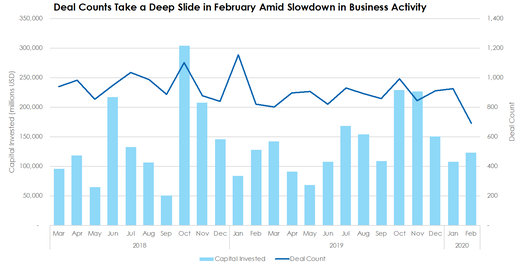

Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month. Skyline Advisors Releases its Third Quarter 2019 Capital Markets Review: Midwest Edition Report12/6/2019

Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for the third quarter of 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

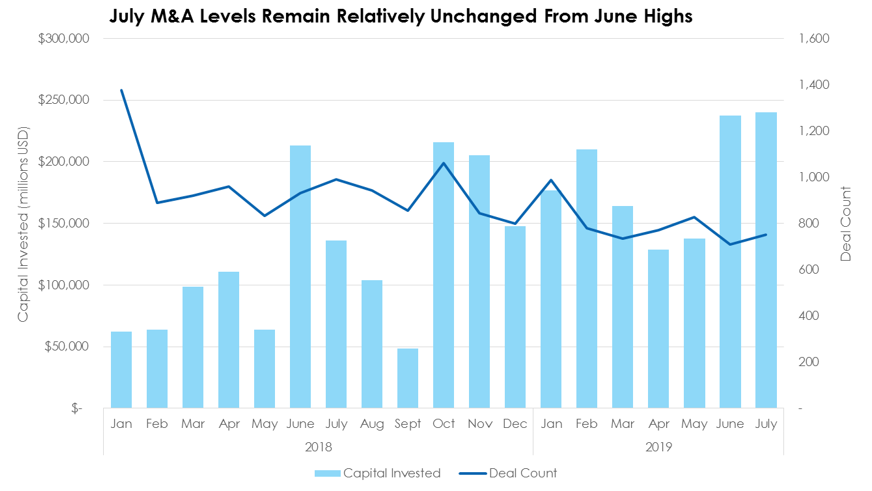

Acquisition Investment is Lifted to a Two-Year High on the Back of Five Out-sized DealsAccording to preliminary data from Pitchbook, there were 752 M&A deals worth a total of $240 billion in July, remaining relatively unchanged from the $237 billion spent on corporate acquisition and leveraged buyout deals in June. Over 60% of the deal value is comprised of the buyouts of five target companies: Worldpay, L3 Technologies, Red Hat, First Data, and Array BioPharma.

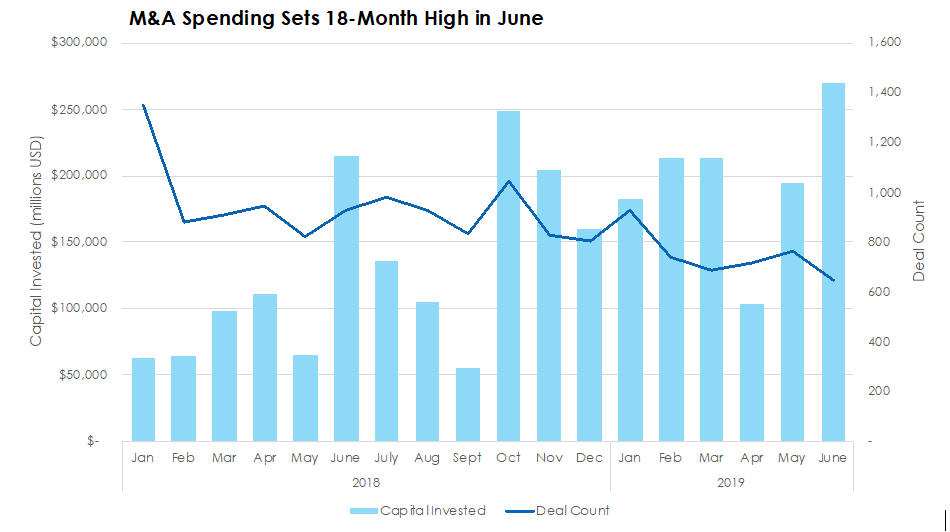

M&A Activity Spikes in June on the Back of Mega Deals In June, there were 643 deals in M&A capital markets worth a combined $270 billion, the highest level since the start of the decade in 2010. However, 45% of that value is attributable to United Technologies’ blockbuster acquisition of defense contractor Raytheon. In fact, the deal is the largest since Time Warner acquired AOL in January 2001.

The minutes from the Federal Open Market Committee’s December meeting were released, showing the board’s reluctance to increase interest rates amid weakening inflationary pressures and slowing global growth. The Bureau of Labor statistics furthered this point when releasing its December Consumer Price Index, which revealed the first monthly decrease in prices in nine months. The inflationary gauge did rise on an annualized basis, albeit slower than in prior months. Also, unemployment insurance claims fell unexpectedly in the first week of the new year.

Last Tuesday and Wednesday, the Federal Open Market Committee held their December meeting. The board elected to raise rates for the fourth time this year, although the median governor is anticipating one less rate hike in 2019. The Commerce Department made downward revisions to its third quarter GDP estimates, knocking a tenth of a percent off its previous estimates. Lastly, the Kansas City Federal Reserve released its December Manufacturing Survey and Index, showing a slowdown in manufacturing activity during the month due to declines in production, shipments and new orders for exports.

Last week, U.S. retail sales growth dramatically missed economists’ expectations for September, according to Commerce Department data. The Labor Department released their data from the August Job Openings and Labor Turnover Survey, indicating more than one job opening for every unemployed worker. Also, the Federal Open Market Committee shared the minutes from the end-of-September meeting, indicating a potential for interest rates to continue to rise.

Labor figures released last week showed a nearly full labor market. The unemployment rate fell to 3.7%, wages grew at a controlled 2.8%, and jobless claims were near levels not seen since 1969. However, the impressive jobs report spooked bond investors about future rate hikes by the Fed, prompting a bond market selloff that sent yields to seven-year highs.

Last week, the Bureau of Labor Statistics reported the unemployment rate fell, hourly wages grew modestly, and the economy added fewer jobs than expected. Also last week, the Federal Open Market Committee decided to leave the federal funds rate unchanged and automakers announced U.S. sales fell in July.

Last week’s economic news continued to signal a booming U.S. economy. In summary, the NFIB’s Small Business Optimism Index rose to its second-highest all-time level of 107.8; the Consumer Price Index (CPI) for May, often a sign of inflation, rose 2.8% over the last twelve months; and Federal Reserve officials elected to raise rates a quarter of one percentage point to keep the economy from growing too quickly. The Fed’s Board of Governors also signaled for an extra rate hike for 2018.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed