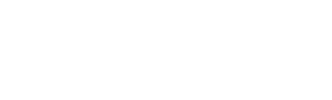

Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

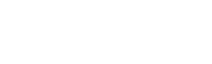

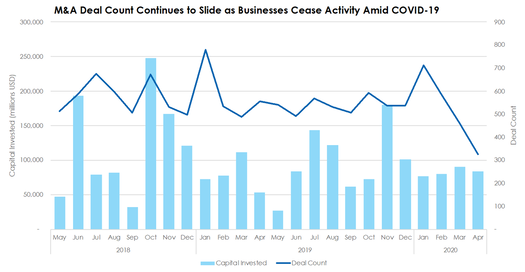

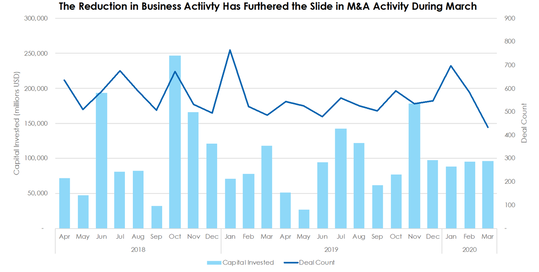

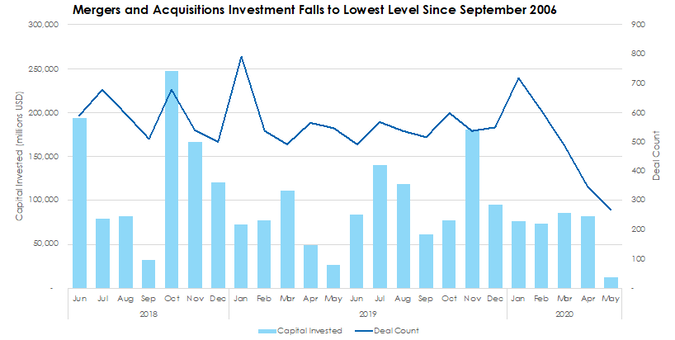

M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%. M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%. Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month. M&A Activity Picks Up in May Despite Weaker Year than 2018There were 720 M&A deals valued at a combined $194 billion in May, according to Pitchbook. For the year through the end of the May, there were 3,756 deals for $906 billion capital, roughly 1,140 fewer deals and $506 billion less value for the same period in 2018.

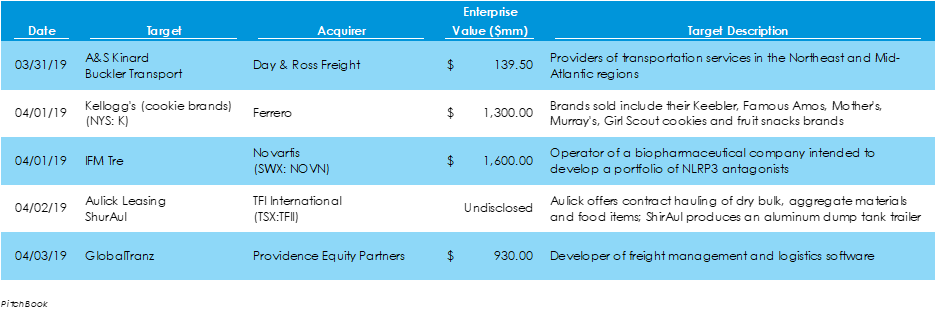

Transportation Space Highlights Last Week’s M&A ActivityData from Pitchbook shows that $15.2 billion of capital was invested across 29 M&A deals last week, $4.4 billion less capital on two more deals than the previous week. The largest two deals during the week were Stonepeak Infrastructure Partners’ $3.6 billion LBO of Oryx Midstream Partners and the $2.44 billion acquisition of AmeriGas Partners by UGI Utilities. AmeriGas is a publicly traded propane distributor, and Oryx is a natural gas collection group. The transportation space was an active sector, as A&S Kinard and Buckler Transport were acquired by Day & Ross Freight; TFI International acquired Nebraska-based Aulick Leasing and its manufacturing business, ShurAul; and Providence Equity Partners acquired transportation software provider GlobalTranz.

Last week, the Bureau of Labor Statistics reported the unemployment rate fell, hourly wages grew modestly, and the economy added fewer jobs than expected. Also last week, the Federal Open Market Committee decided to leave the federal funds rate unchanged and automakers announced U.S. sales fell in July.

Last Monday, the Institute for Supply Management released their monthly manufacturing report, showing strong gains, despite industry disruption. On Tuesday, U.S. automakers released their monthly auto sales reports, all showing gains from the year before. Finally, on Friday, the U.S. Department of Labor released the monthly jobs report, which beat analyst expectations on job growth, while unemployment rose slightly.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed