Venture capital (VC) activity showed more money being invested in fewer deals during the first quarter (Q1), continuing a trend seen in recent quarters. Overall deal count slowed 18%, while aggregate deal volume increased 10% from the fourth quarter to $34 billion. With the onset of the coronavirus impacting markets and the economy in the latter half of Q1, VC activity is expected to show further slowing in the second quarter.

In the first quarter (Q1), the global economy was brought to a halt as a result of the spread of coronavirus (COVID-19) and its ripple effects. Whereas general merger and acquisition (M&A) activity began to decrease in the first quarter (see M&A results here), private equity (PE) firms continued to make use of their record-high levels of dry powder. PE investments were up an estimated 6% by volume year over year in Q1, and valuation multiples were higher than the averages for each of the prior ten years (see page 7).

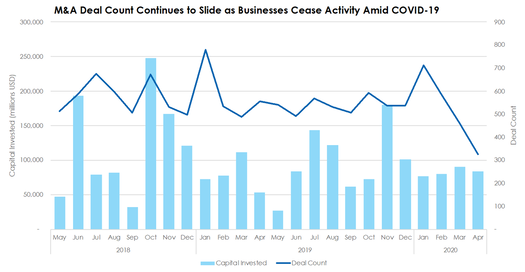

As the world struggled to contain and understand the full impact of the coronavirus (COVID-19) pandemic in the first quarter, the main economic impact (see our summary here) did not manifest itself until the second half of March. It is unsurprising, given the sudden stop, that merger and acquisition (M&A) activity echoed general economic trends, particularly in light of the uncertainty surrounding how long restrictive measures would remain in place and whether there would be a “V-shaped” recovery.

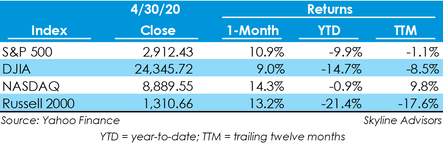

As we publish our Economic and Public Market Update for the first quarter of 2020, it is obvious that the first quarter was a wild ride. It included US stock markets reaching all-time highs and ended with the fastest 20% market drop on record. The drop, spurred on by the coronavirus pandemic, put an end to the longest bull market in history.

While nothing compares to the loss of human life, the economic toll of the pandemic and the practical shutdown of the economy has been significant to say the least. The full impact is still playing out, including whether we can achieve the V-shaped recovery we all hope for, but the economic results began to deteriorate in the final weeks of the first quarter. Advanced estimates of the first quarter GDP came in at -4.8%, marking the first quarterly decline since 2014. Estimates for second quarter GDP project a decline of more than 30%. M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%.  The effects of the novel coronavirus have continued to disrupt financial markets worldwide. Uncertainty over how long the pandemic will last has kept markets in flux, with the CBOE Volatility Index (VIX) averaging 41.45 points in April, which is down from March’s average but significantly greater than the 2019 average of 15.39 points. Moreover, unprecedented activity in oil markets added more context to the possible depth of the economic slowdown. However, during the month, markets seemed to rebound from a major pullback in the first quarter, with three of the four major indices growing by double-digit percentages. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed