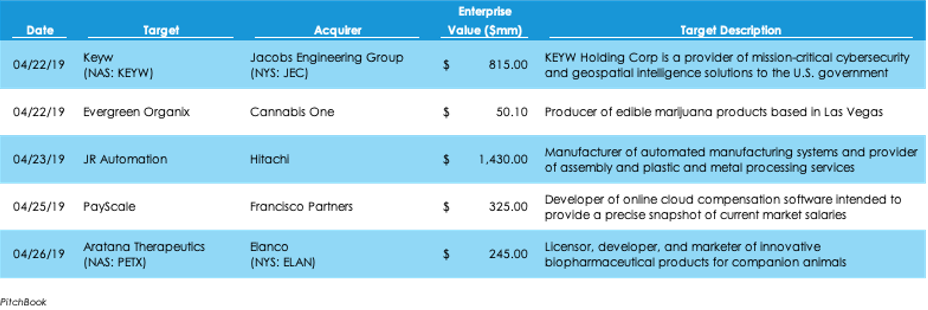

Cannabis M&A Spiked Last Week with Four Deals in the U.S.Pitchbook data shows M&A activity slowing last week, with $3.6 billion invested across 24 deals, $11.2 billion capital and seven deals fewer than the week prior. Japanese multinational conglomerate Hitachi shelled out $1.43 billion for Michigan-based industrial robotics integrator JR Automation in the week’s largest deal. Deal making in the cannabis space was hot last week, with four U.S. cannabis producers and distributors being acquired. Uber Prices IPO, Expected to Go Public in MayThere were no new initial public offerings last week, according to the New York Stock Exchange, after seven companies had IPOs the week before. Progress still continues toward more tech unicorn IPOs. On Friday, Slack filed its public S-1 filing, revealing $400 million in revenue. Also, Uber officially priced its IPO range, with a maximum $90-billion market cap. Consumer Sentiment Remains High while Durable Goods and New Home Sales OutperformAmong economic news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed