|

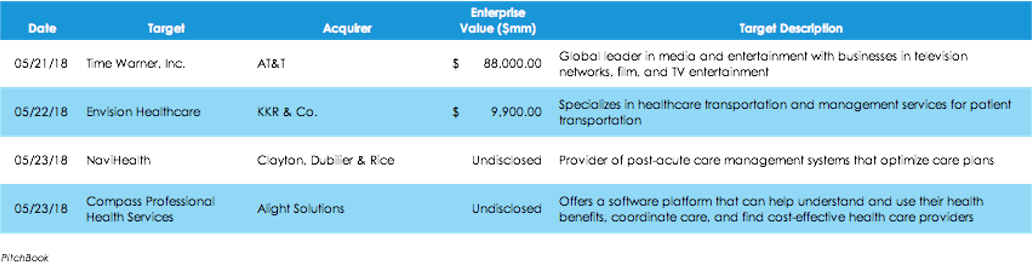

AT&T stole the spotlight in M&A news this week, but there was plenty of action in the healthcare space. KKR & Co. completed their second major deal this week in a leveraged buyout of Envision Healthcare; NaviHealth is selling 55% of their business to Clayton, Dubilier & Rice, a private equity firm, for an undisclosed sum; and Compass Professional Health Services, out of Dallas, was acquired by Alight Solutions for an undisclosed sum.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed