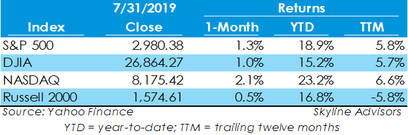

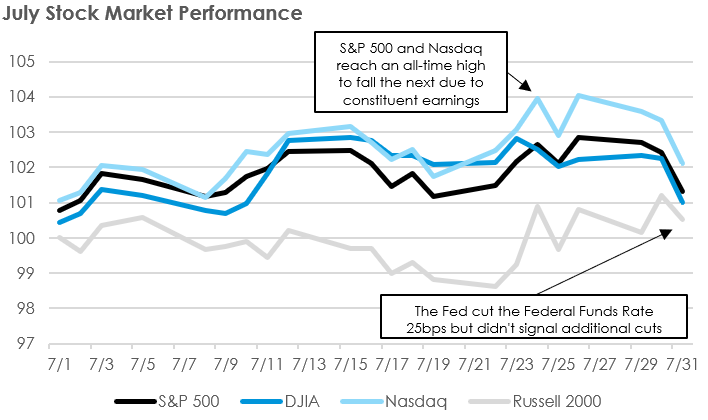

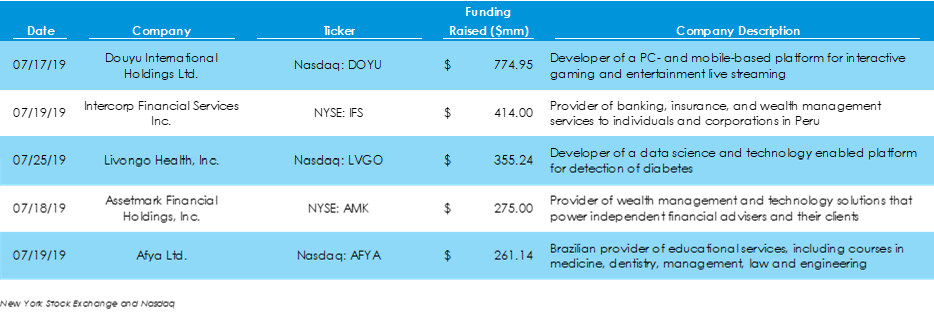

Major stock market indices advanced in July, building upon a strong year for market returns. The Nasdaq advanced the most, gaining 2.1% to 8,175.42, while the S&P 500 gained 1.3% to 2,980.38. The Dow Jones Industrial Average and Russell 2000 also closed the month in positive territory. Only the Russell 2000 has a negative return through the last twelve months. Markets ended on a volatile note, as statements from Fed Chairman Jerome Powell added to mixed earnings results during the month. In its July FOMC meeting, the Federal Reserve cut the federal funds rate by 25 basis points. Powell was mute on anticipated rate cuts through the rest of the year, sending markets lower on the last day of the month. IPO Value in July Reaches Just Half of June’s Value There were 26 initial public offerings that raised a combined $5.7 billion in July. The $5.6-billion total is approximately half of the $11.1 billion raised one month before. Volatility has rocked the stock market this summer amid heightened geopolitical uncertainty and a slowing global economy, dissuading private firms from making the jump to public markets.

In July, the largest IPO was a $775-million fundraising by DouYu International Holdings, a video game-centric live streaming platform in China. July was the first month since February in which no company raised over one billion dollars in their IPO. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed