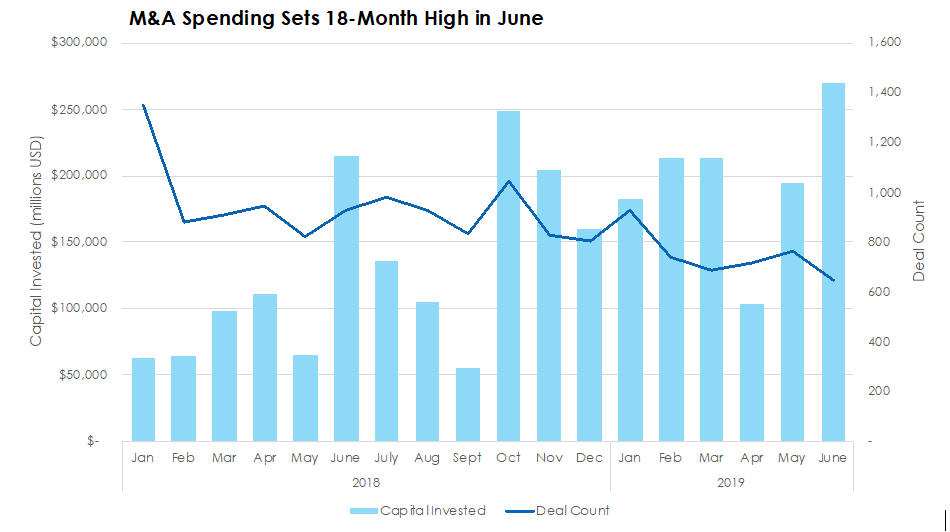

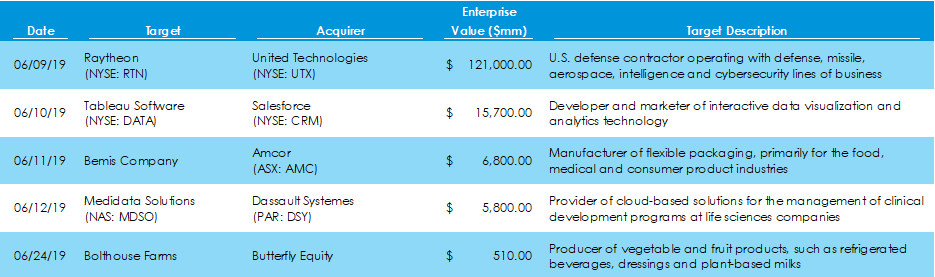

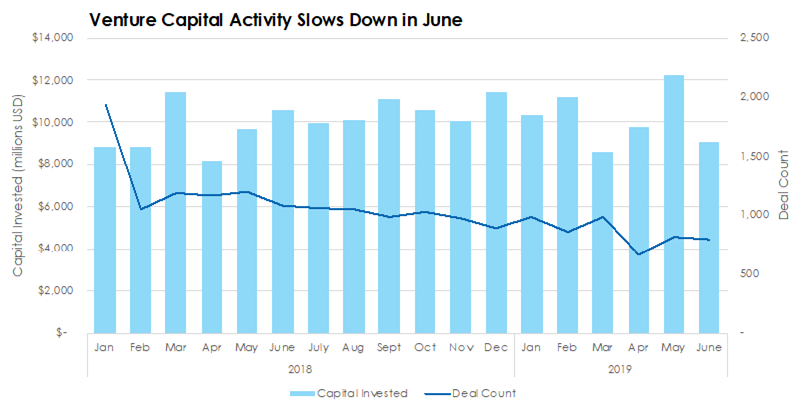

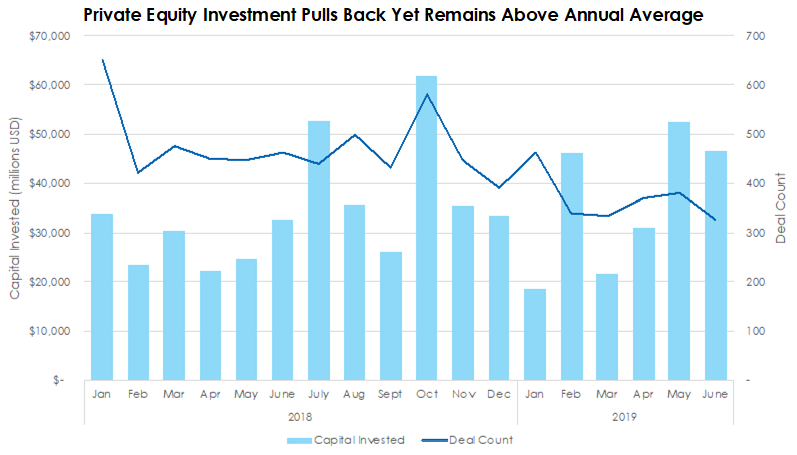

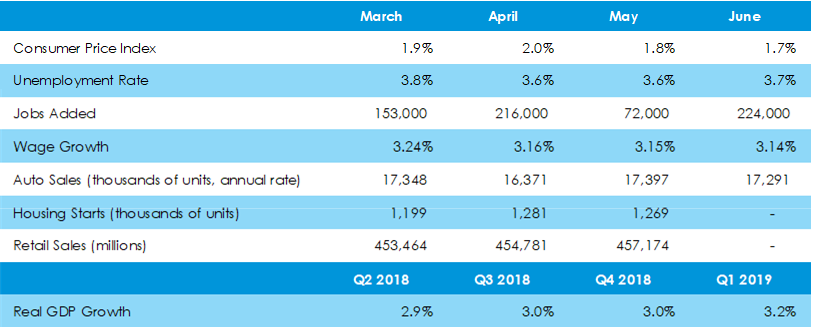

M&A Activity Spikes in June on the Back of Mega Deals In June, there were 643 deals in M&A capital markets worth a combined $270 billion, the highest level since the start of the decade in 2010. However, 45% of that value is attributable to United Technologies’ blockbuster acquisition of defense contractor Raytheon. In fact, the deal is the largest since Time Warner acquired AOL in January 2001. Compared with the month prior, deal value grew 39% from $194 billion on 121 less total deals. Compared to June of 2018, deal value is up 26% from $214 billion. Excluding the Raytheon deal, invested capital is down 23% and 30% from last month and last year, respectively. Year-to-date, there have been 4,476 deals worth $1.17 trillion, which is nearly double the $614 billion invested during the same period of 2018. The Midwest had only one of their 17 M&A deals disclose terms which was publicly traded AeroVironment’s $28 million purchase of Lawrence, Kansas-based Pulse Aerospace. Venture Capital Deal Count and Investment Fell from May Highs Venture capital investment fell 26% to $9 billion across 787 deals in May, and value is down 14% from last June. SpaceX received the largest venture investment, at $314 million, from the Ontario Teachers’ Pension Plan, an active investor in the alternative investment space. About half of the VC activity took place in series A, B and C rounds, totaling 392 deals and $3.7 billion. Another 218 deals and $300 million was invested in the angel stage. Machine learning and artificial intelligence were attractive areas for investment, recording 102 deals and $1.4 billion in capital invested Private Equity Firms Showing Signs of Softening as Economic Conditions are Assessed According to Pitchbook, buyout shops invested $47 billion across 328 deals, 11% less in invested capital and 14% less in deal volume than in May. Compared with June 2018, investment is up 43% for private equity firms across 29% fewer transactions. Year-to-date in 2019, 29%, or $42 billion, more capital has been spent across 690 fewer deals. Oil and gas companies absorbed $5.5 billion in capital across 14 deals, the largest of which was JPMorgan Asset Management’s buyout of natural gas electricity provider El Paso Electric. Cybersecurity also saw a good amount of activity, receiving $503 million in buyout funding among seven deals. Cybersecurity investment has become an increasingly attractive investment as big data and the digital age continues to grow in importance for corporations and enterprises. Economic Signals Show Continued Strength Despite Trade Headwinds and Fed Consideration of a Rate Cu

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed