|

Last week’s economic news was largely mixed, as home building saw strength in starts but weakness in permits, while the manufacturing sector showed signs of slowing (but still expanding) in purchasing activity, and manufacturing services saw continued growth in activity.

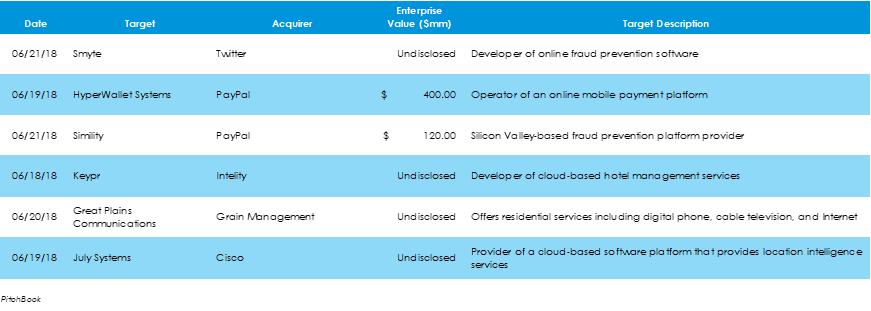

Last week was a busy week for companies in the tech, media, and telecom (TMT) sector. PayPal made two acquisitions, HyperWallet and Simility, for a total of $520 million. Twitter improved its scam protection with its purchase of Smyte. Kepyr and Intelity merged to integrate their guest services platforms. Cisco is making improvements to its location intelligence services business in its buyout of July Systems. Finally, a Nebraska telecom firm, Great Plains Communications, was bought out by Grain Management, a Florida private equity firm.

A busy week for IPOs had major involvement from biotech firms. Six biotech firms made their exchange debuts: Eidos Therapeutics, Aptinyx, Magenta Therapeutics, Xeris Pharmaceuticals, Kezar Life Sciences, and AVROBIO. There was also a single non-healthcare transaction: i3 Verticals, a Nashville-based fintech company

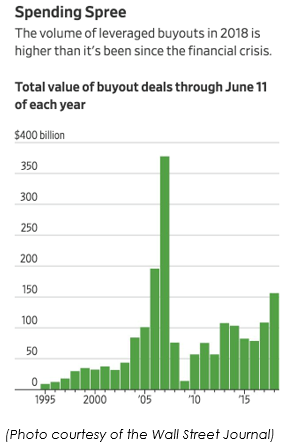

Leveraged buyout, or LBO, activity has been booming in 2018. According to an article from the Wall Street Journal last week, 2018 is on pace to have the highest dollar volume of LBOs since 2007, before the Great Recession. LBO activity for the year is up 44% from the same time-period last year. Overall M&A activity in 2018, at $2.1 trillion, is on pace to break the current record high for global M&A activity, set in 2007 at $4.3 trillion. Firms are pointing to large corporate deals - such as AT&T and Time Warner, the pending battle between Disney and Comcast for Twenty-First Century Fox, and Bayer’s takeover of Monsanto - as being a driving force behind the increase in activity. Activist investors or regulators may force the sale of assets to allow a corporate deal to take place, leaving more “orphaned” businesses for private equity firms to pursue. Also, debt is still relatively cheap, and the economy is strong, creating a greater incentive to acquire companies and select assets. Last week’s economic news continued to signal a booming U.S. economy. In summary, the NFIB’s Small Business Optimism Index rose to its second-highest all-time level of 107.8; the Consumer Price Index (CPI) for May, often a sign of inflation, rose 2.8% over the last twelve months; and Federal Reserve officials elected to raise rates a quarter of one percentage point to keep the economy from growing too quickly. The Fed’s Board of Governors also signaled for an extra rate hike for 2018.

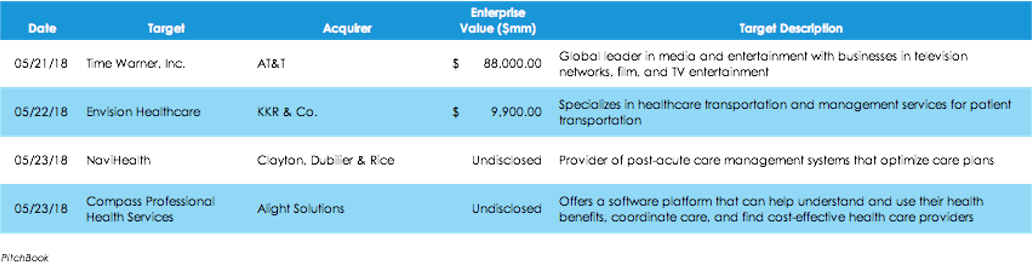

AT&T stole the spotlight in M&A news this week, but there was plenty of action in the healthcare space. KKR & Co. completed their second major deal this week in a leveraged buyout of Envision Healthcare; NaviHealth is selling 55% of their business to Clayton, Dubilier & Rice, a private equity firm, for an undisclosed sum; and Compass Professional Health Services, out of Dallas, was acquired by Alight Solutions for an undisclosed sum.

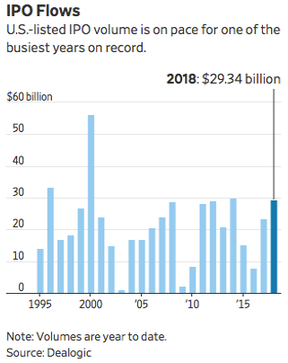

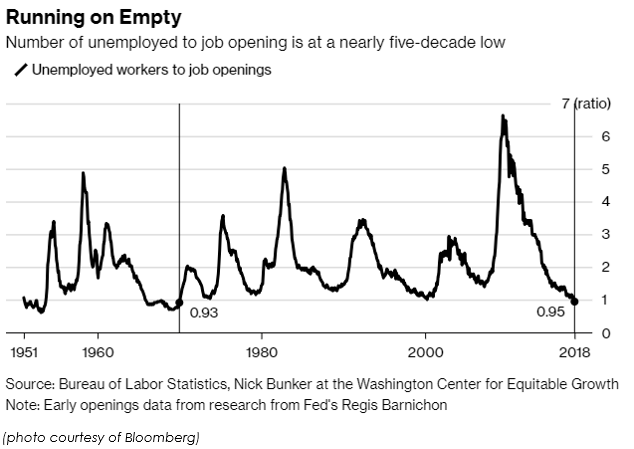

It was another quiet week for IPOs, although we did see some action in healthcare and energy services. In other news, according to the Wall Street Journal and Dealogic, the IPO scene in America has been more active than we have seen in recent years. Capital markets have raised $29 billion from 88 initial public offerings this year, up 25% from the year prior. That level is as high as we have seen since the 2009 recession. The Department of Labor reported, according to its Job Openings and Labor Turnover Survey, that there were approximately 6.7 million job openings in April. It is the first time that job openings have exceeded the number of unemployed persons since January 1970, according to calculations from Nick Bunker, a senior policy analyst with Washington Center for Equitable Growth. In other news, weekly mortgage applications reversed nearly a month of negative growth, and US business activity for services increased in April.

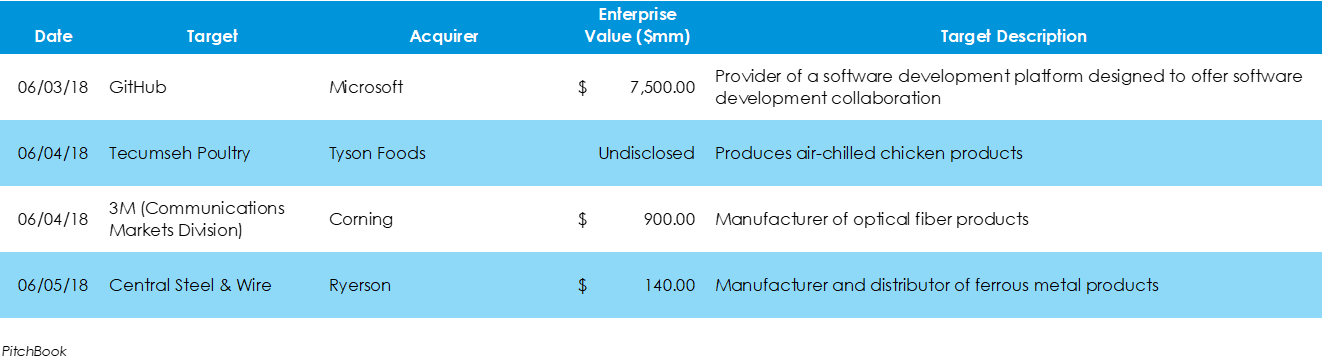

Microsoft grabbed major headlines last week with its acquisition of GitHub, and another large deal was completed with 3M’s sale of its communications market division to Corning. In the food space, Tyson built upon recent M&A activity with the acquisition of Nebraska-based Tecumseh Poultry.

In a week in which no initial public offerings took place, a few companies made headlines with their respective IPO plans.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed