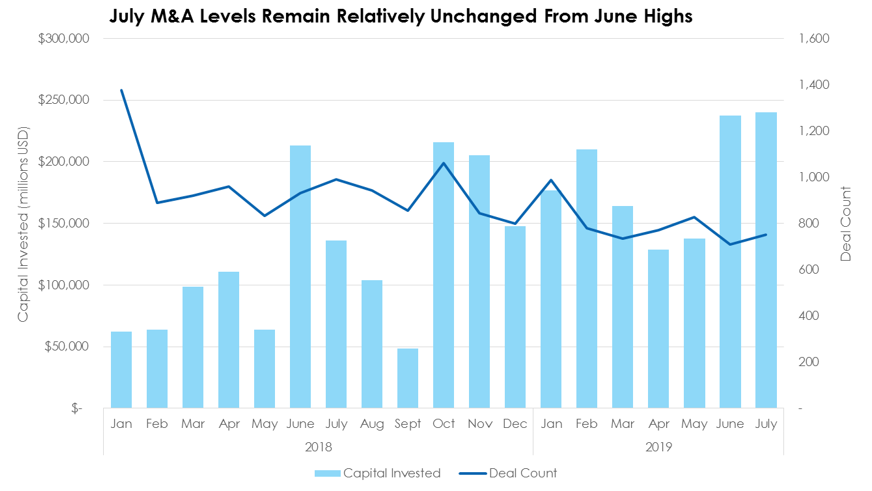

Acquisition Investment is Lifted to a Two-Year High on the Back of Five Out-sized DealsAccording to preliminary data from Pitchbook, there were 752 M&A deals worth a total of $240 billion in July, remaining relatively unchanged from the $237 billion spent on corporate acquisition and leveraged buyout deals in June. Over 60% of the deal value is comprised of the buyouts of five target companies: Worldpay, L3 Technologies, Red Hat, First Data, and Array BioPharma.

Skyline Advisors has released its Capital Markets Review: Midwest Edition for the second quarter of 2019. The report details developments on the broader economy, public markets, valuations, as well as activity and trends for mergers and acquisitions, private equity deals, and venture capital deals, both at national and Midwest levels. Key highlights within the report include:

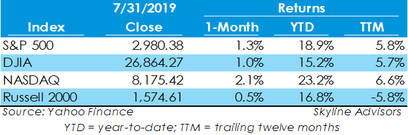

Major stock market indices advanced in July, building upon a strong year for market returns. The Nasdaq advanced the most, gaining 2.1% to 8,175.42, while the S&P 500 gained 1.3% to 2,980.38. The Dow Jones Industrial Average and Russell 2000 also closed the month in positive territory. Only the Russell 2000 has a negative return through the last twelve months. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed