|

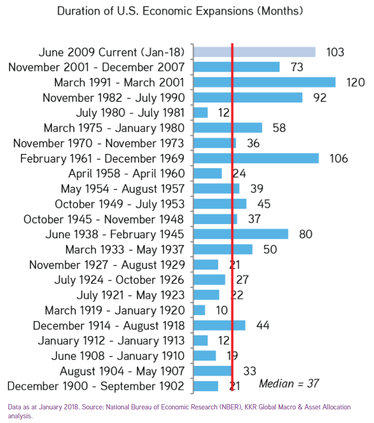

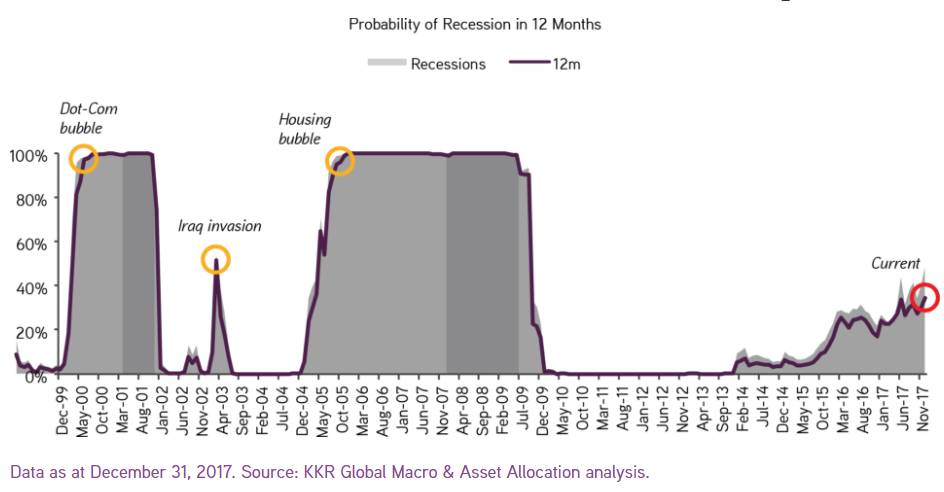

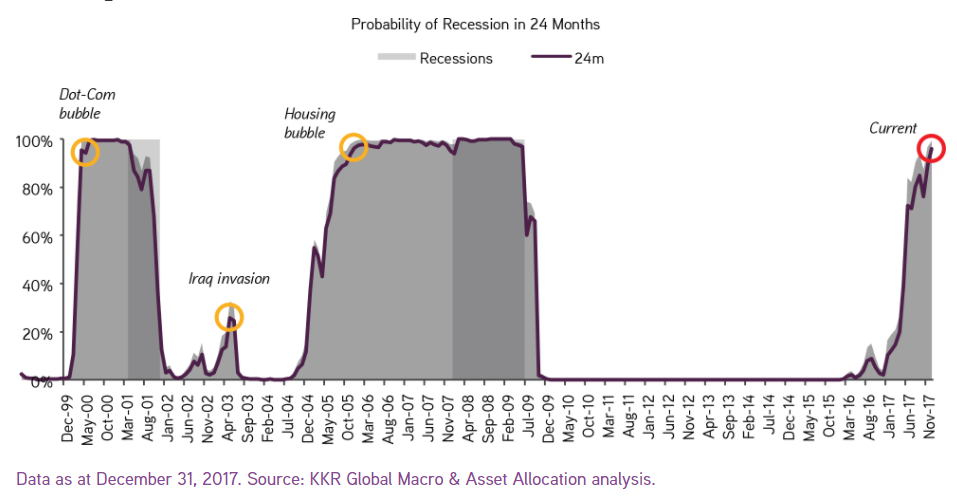

Kohlberg Kravis Roberts & Co, a leading global investment firm, provided earlier this year a comprehensive outlook for the economy in 2018. One of the more interesting aspects of the research is one of their models predicted a 100% chance of a recession in the next 24 months. The firm notes that their recession-prediction model has suggested a moderate slowdown in 2019 for some time. At the end of 2017, their model stood slightly below a 50% chance of a recession in the next 12 months. In fact, in addition to recent tax policy, many credit metrics, including interest coverage, high-yield spreads, delinquencies, and consumer obligations, all seemed to favorably support economic growth into 2018. The risk of recession rose substantially when KKR extended the model from 0-12 months to 24 months. The firm sees the rise in probability as a result of a peaking US dollar, a flattening yield curve, high unit labor costs, and a reversion to the mean in both consumer confidence and home building expectations. Furthermore, KKR noted its belief that current prices of several financial asset classes appear more cyclically elevated than current economic conditions support. The current economic expansion – the third longest in history – is demonstrated by an unusually prolonged period of nine years of positive returns on the S&P 500. In fact, only the 1991-1999 period has reached this duration of positive performance.  What does this mean to high-growth and middle-market companies? One of the lessons from finance and economics is that past results are not necessarily indicative of future results. While we have generally benefited from positive growth and economic news the last nine years, the horizon a couple years out may result in a little bumpier ride. Business owners who are planning to continue owning their business for the long term should keep in mind that growth will not always be linear. They need to perform sensitivity analyses to ensure that they have sufficient working capital to weather a variety of market conditions and to make opportunistic investments in growth. For owners that have a shorter time horizon, they may want to evaluate the benefits of exiting sooner while multiples and market liquidity are at or near record levels versus the potential growth in profits over the next couple years but at unknown future market conditions and valuation multiples. No one has a crystal ball and there are numerous factors that go into these decisions. Contact one of our team members if you like more detailed information on the outlook in your individual market segments. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed