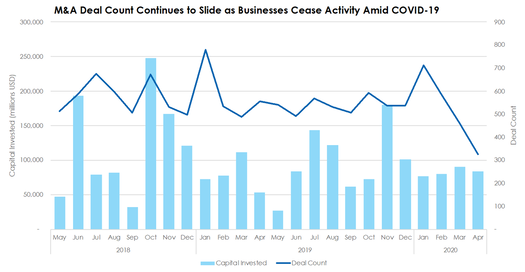

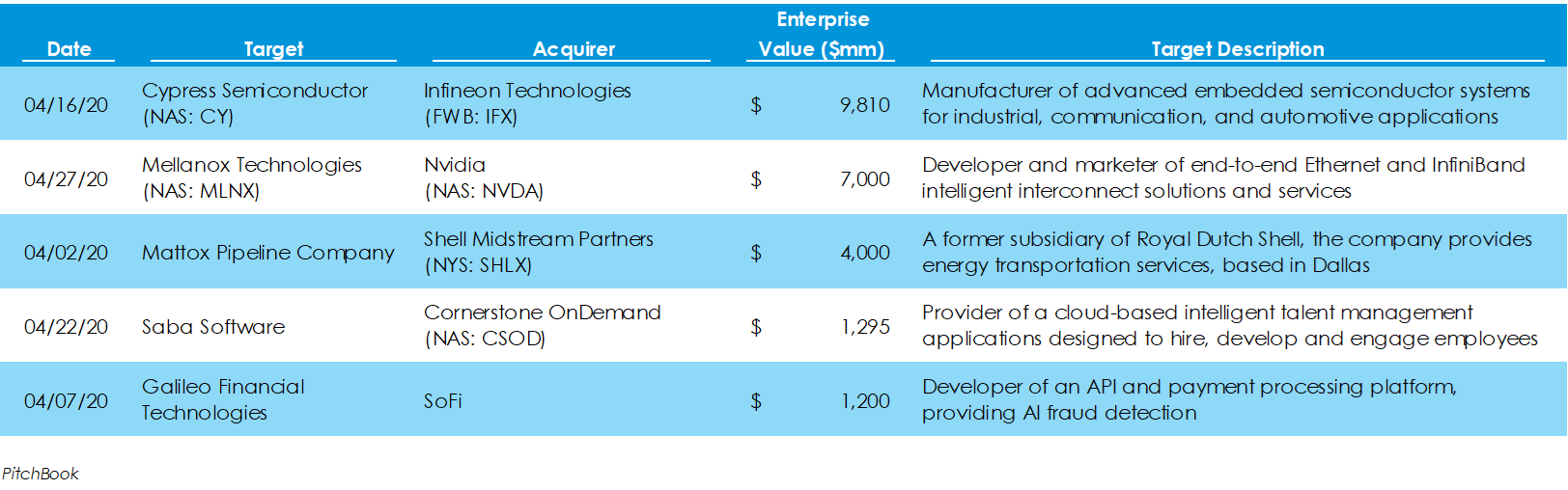

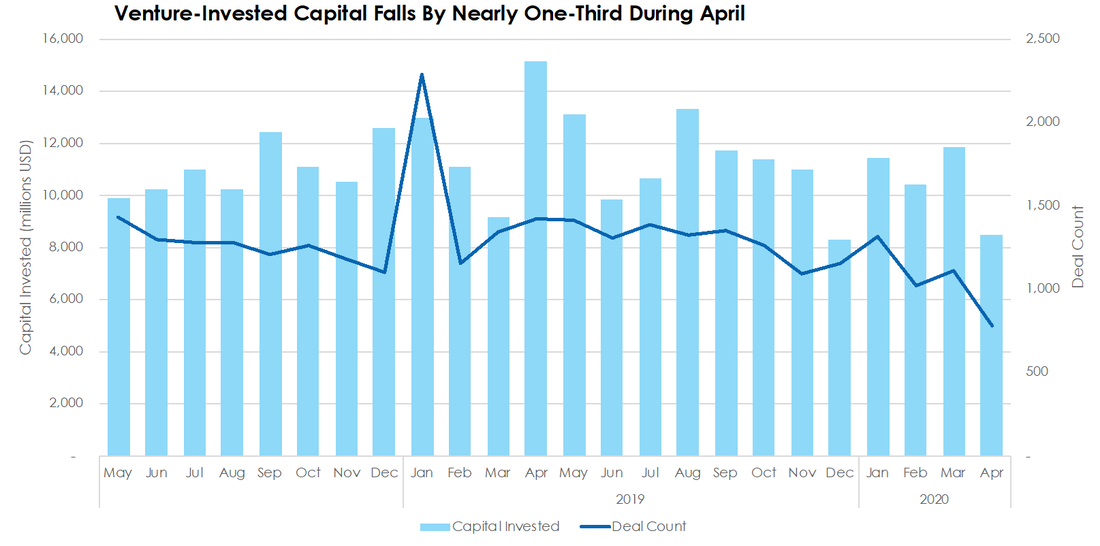

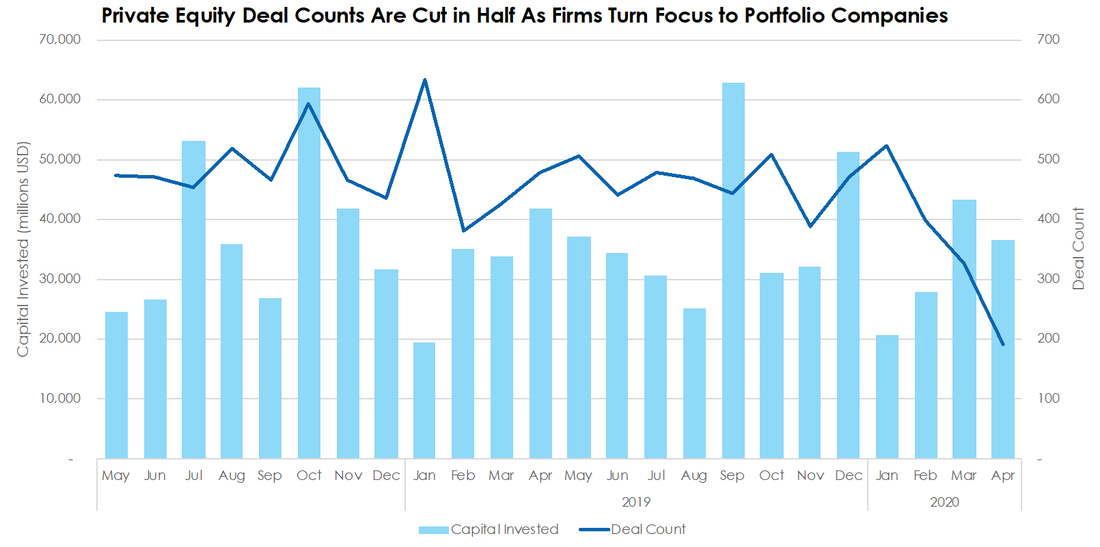

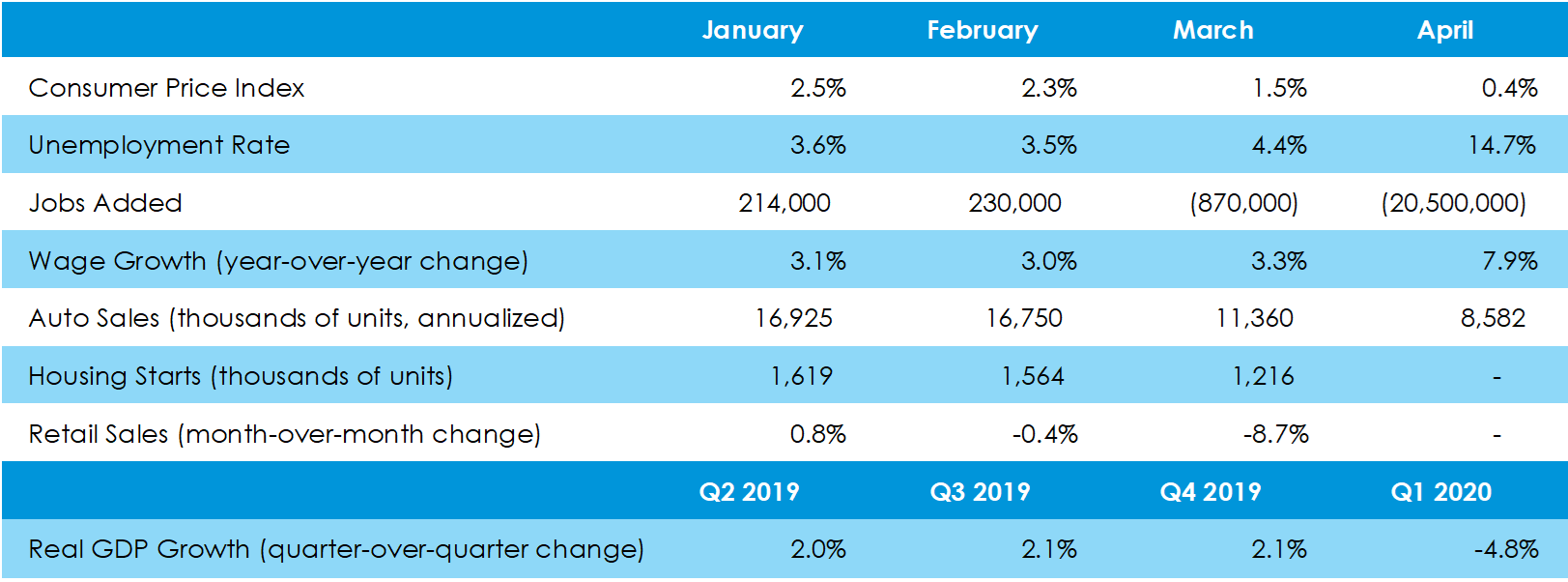

M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%. Excluding the previously announced blockbuster deals of Sprint (NYS: S) and Symantec’s enterprise cybersecurity business for $26.5 billion and $10.7 billion, respectively, invested capital totaled only $46.8 billion, marking a 48% decline from the month before. Otherwise, the largest deal of the month was a $9.8-billion buyout of Cypress Semiconductor by Germany-based Infineon Technologies. Venture Capital Activity Turns Downward After Holding Constant in the First QuarterAfter venture capital activity plateaued during the first quarter, invested capital and deal count fell sharply during April. April deal counts totaled 784 and invested capital totaled $8.5 billion. In fact, deal count and invested capital in April were down 31% and 25% from their respective first quarter averages. Deal counts have now fallen to their lowest level since the 2009 recession. Venture capital firms had been recently supplementing their portfolio companies’ cash balances instead of making new deals; however, the numbers are now indicating that the supplementing is reaching its limits, and portfolio companies are left to wait out the effects of the virus. Noteworthy firms receiving investments last month include payment processing firm Stripe, personal finance software provider Stash, and quantum computing developer PsiQuantum. Half of Private Equity’s Largest Deals of the Month Were Development Capital InvestmentsIn line with corporate M&A deal flow, private equity activity has taken a deep downturn, with deal count falling by 64% since January to a low of 190. Invested capital, on the other hand, has increased from January and February lows, increasing 78% to $36.5 billion. Excluding the month’s largest buyout of Ultimate Software Group for $22 billion, invested capital only totaled $14.5 billion, a 29% decrease since January. Interestingly, many of the deals during the period were development capital investments from private equity general partners to portfolio companies. These investments were intended to support cash runways and stabilize balance sheets. Ten of the twenty largest private equity deals during the month were either development capital investments or minority stake investments intended to boost cash balances. Some firms receiving these investments include Airbnb, US Foods, and Carnival. Wages Grow at Record Levels Despite Unprecedented Layoffs in the Economy

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed