|

Economic news last week included a surprise drop in existing home sales. It continues to appear that the Fed is poised to raise interest rates going forward. Furthermore, FINRA is reporting that margin debt balances are at record highs.

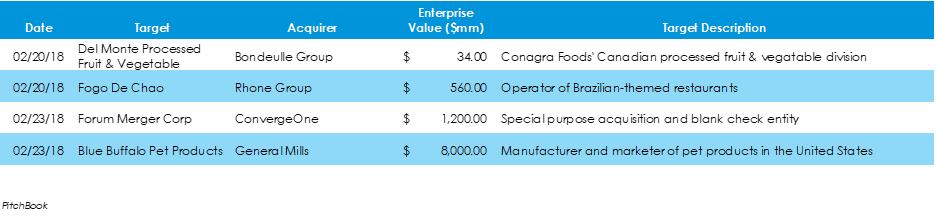

The past week included a handful of mega-billion-dollar deals and plenty of multi-million-dollar deals. Leading the billion-dollar deal charge was General Mills' acquisition of Blue Buffalo Pet Products. On the smaller end, we saw Chicago-based ConAgra Foods sell off its Del Monte Processed Fruits and Vegetables division.

The past week included two high-level events and another billion-dollar IPO: Albertson's withdrawn IPO filing, Dropbox's IPO announcement, and the initial public offering of Columbia Bank New Jersey.

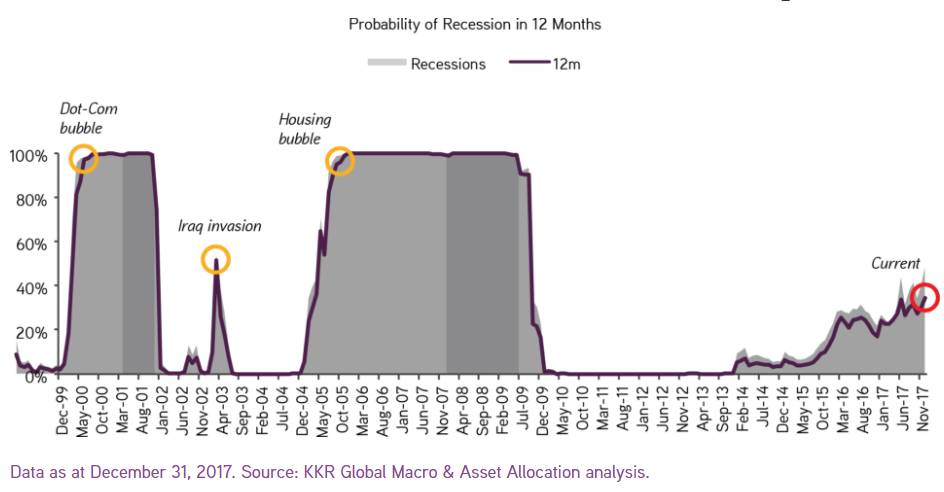

Kohlberg Kravis Roberts & Co, a leading global investment firm, provided earlier this year a comprehensive outlook for the economy in 2018. One of the more interesting aspects of the research is one of their models predicted a 100% chance of a recession in the next 24 months.

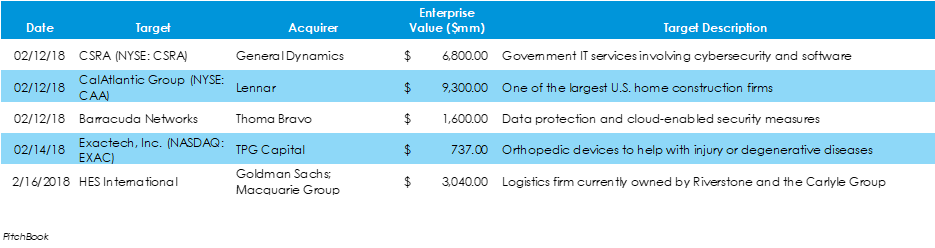

The firm notes that their recession-prediction model has suggested a moderate slowdown in 2019 for some time. At the end of 2017, their model stood slightly below a 50% chance of a recession in the next 12 months. In fact, in addition to recent tax policy, many credit metrics, including interest coverage, high-yield spreads, delinquencies, and consumer obligations, all seemed to favorably support economic growth into 2018. The past week was quite monumental within the mergers and acquisitions environment, where over a dozen multi-billion deals were announced, negotiated, or closed. Additionally, the Qualcomm and Broadcom mega-deal saga is still undergoing various developments such as price increases, licensing issues, regulatory compliance, and shareholder interests. Other billion-dollar deals included General Dynamic adding on another government IT business, Lennar becoming the largest U.S. homebuilder via a strategic add-on acquisition, Thoma Bravo acquiring a cloud-enabled data protection and security firm, TPG Capital acquiring an orthopedic device manufacturer, and a Goldman Sachs and Macquarie joint acquisition of an international logistics firm.

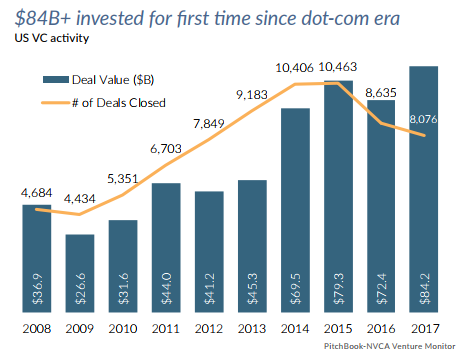

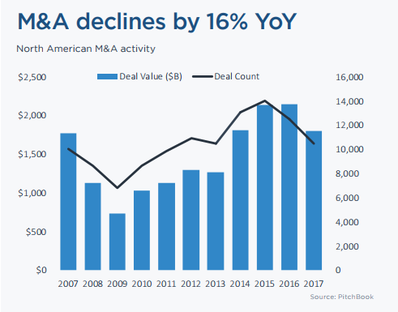

The fourth quarter of 2017 marked the third consecutive quarter with at least $20 billion invested in US venture-backed companies. Investment in 2017, as a whole, reached $84 billion, which is the first time venture investment has eclipsed $80 billion since the dot-com boom. The $84 billion was spread over 8,076 deals, reflecting a 6% drop in deal count from 2016 but a 16% improvement in total value.  North American mergers and acquisition activity totaled $1.8 trillion across 10,465 deals in 2017, according to PitchBook. Value and volume were down from 2016 by 16.0% and 16.1%, respectively, as buyers struggle to deal with rising valuations and quality prospects as well and are placing their focus on integrating previous acquisitions. The slowing in activity occurred even as the economy heated. Since the release of the jobs report, Wall Street has seen tremendous volatility amidst positive economic news for Main Street such as low unemployment, higher wages, and economic prosperity. Since the Great Recession, Wall Street has witnessed an economy with decent growth and peculiarly low inflation, and a strong market over the past year. The market's current reactions appear to speak to the market's expectation about the Fed's intention to raise interest rates and the potential for inflation.

Last week presented a strong week of multi-billion-dollar deals within the food/retail and energy industries. Negotiations continue between Broadcom and Qualcomm, a proposed merger that would be the largest in history, currently valued at $121 billion.

Initial public offering (IPO) activity was slower than usual last week, as the stock market experienced heightened volatility. International and domestic markets saw a Cleveland-based asset management firm's IPO struggle greatly, the first German IPO of the year, and the debuts of two Houston fracking equipment providers, as well as some IPO postponements due to general market volatility.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed