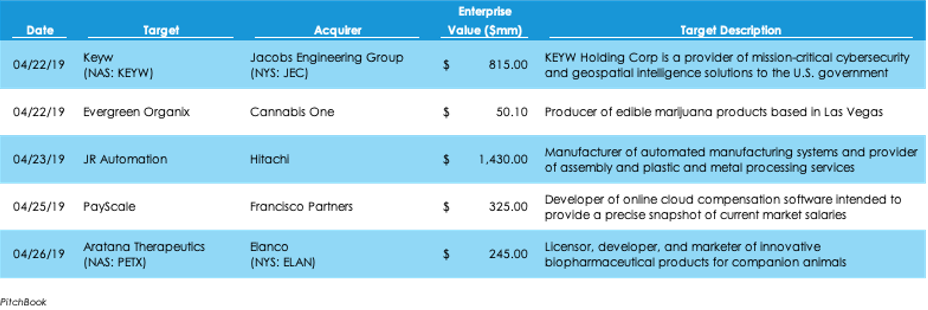

Cannabis M&A Spiked Last Week with Four Deals in the U.S.Pitchbook data shows M&A activity slowing last week, with $3.6 billion invested across 24 deals, $11.2 billion capital and seven deals fewer than the week prior. Japanese multinational conglomerate Hitachi shelled out $1.43 billion for Michigan-based industrial robotics integrator JR Automation in the week’s largest deal. Deal making in the cannabis space was hot last week, with four U.S. cannabis producers and distributors being acquired.

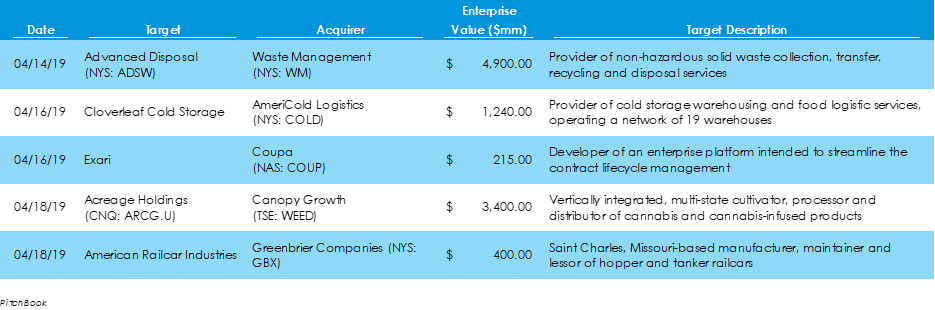

Waste Management Grows Eastern U.S. Operations by Acquiring Advanced Disposal Data supplied by Pitchbook reveals that $14.8 billion in capital was deployed across 31 M&A transactions last week, four deals more and $28.8 billion less capital than the elevated levels of the week prior. The largest deal of the week was Waste Management’s $4.9 billion acquisition of Advanced Disposal, which will help expand the nation’s largest waste collector’s East Coast operations. Also, Canopy Growth announced a deal to acquire Acreage Holdings once cannabis is federally legalized in the U.S.

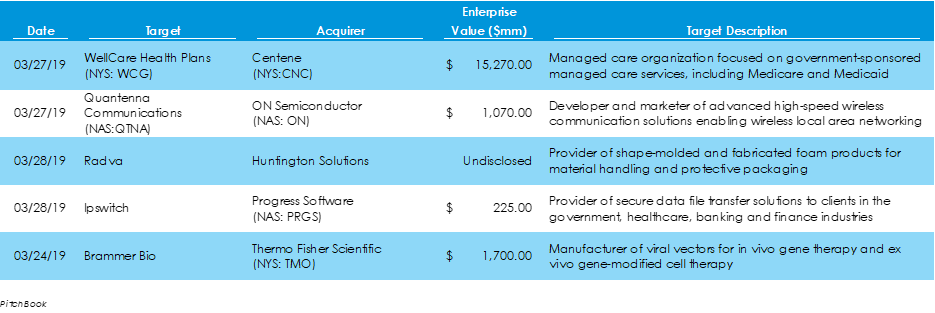

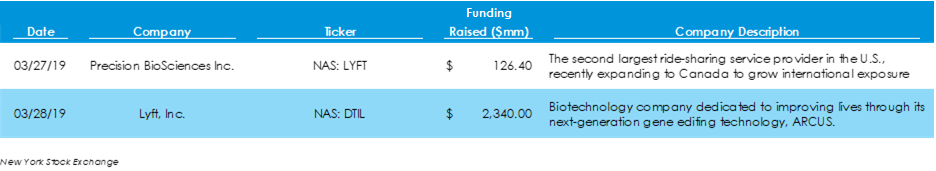

Mergers & Acquisitions: Manufacturing Sector Sees Continued Strong Activity in the M&A SpacePitchbook data reveals that $19.6 billion of capital was invested across 27 M&A transactions last week, twelve more deals but $17.2 billion less capital than in the week prior. The largest deal was publicly traded Centene’s corporate acquisition of WellCare Health Plans, also a publicly traded company, for $15.3 billion. The manufacturing vertical has been busy in 2019 through the end of last week, posting 48 transactions and $19 billion capital invested in LBOs and corporate acquisitions. Initial Public Offerings: Lyft Follows Through with Long-Awaited IPO According to the New York Stock Exchange website, two companies went public last week, the same figure as the week before. However, those two companies, Lyft and Precision BioSciences, combined raised more than in the prior week, raising $2.3 billion and $126 million, respectively. Lyft has been a highly anticipated IPO since the beginning of 2018, and the results of its IPO are indicative of it. The company priced its IPO at $72 per share, well above its initial estimates after a roadshow in which the firm received commitments in excess of expectations. As of trading close on Friday, Lyft was valued at approximately $26.5 billion. Economy: U.S. Fourth Quarter Economic Growth Revised Downward Among news last week:

The U.S. Federal Reserve has reported that, overall, U.S. industrial production has continued to grow thanks to increased manufacturing and mineral outputs, while utilities production has fallen sharply. IHS Markit’s U.S. Services index showed services output falling to a four-month low but staying in growth territory. Lastly, U.S. soybean exports to China have fallen dramatically from stable levels in August, likely due to the implementation of tariffs from China.

The U.S. job market added over 300,000 jobs while wages grew 3.2% for the last twelve months. The job market has been a shining spot in an economy facing rising rates, tariffs, and slowing global growth. New home sales grew dramatically month-to-month in November but are still slumped 7.7% from a year before. Lastly, the Institute for Supply Management showed that manufacturing growth is expanding at a faster rate in the first month of the new year, thanks to increased production and new orders.

Two surveys on U.S. manufacturing activity suggest a dramatic slowdown in the sector. HIS Markit’s manufacturing PMI revealed a subtle 1.5-point drop to a 15-month low, while the Institute for Supply Management’s PMI experienced a one-month decline of 5.2 points, the greatest in 10 years. Despite waning manufacturing activity, the job market experienced an unexpected surge as 312,000 jobs were added, 136,000 more than expected, while the unemployment rate rose slightly and wage gains posted a nine-year higher.

Initial claims for unemployment benefits fell by a marginal amount last week, continuing a downward trend towards the 49-year low set in September. Chicago’s manufacturing activity slowed last month, although only slightly, due to slip-ups in new orders, employment and supplier deliveries indices. The Conference Board’s December consumer confidence index revealed a sharply lower measure from November, as market volatility and lower economic growth expectations alarm consumers.

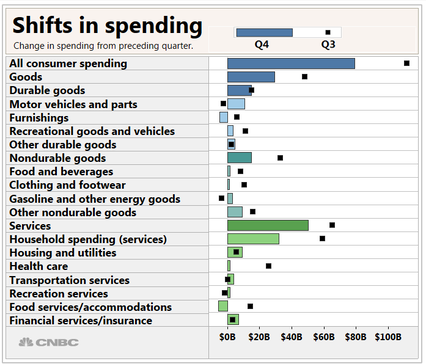

Last Tuesday and Wednesday, the Federal Open Market Committee held their December meeting. The board elected to raise rates for the fourth time this year, although the median governor is anticipating one less rate hike in 2019. The Commerce Department made downward revisions to its third quarter GDP estimates, knocking a tenth of a percent off its previous estimates. Lastly, the Kansas City Federal Reserve released its December Manufacturing Survey and Index, showing a slowdown in manufacturing activity during the month due to declines in production, shipments and new orders for exports.

Last week, the Commerce Department’s retail spending report showed a notable gain in retail spending for the trailing twelve months through November, showing strong consumer demand heading into the holidays. Also, the Institute for Supply Management (ISM) released its semi-annual economic growth survey, revealing that although purchasing and supply managers expect revenue and investment growth, they believe 2019 will be a weaker year than 2018. Lastly, the Labor Department shared the November Consumer Price Index, which showed flat growth from October and a 2.2% annual increase. This week, the Federal Open Market Committee will meet on Tuesday and Wednesday to determine whether a rate hike is justified.

For August, the U.S. posted surprising job figures, adding more jobs than expected and finding the wage inflation that has been missing for so long. Further, the unemployment rate maintained at consistent levels. Lastly, the ISM Purchasing Manager’s Index was released for August, registering at its highest level in 14 years.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed