $9.5 billion during the month, not far off of the average over the trailing twelve months of $10.2 billion. However, similar to private equity activity, deal count was down again during the last month, falling 29.1% to 572 deals. For the year-to-date period, VC investments totaled $19.4 billion, up just 5.8% from the same two-month period one year ago.

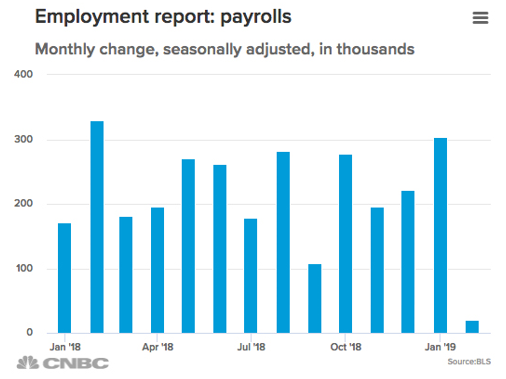

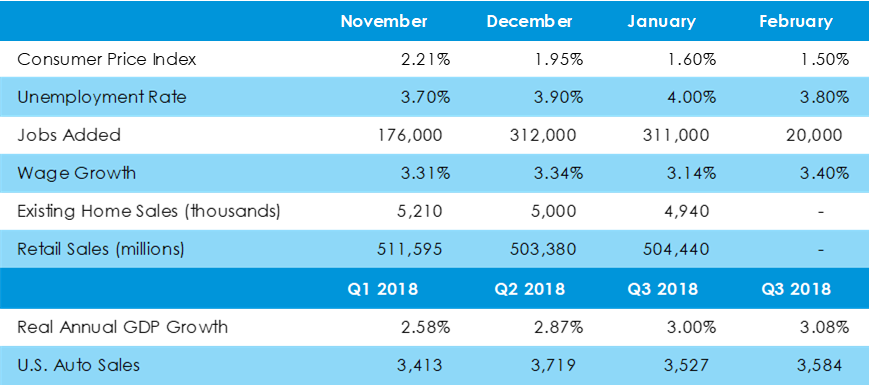

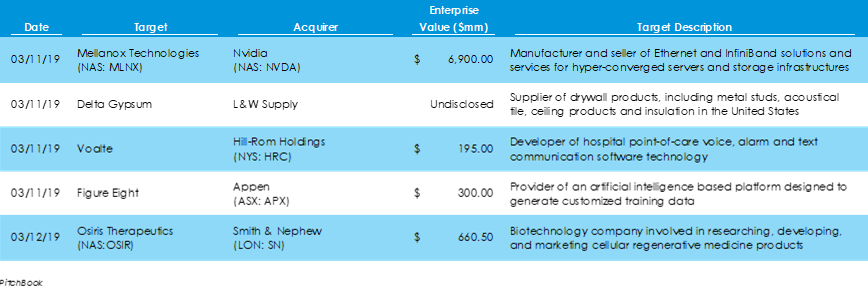

The U.S. economy has continued to show signs of slowdown in February, as recessionary fears for 2020 continue to mount. Labor market growth hit a sudden slump as only 20,000 jobs were added in February. Analysts and economists suggest that such a low figure is mostly an anomaly but that job growth should continue to slow headed into 2019. The unemployment rate fell by 0.2% while non-farm wages grew 3.4% for the year ended February, a strong reading and prompting hope for higher consumer demand in the coming months. It was also reported that worker productivity reached record highs in the fourth quarter of 2018, lending more credence to higher output forecasts for this year. Mergers & Acquisitions: Nvidia’s Acquisition of Mellanox Technologies Highlights Last Week’s M&A ActivityData from Pitchbook shows that there were 23 M&A deals in the U.S. last week for total invested capital of $17.3 billion. The week before had four additional deals for $12.3 billion less capital. Nvidia had the largest deal of the week, a $6.9-billion acquisition of Mellanox Technologies. Also, two over-the-counter traded cannabis firms, Curaleaf and Acreage Holdings have made acquisition bids for a Nevada cultivation farm and an Oakland-area dispensary, respectively.

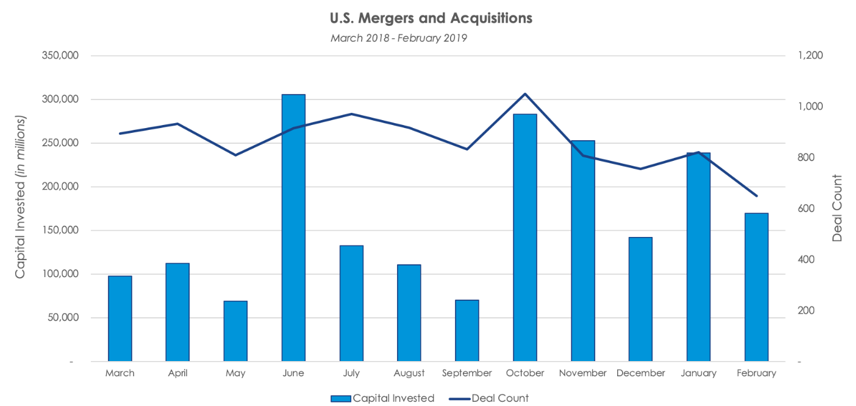

In February, mergers and acquisitions activity reversed its rebound from December lows, falling 28.9% from $238.8 billion in January to $169.9 billion across 649 deals. Year over year, M&A activity was up 168.9% in February, as financial markets continued to rebound in 2019 compared to their volatile state this time in 2018. Year to date through February, M&A investment totaled $408.7 billion, a $284.8 billion, or 230%, increase from the same period 2018.

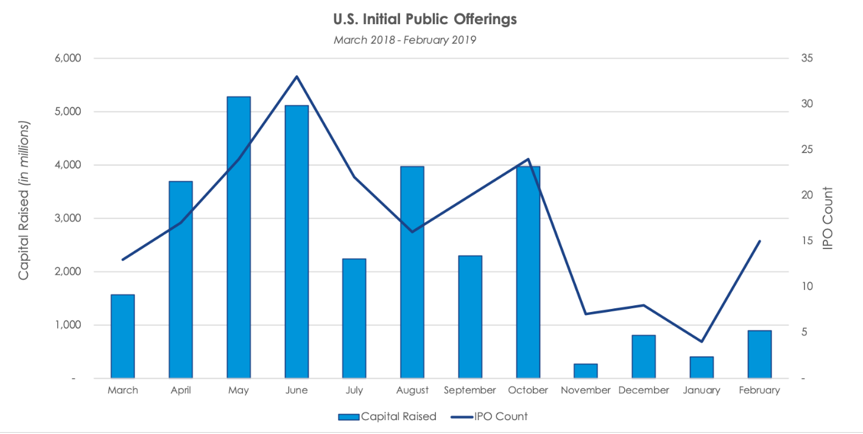

Activity for initial public offerings remained at low levels in February, with 15 U.S. companies going public, raising a total of $887 million in capital. IPO fundraising is down 72.9% from last February and Is down 90% to $1.3 billion for the first two months of 2019 compared to the first two months of 2018. The end of 2018 and beginning of 2019 are well off of recent highs set in the early summer last year. However, month-to-month, the trend has shifted upward, rising 120% from the $403 million raised in January.

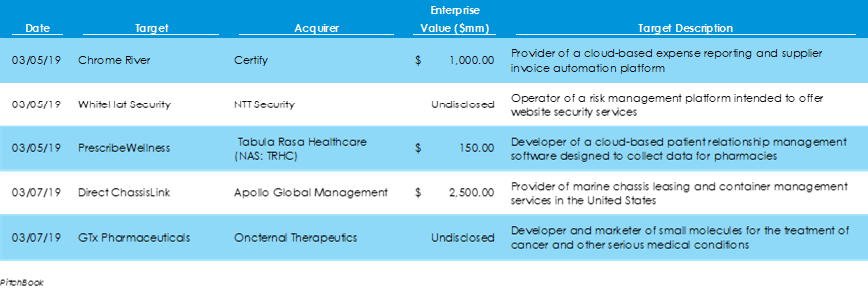

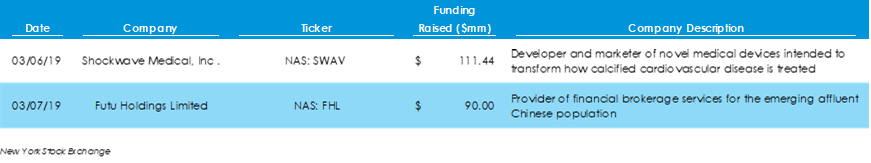

Mergers & Acquisitions: Apollo Global Management Acquires Direct ChassisLinkPitchbook data reveals that there were 27 M&A transactions last week for total invested capital of $5.03 billion, $27.3 billion less than last week across 10 less deals. Apollo Global Management’s $2.5 billion leveraged buyout of Direct ChassisLink was the largest deal of the week. Publicly traded pharmaceutical manufacturer GTx, Inc. will be acquired by Oncternal Therapeutics in a reverse merger for an undisclosed amount. Two Companies Raise Roughly $200 Million through Initial Public OfferingsLast week, Shockwave Medical, a medical device manufacturer for cardiovascular health, and Futu Holdings Limited, a Chinese financial brokerage for overseas trading, completed their initial public offerings, raising approximately $200 million combined. U.S. Adds a Lackluster 20,000 Jobs but the Housing Market Shows Strong Signs of Growth Among news last week:

Initial Public Offerings: Lyft Files for IPOLast week, Super League Gaming (live streaming of in-person amateur gamer competitions) and Kaleido Bioscience (clinical-stage healthcare company focused on the human microbiome) completed their initial public offerings. Super League is the first e-sports company to go public.

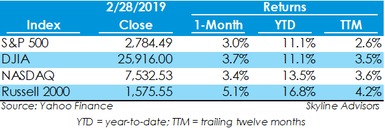

The stock market continued to rebound from its weak performance in December, as the S&P 500, Dow Jones Industrial Average (DJIA), Nasdaq, and Russell 2000 all climbed 3.0% or more in February. Year to date, the indices are up more than 11.0%. Small stocks appeared to outperform larger stocks, as the Russell 2000 rose 5.1%, outperforming its larger index peers during the month. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed