|

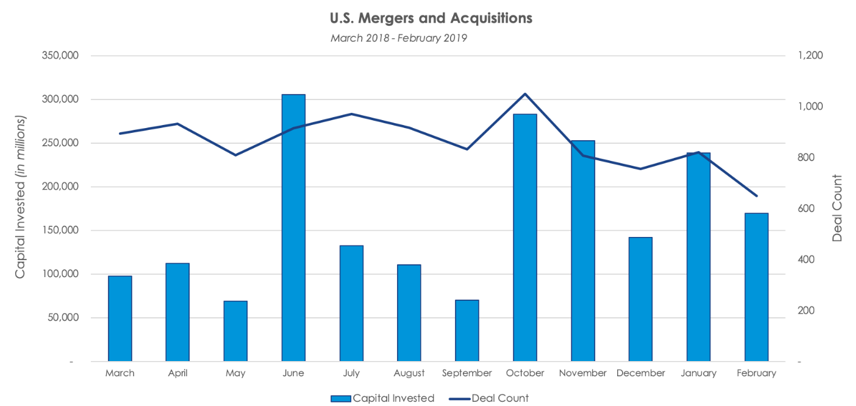

In February, mergers and acquisitions activity reversed its rebound from December lows, falling 28.9% from $238.8 billion in January to $169.9 billion across 649 deals. Year over year, M&A activity was up 168.9% in February, as financial markets continued to rebound in 2019 compared to their volatile state this time in 2018. Year to date through February, M&A investment totaled $408.7 billion, a $284.8 billion, or 230%, increase from the same period 2018. During the month, business-to-business (B2B) companies comprised the most active sector, recording 95 deals for $13.8 billion in invested capital. Of those B2B deals, 38 were in the industrials vertical and 44 were involved with manufacturing. Another 42 deals and $20.9 billion of invested capital were for healthcare companies. Buyout firms were busy during February, engaging in 236 deals, or 36.4% of transactions, for $41.9 billion.

General Electric had two of the three largest deals in the month as it continues to sell off units of the business in an effort to consolidate its offerings. The firm unloaded its transportation division for $11.1 billion and its biopharma group for $21 billion. Highlights from our weekly M&A market updates during February 2019 included:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed